As MetaTrader is revoking licenses for its MT4 and MT5 products, more and more brokers and traders are looking for platforms to continue their trading. This article will help you navigate this shift, offering top-tier alternatives tailored to meet trading demands in 2024 and beyond.

Can’t use MetaTrader anymore? What are your options?

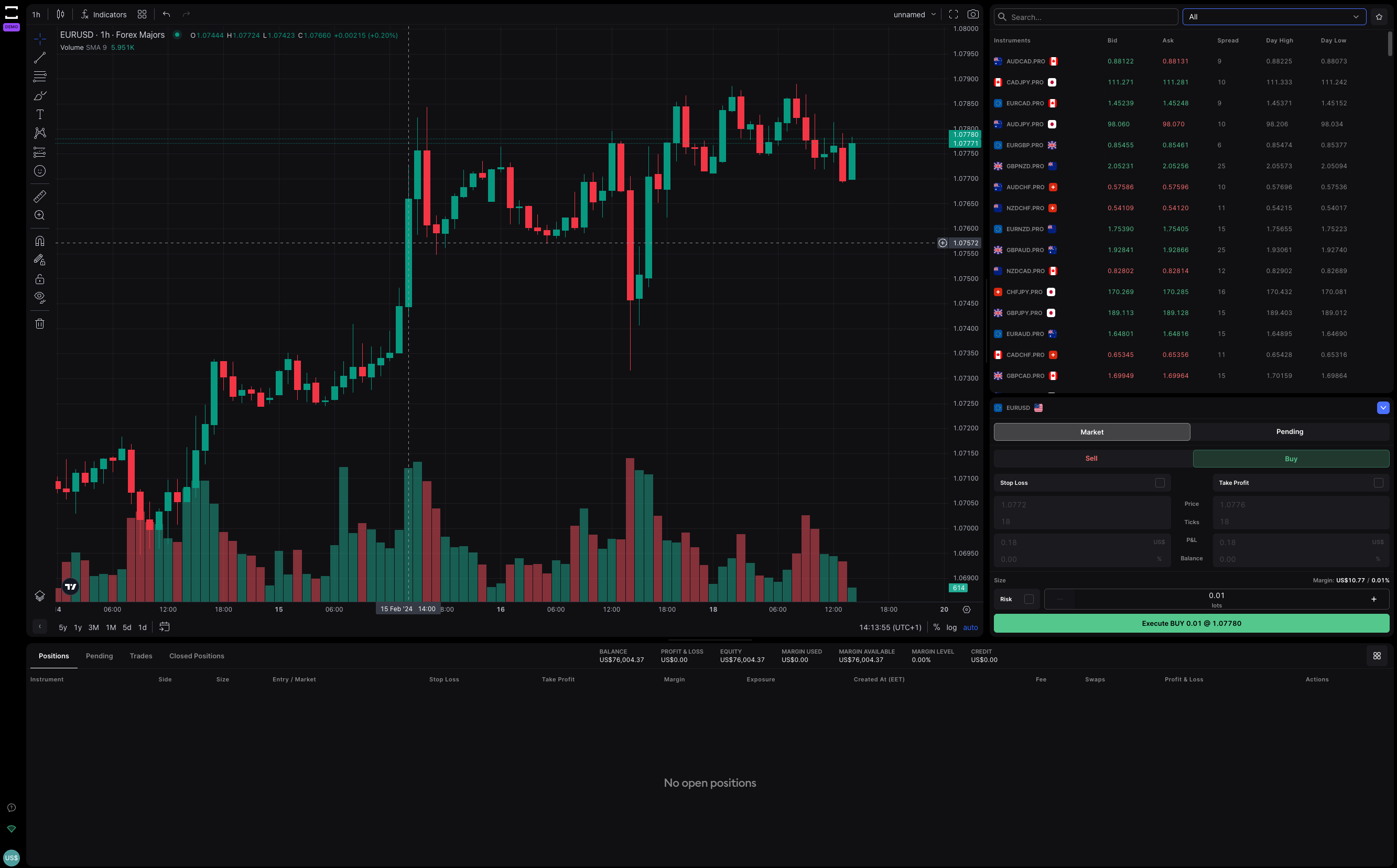

TradeLocker – Best for beginner to intermediate traders

TradeLocker is the new kid on the block. It’s been around for less than a year and is gaining more momentum. Check why it has become a hot topic in the trading community.

Built by listening to the community

As soon as development started, TradeLocker invited traders to join the Discord channel, asking them to suggest features, improvements, and ideas. The community hit 20k members in less than a year, generating endless feedback and support.

This means the TradeLocker team is constantly rolling out updates and new stuff to make things even better, tackling what matters most in real time.

On top of that, channel admins and mods keep the community engaged with constant improvements. For example, the Auditorium features community members talking about their paths, strategies, and learnings, providing free, real-life examples crucial for beginners.

Ease of Use

The first thing users see is a super clean and customizable interface. Particular effort was put into making it intuitive so beginner traders could find their way around and start trading without fuss. The platform uses industry-standard TradingView for charting, which is familiar to most traders. TradeLocker supports various trading instruments, such as stocks, ETFs, options, and cryptocurrencies, allowing you to try your strategy with different asset types.

It is available as a desktop, web application, and on iOS and Android mobile platforms.

Given the risk of trading, TradeLocker has invested extra effort to improve existing risk management tools. Innovative approach to Risk calculator industry norms. Risk calculator is

For more advanced users, TradeLocker is in the final stretch of releasing Studio to enable algo trading. Algo trading is short for Algorithmic trading or Automated trading, where you create a program, often called a robot or a bot, which follows your predetermined instructions. Using Algo trading can, in theory, generate profits impossible for human traders, but ensure you know what you are doing, as automating bad trades can only lead to losing money.

| Pros | Cons |

|---|---|

| Mobile App, Desktop App, and Web application | No algotrading option (in development) |

| Ease of Use | Limited Brokerage Availability |

| TradingView Charting | No Level 2 pricing |

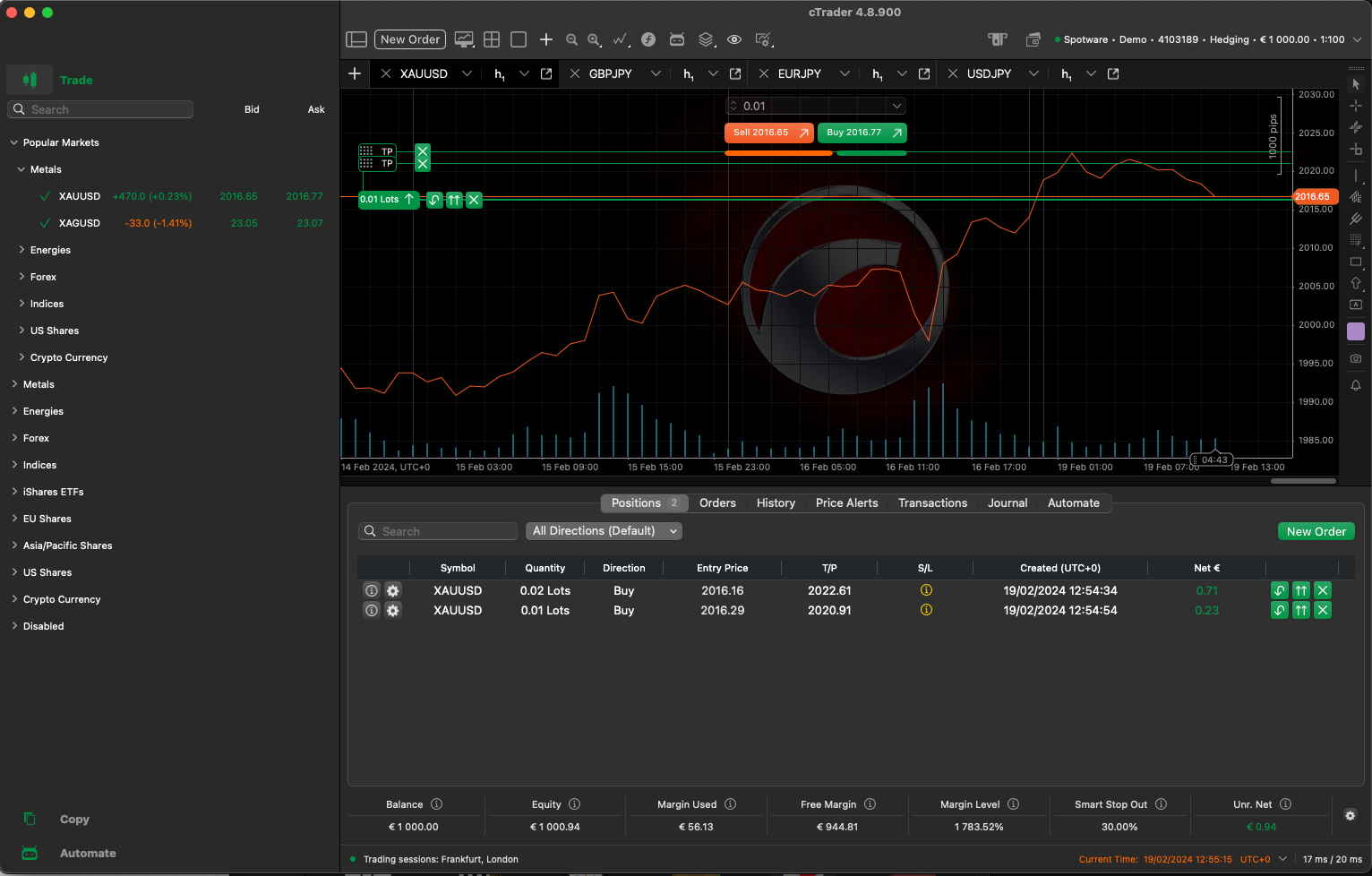

cTrader – Ideal for traders seeking algorithmic trading capabilities

cTrader is a comprehensive trading platform that prioritizes transparency and advanced trading capabilities. It stands out for its direct access to currency trading markets without the involvement of a desk, ensuring faster execution speeds and lower spreads.

A key feature of cTrader is its algorithmic trading support through cAlgo, enabling traders to develop custom trading robots and indicators using C# language. This particularly appeals to those interested in automating their trading strategies and conducting thorough back-testing with historical data.

One of the platform’s unique selling points is its advanced charting tools and technical analysis features, which include over 50 pre-installed indicators and customizable charting templates. This makes it easier for traders to analyze market trends and make informed decisions.

cTrader differentiates itself by providing a level of market transparency that is rare in other platforms. Features like Level II pricing show the full range of executable prices coming directly from liquidity providers, which can be particularly beneficial for understanding market dynamics and planning trades accordingly.

The platform’s integration with various brokers worldwide allows traders to choose their preferred broker, ensuring they control where their funds are held and how they are managed.

Community support is another strong aspect of cTrader, with numerous forums, tutorials, and online resources available to help traders get the most out of the platform. While it may not have a singular, massive community like TradeLocker’s Discord group, the distributed nature of its community support across various forums and websites ensures that traders can find the help and information they need.

| Pros | Cons |

|---|---|

| Advanced charting and technical analysis tools | Can be complex for absolute beginners |

| Algorithmic trading support with cAlgo | Algorithmic trading requires knowledge of C# language |

| High level of market transparency with Level II pricing | May have higher requirements for initial deposit depending on the broker |

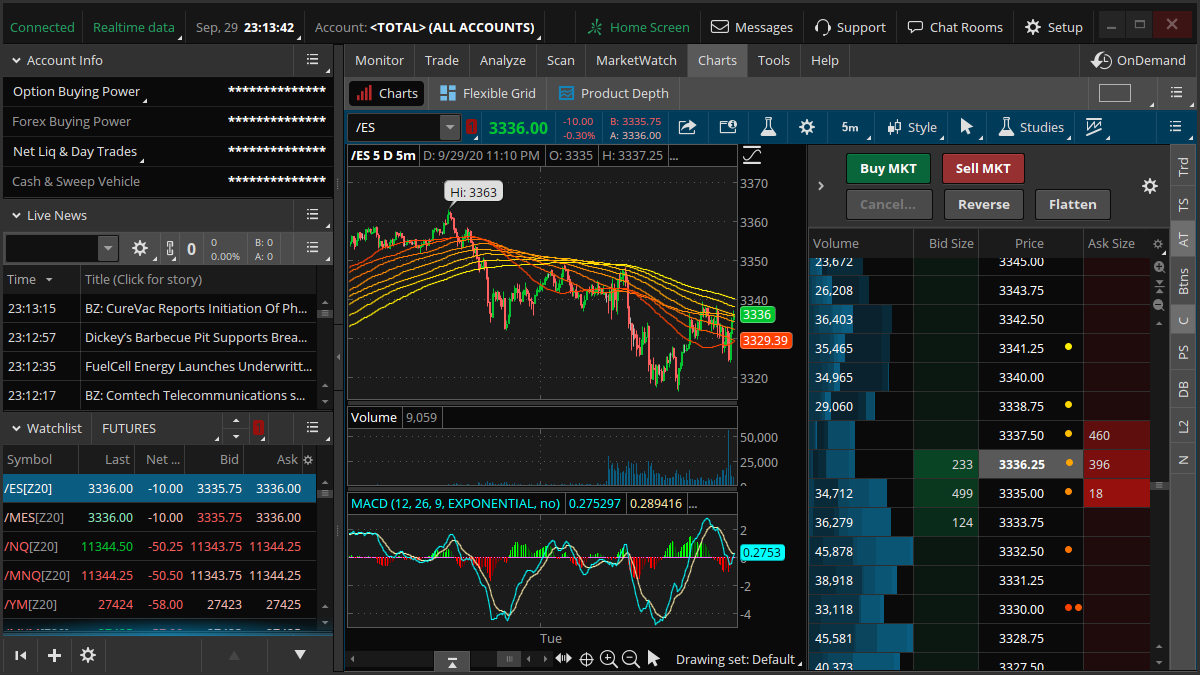

NinjaTrader – Perfect for professional traders focusing on futures and forex

NinjaTrader is a powerful trading platform that is highly regarded among professional traders for its advanced automation tools and comprehensive analysis capabilities. It specializes in providing a robust environment for futures and forex trading but also supports stocks and options.

The platform’s standout feature is its sophisticated algorithmic trading functionality, enabling traders to automate their trading strategies precisely. NinjaTrader uses the NinjaScript programming language, allowing users to create trading indicators, strategies, and automation scripts. This level of customization makes it an attractive choice for traders who require detailed control over their trading execution.

NinjaTrader offers a deep array of analytical tools, including advanced charting, back-testing capabilities, and market analytics. Its simulation feature is handy for testing strategies against historical data before applying them in live markets, minimizing risk.

The platform is available for free with limited features, which are sufficient for basic charting and analysis. However, the full suite of advanced functionalities, including live trading, requires purchasing a license or leasing the platform quarterly or annually. NinjaTrader also connects with multiple brokers and market data providers, allowing traders to choose the best options for their trading needs.

In terms of accessibility, NinjaTrader is primarily a desktop-based platform, focusing on providing a comprehensive and immersive trading experience. While it doesn’t have a native mobile app, the platform’s extensive customization and powerful trading tools more than compensate for this, catering to the needs of traders who prefer a desktop-centric trading environment.

| Pros | Cons |

|---|---|

| Advanced algorithmic trading and customization with NinjaScript | Primarily desktop-based with no native mobile application |

| Extensive charting and analysis tools | The learning curve for NinjaScript and advanced features can be steep for beginners |

| Simulation and back-testing capabilities for strategy development | Full suite of features requires a paid license or lease |

Thinkorswim – Optimal for those prioritizing comprehensive research tools

Thinkorswim, TD Ameritrade’s flagship platform, is renowned for its robust set of research tools and a comprehensive selection of tradable securities. It provides a powerful yet user-friendly environment for trading stocks, options, futures, and forex. The platform is particularly celebrated for its advanced analytical tools, including real-time quotes, technical indicators, and the ability to simulate trading strategies through paper trading.

The platform’s standout feature is its state-of-the-art charting capabilities, offering over 400 technical studies and drawing tools, enabling traders to perform in-depth market analysis. Thinkorswim also supports extensive customization, allowing users to tailor the interface, charts, and workspaces to their preferences, enhancing the trading experience.

Options traders find Thinkorswim especially advantageous due to its sophisticated options trading tools. Features like the Options Hacker, Spread Hacker, and Risk Profile provide invaluable insights into options strategies, potential returns, and risk assessment, making it easier to plan and execute trades with precision.

Another significant advantage of Thinkorswim is its access to TD Ameritrade’s educational resources and trading community. Traders can benefit from a wide range of tutorials, webinars, and courses covering various trading topics and participate in a vibrant community of traders.

The platform is free to TD Ameritrade clients, with no minimum account balance required, although certain advanced features and trading options may incur fees.

| Pros | Cons |

|---|---|

| Comprehensive research tools and advanced charting capabilities | Can be overwhelming for beginners due to its complexity |

| Wide range of tradable securities, including forex and futures | Some advanced features may have a steep learning curve |

| Sophisticated options trading tools for in-depth strategy analysis | Trading costs and fees may be higher compared to some competitors |

The Transition from MetaTrader

Transitioning from Metatrader to alternatives like TradeLocker, cTrader, NinjaTrader, or Thinkorswim involves several challenges, but they can be effectively managed with targeted strategies:

- Learning New Interfaces: Use demo accounts to familiarize yourself with the new platform’s layout and functionalities without financial risk.

- Understanding Different Features: Take advantage of educational resources—tutorials, webinars, and forums—to grasp your new platform’s unique features and tools.

- Adjusting Trading Strategies: For algorithmic traders, converting or adapting trading scripts to the new platform’s language is crucial. Seek tools or community support for translation and optimization.

Final Word

In conclusion, the need for robust and versatile trading platforms becomes increasingly crucial as the trading environment evolves. For those moving away from Metatrader in 2024, the alternatives presented—TradeLocker, cTrader, NinjaTrader, and Thinkorswim—offer a diverse range of features tailored to meet the needs of traders at every level. Whether you prioritize user-friendly interfaces, advanced algorithmic trading capabilities, comprehensive research tools, or a mix of these features, there is a platform designed to support your trading journey.

By selecting the platform that aligns with your trading style and goals, you can ensure that your trading activities remain uninterrupted, efficient, and profitable in the dynamic landscape of 2024 and beyond. This transition may allow you to explore new strategies, instruments, and communities, ultimately enhancing your trading experience.