When trading, understanding your margin level and what a stop out means can save you from unexpected losses. This helps you keep track of how much of your funds are at risk and what happens when things don’t go as planned.

Let’s break down these concepts into simpler terms.

Margin level explained

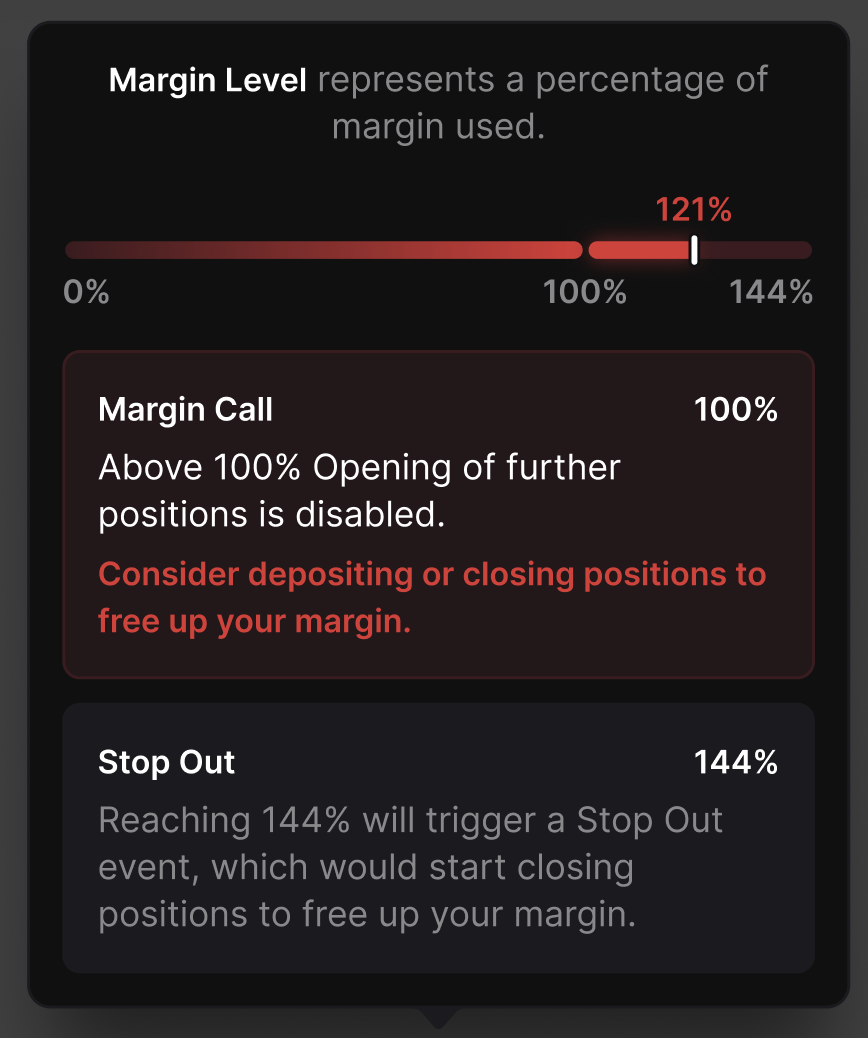

On TradeLocker, the margin level is calculated by default as the Margin used divided by the total Equity. This ratio helps traders understand how much of their funds are leveraged in trades.

As traders open more positions, they utilize more of their margin. This decreases the margin level, signaling how close an account is to exhausting its available funds. Its value ranges from 0% (the total available amount) up to a stop-out level set by the broker, typically between 100% and 150%.

Here’s an example:

Margin call

Think of the margin call as a warning signal.

Before hitting the stop-out level, traders receive a Margin call. This is essentially a warning that your margin level is being used up. It occurs when your margin level falls within the range of 70% to 100%, depending on the broker. The margin call serves as a reminder to either deposit more funds or close some positions to free up the margin, and it disables the opening of new positions.

Stop out

The stop-out feature on TradeLocker serves as a safety net.

As your Profit and Loss is dropping more and more, the margin level will reach the maximum limit set by your broker and this will trigger a Stop Out. This is a protective measure where the broker starts closing your open positions. The goal is to stabilize your margin level by reducing the amount of leveraged funds.

Unlike other platforms where a margin call closes your entire position abruptly, TradeLocker uses a different approach. Instead of completely liquidating your position, it minimally closes at 0.01 lots, giving you a chance to recover and potentially turn the trade around. It’s a unique feature that provides traders with more flexibility during challenging market conditions.

Check out this video for more info:

By understanding and monitoring your margin level, you can take proactive steps to avoid a margin call or a stop out, ensuring that your trading strategy remains sustainable.