If you’re stepping into the world of trading, you’ve probably heard the terms prop firm, broker and trading platform. While they all let you trade, each serves a different purpose and operates differently.

Understanding the difference is key to deciding the best path for your trading journey.

What is a Broker?

A broker is a financial institution that lets you buy and sell assets using your own money. When you deposit funds, they’re held in an account managed by the broker. Brokers also set the trading conditions, including spreads, fees, margins, and leverage.

What is a Prop Firm?

A proprietary (prop) firm is different. Instead of using your own money, prop firms allow you to trade with the firm’s capital. Traders must first pass a challenge or evaluation to prove they can manage risk and generate profits. Once you pass, you get access to significant capital and usually share profits with the firm, depending on the firm’s policy.

Main Differences

Using a broker is ideal if you want full control over your trading account and capital, but it also means your profits and losses are entirely your responsibility.

Prop firms are perfect if you want to scale quickly without risking large sums of your own money, but you need discipline, skill and the ability to stick to the rules.

| Broker | Prop Firm | |

|---|---|---|

| Capital | Your own | Firm’s capital |

| Profit/Loss | All yours | Shared with prop firm |

| Rules | Flexible | Strict (targets, drawdowns, consistency) |

| Access | Direct trading | After passing challenge |

As outlined in the table, brokers give you full control over your own capital, allowing you to make independent trading decisions and keep all profits, but you also take on all the risk.

Prop firms, on the other hand, provide access to the firm’s capital, which lets you scale faster without risking large sums of your own money. However, you must follow strict rules and risk management guidelines and profits are shared with the prop firm.

Which One Should You Choose?

Both brokers and prop firms give you access to the markets, but they serve different needs. Brokers offer freedom and independence, while prop firms provide the opportunity to trade with larger capital under structured conditions.

- Choose a broker if you want full control, if you’re starting with small capital and enjoy independent trading.

- Choose a prop firm if you want to scale faster, access larger funds and don’t mind following structured rules.

The right choice depends on your goals, capital, and trading style. Whichever path you take, combining it with the right trading platform ensures you’re equipped to trade with confidence.

Conclusion

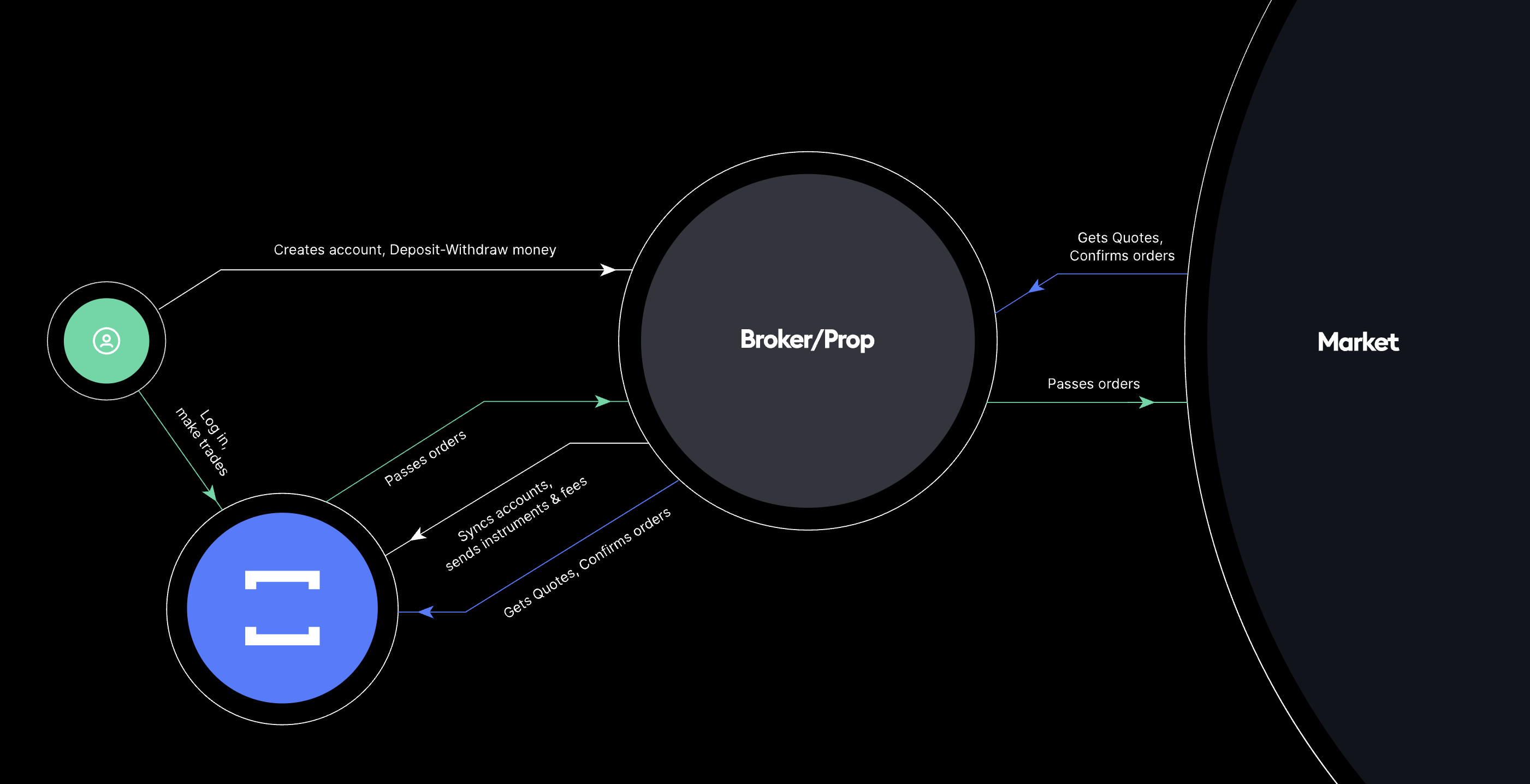

Whether you trade through a broker or a prop firm, the right platform makes all the difference and that’s where TradeLocker comes in.

TradeLocker offers different options to suit every trader, whether you want to connect to a broker account or use it while working with a prop firm. To learn more about the differences between trading platforms and which one might be right for you, check out our full guide here.

With a clean, intuitive interface, TradeLocker offers features like integrated TradingView charts with on-chart trading, risk calculator and automated trading bots to help you execute your strategy seamlessly.

You get the same user-friendly experience whether you’re trading with your own funds through a broker or scaling up with a prop firm so you can concentrate only on your trading. Explore available brokers and prop firms on TradeLocker to start your trading journey.