Paper trading sounds perfect: you trade with virtual money, learn fast, and avoid expensive mistakes.

But there’s a catch.

A lot of paper trading platforms are “too nice.” They give you fills you wouldn’t get live. They ignore the spread at the worst possible moment. They make every exit feel effortless.

So you end up practicing a version of trading that doesn’t exist.

This guide fixes that.

You’ll get:

- A quick shortlist of the best options (based on what you trade and how you trade).

- A simple “realism checklist” that instantly exposes misleading simulators.

- A full comparison table you can actually use.

- A step-by-step plan to make paper trading transfer to live performance.

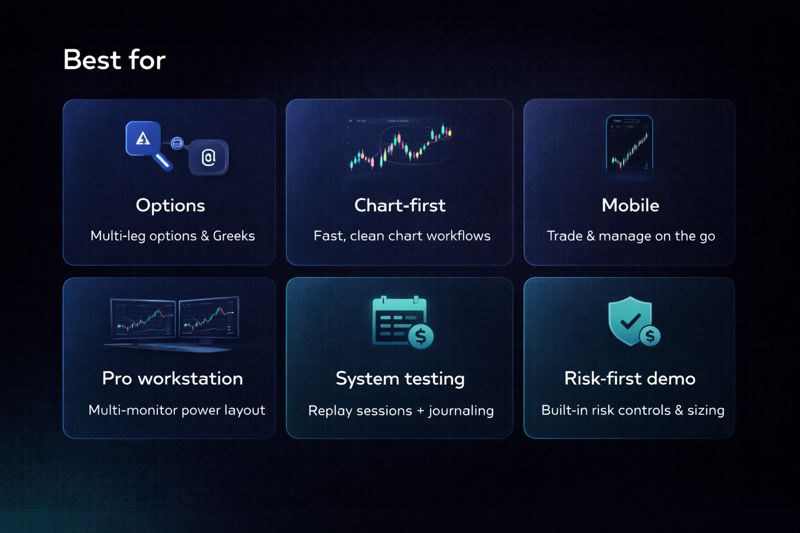

Quick answer: the best paper trading platforms (by use case)

If you just want the fast shortlist, use this section.

Because the truth is: there’s no single best paper trading platform for everyone.

The best platform depends on:

- your market (options vs stocks vs forex/CFDs),

- your style (day trading vs swing vs system testing), and

- how much realism you need right now (beginner reps vs execution testing).

Best picks at a glance

| Platform | Best for | Why it wins | Watch-out |

| TradingView Paper Trading | Chart-first practice and fast daily reps | Easiest way to practice from charts without extra setup | Can feel “cleaner” than live execution; treat results as training reps |

| thinkorswim paper trading (paperMoney) | Options workflows and advanced platform practice | Strong options tools and workstation depth | Still simulated; liquidity edge cases can differ from live |

| Interactive Brokers paper trading | Pro-style practice + broad market access | Great for traders who want a more “professional” environment | Learning curve is real |

| Webull paper trading | Mobile-first beginners | Low-friction practice that’s easy to repeat | Simulated fills can be optimistic for fast strategies |

| TradeStation simulated trading | Strategy testing and systematic workflows | Better fit if your practice is rules-based and repeatable | Access/features can vary by account setup |

| TradeLocker demo environment | Modern demo practice with built-in risk workflow (forex/CFD-style) | On-chart execution + risk tools help you practice sizing and exits properly | Access is through a broker or prop firm environment, not a standalone simulator |

What “best” really means in paper trading (the realism checklist)

Here’s the biggest mistake people make: they judge a paper trading platform by how fun it is.

You don’t want fun.

You want a simulator that trains the right instincts.

A truly useful paper trading platform gets 3 things right:

- It doesn’t hide the ugly parts of execution (spread, slippage, partial fills).

- It lets you practice the order types you’ll use live (not a simplified toy version).

- It makes risk management unavoidable (position sizing, stop placement, take profit logic).

The 7 realism factors that matter most

1) Spread awareness (bid/ask behavior).

If your platform regularly fills entries and exits at prices that ignore the spread, your stats will look better than reality. The spread is not a detail. It’s the tax you pay for getting in and out.

2) Slippage (even if it’s basic).

Slippage is the gap between the price you want and the price you get. In real markets, it shows up most when you’re late, fast, emotional, or trading thin liquidity. A platform that never shows slippage can accidentally teach bad habits.

3) Partial fills and liquidity constraints.

Some strategies work on liquid products and fall apart on thin ones. If your platform fills everything instantly at your requested price, you’re not practicing execution—you’re practicing wishful thinking.

4) Real order types.

A serious simulator should support the same order logic you rely on live. If you use bracket orders, trailing stops, OCO, or conditional orders, your practice platform should let you rehearse that exact process.

5) Fees and P&L clarity.

You don’t need perfect fee modeling to learn. But you do need clear P&L and a way to review trades. Otherwise paper trading becomes “vibes-based” instead of measurable.

6) Data timing (real-time vs delayed).

Delayed quotes can still be fine for swing trading practice and platform learning. But if you’re practicing day trading or quick execution, delayed data can corrupt the whole exercise.

7) Session realism.

Markets behave differently across sessions. A simulator that ignores market hours and liquidity shifts can make trading feel smoother than it is.

Paper trading vs demo accounts vs simulators (and why it matters)

People use these terms interchangeably, but they’re not the same thing.

Paper trading is usually the fastest path to practice. It’s often built into charting tools or broker platforms and is designed to help you rehearse decision-making and order placement without risking capital.

Demo accounts are typically closer to a real trading environment (especially for forex/CFDs), because they mirror a broker-style workflow. When the demo environment includes risk tooling directly in the order flow, it becomes much easier to practice the part that actually determines survival: position sizing, stop-loss discipline, and consistent exits. That’s one reason “risk-first” platforms (including TradeLocker-style demo workflows) can be so effective for structured practice.

Standalone simulators are often built for education and accessibility. They can be excellent for beginners, but some simplify execution in ways that matter later.

Full comparison: best paper trading platforms side-by-side

This table is designed to answer the question most posts don’t: “Which platform is best for my style?”

| Platform | Best for | Realism focus | Learning curve | Best use |

| TradingView Paper Trading | Chart-first practice | Medium | Low | Setups + entries/exits rehearsal |

| thinkorswim paper trading | Options + advanced workflows | Medium–High | Medium | Options chains, multi-leg order rehearsal |

| Interactive Brokers paper trading | Pro environment + breadth | High | High | Serious practice, multi-market workflows |

| Webull paper trading | Mobile beginners | Medium | Low | Habit-building, daily reps |

| TradeStation simulated | System testing | Medium–High | Medium | Repeatable strategy testing |

| TradeLocker demo workflow | Risk-first demo practice | Medium–High | Low–Medium | Position sizing + stop/TP discipline + on-chart execution |

Platform deep dives (what each is actually good at)

The goal here isn’t to crown a single winner.

The goal is to match you with a platform you’ll actually use—and one that trains the habits you need.

TradingView Paper Trading: best for chart-first practice and fast reps

If you’re the type of trader who thinks in charts first, you want a platform that lets you go from “setup spotted” to “practice trade placed” without friction. That’s the big advantage here: you can practice decision-making and execution while staying in your charting environment.

This is especially useful for building the muscle memory of entry triggers, stop placement, and exit rules. It’s also a strong choice if you want to review trades visually and quickly.

Where you need to be careful is assuming simulated fills represent real execution quality. For execution-sensitive strategies, treat paper results as a training tool, then validate with small live size later.

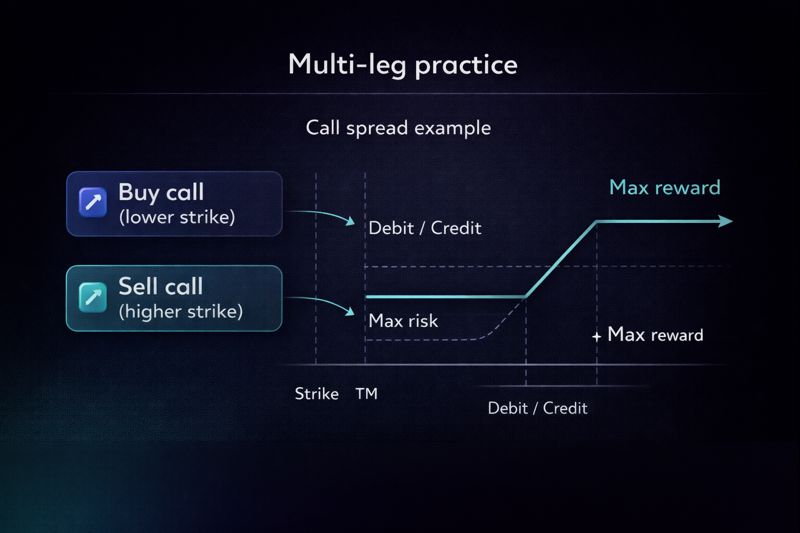

thinkorswim paper trading: best for options workflows

Options trading is workflow-heavy. You’re not just choosing direction—you’re choosing strikes, expirations, and structures. That means paper trading for options is less about “perfect realism” and more about rehearsing a complex process until it becomes automatic.

This platform is a strong fit if you want to get comfortable with options chains, multi-leg construction, and position management in a deep workstation.

The main mindset shift is simple: use it to become faster and cleaner at execution. Don’t use it as proof your fills will always be that cooperative when markets move fast or liquidity gets thin.

Interactive Brokers paper trading: best for traders who want a pro environment

Some platforms are built for quick learning. Others are built for serious workflows.

This is one of the better fits if you want a platform environment that feels closer to how professionals interact with markets. It can be great for practicing across instruments and building more structured routines for order placement and review.

The tradeoff is that you’ll spend more time learning the platform itself. If you’re brand new, that can slow your reps. If you’re already committed to trading as a craft, the depth can pay off.

Webull paper trading

If you’re trying to build consistency, mobile friction matters. A lot.

This is the kind of platform that can help you practice frequently because it’s easy to open, easy to place a simulated trade, and easy to repeat the routine. For beginners learning stops, targets, and basic discipline, that’s often the highest ROI.

Just keep your standards straight: if your long-term goal is day trading execution, you’ll eventually want to validate in an environment that better reflects live fills and fast-market conditions.

TradeStation simulated trading: best for systematic practice and strategy testing

If your trading is rules-driven, your paper trading should be rules-driven too.

Platforms in this category tend to fit traders who want to test repeatable processes, track results, and refine execution based on measurable outcomes. It’s less “practice clicking” and more “practice running a system.”

This can be a strong bridge between research and live execution, especially when you’re committed to a process and want to evaluate it honestly.

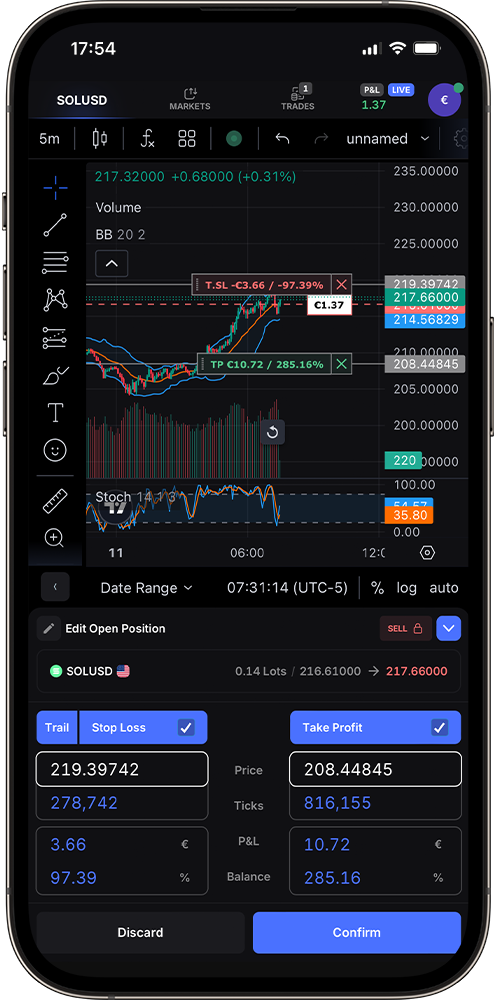

TradeLocker demo workflow: best for practicing risk and execution discipline (forex/CFD-style)

A lot of traders focus their paper trading on entries. But most of the money is made (or lost) in position sizing and exits.

That’s where a modern, risk-first demo workflow can help. When your platform makes it natural to define the stop, take profit, and risk size as part of placing the trade, you rehearse good habits every single time.

TradeLocker is often positioned in that “next-gen” category: modern UI, cross-device access, TradingView-style charting integration, on-chart trading, and built-in risk tooling that encourages structured execution. Used in a demo environment, it’s a practical way to train consistent sizing and clean exits without turning paper trading into a game.

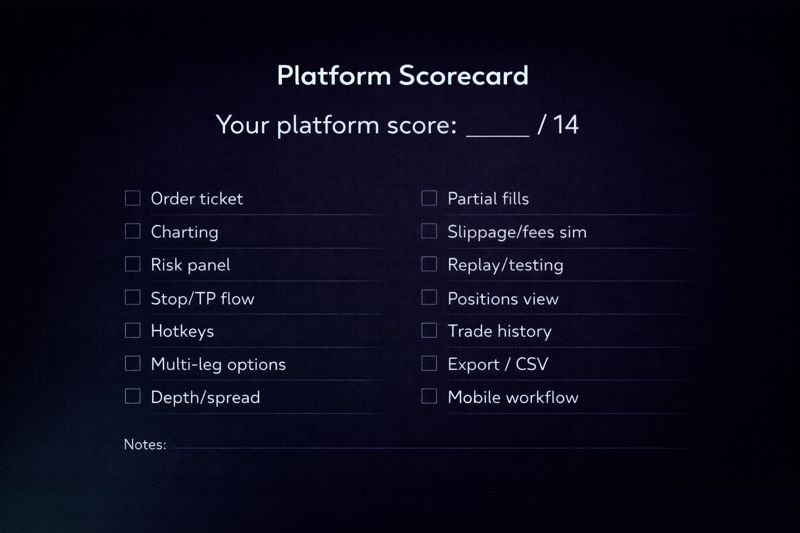

The 10-minute scoring rubric (use this before you commit)

Here’s a fast way to score any paper trading platform without overthinking it. Give each category a 0–2 score and total it up.

| Category | 0 | 1 | 2 |

| Spread realism | ignores spread | sometimes reflects spread | consistently spread-aware |

| Slippage | never appears | manual assumption | modeled or configurable |

| Partial fills | never | rare | common where expected |

| Order types | basic only | some advanced | matches your live needs |

| Review tools | weak | ok | strong and easy |

| Data timing clarity | unclear | mixed | clear and suitable |

| Habit building | clunky | usable | effortless daily reps |

A beginner can get strong value even with a mid score if it drives repetition and habit. But if you’re testing a strategy that depends on execution precision, realism becomes the priority.

How to paper trade the right way (so it transfers to live)

Most paper trading fails for one reason: people practice outcomes instead of practicing process.

If you want paper trading to translate, your goal is simple: build a routine that produces clean, repeatable decisions.

Start by matching your virtual account size to your planned live size. If you intend to trade small, paper trade small. Otherwise you train your brain to accept risk you won’t tolerate later.

Next, pick one setup and commit to it for 30 trades. Not forever. Just long enough to see whether you can execute the same idea consistently without improvising mid-trade.

Then force realism where the simulator is weak. If your platform doesn’t model slippage, assume it. If it fills too cleanly, tighten your rules. If you’re practicing day trading, lean toward limit orders in your simulation so you stop assuming perfect market fills.

Finally, focus on exits. Practice placing stops and targets like it’s the main event—because it is.

A simple journal that actually gets used

Keep it tiny so you’ll keep doing it. After each trade, write one paragraph: what you saw, what you did, and what you’d change. Attach one screenshot. That’s enough.

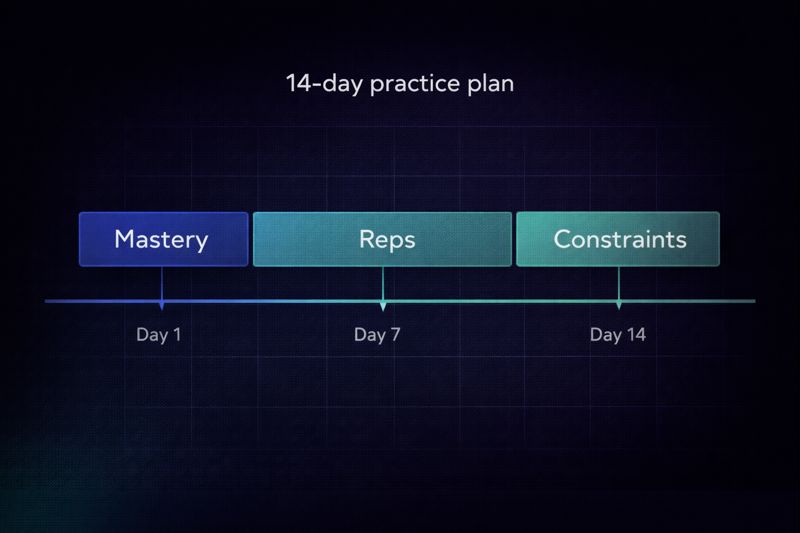

The 14-day paper-to-live transition plan

The biggest gap between paper and live isn’t technical.

It’s emotional and behavioral.

So the fastest way to close that gap is to train constraints.

Days 1–3: Platform mastery.

Your goal is speed and correctness. You should be able to place your typical order, set a stop, set a target, and size the position without hesitation.

Days 4–10: One setup, 30 trades.

You’re building execution consistency. Your job is to follow rules, not chase excitement.

Days 11–14: “Live constraints” mode.

Even if you’re still paper trading, impose live-like limits: one daily loss limit, a cap on trades per day, and no “revenge entries.” The point is to rehearse discipline when you’re slightly frustrated—because that’s when real accounts get damaged.

FAQ (built for search intent)

What is the best paper trading platform for beginners?

The best beginner platform is the one you’ll use consistently and that makes stops and position sizing simple. If you’re learning the basics, low friction matters more than perfect realism.

Is paper trading realistic?

Paper trading is realistic enough to learn workflow and build habits, but it won’t perfectly reproduce live fills and emotions. Treat it as training, then validate with small live size.

What’s the best paper trading platform for options?

Pick a platform with strong options workflow tools (chains, multi-leg structures, position management). Then use paper trading primarily to rehearse process, not to “prove” profitability.

How long should I paper trade before going live?

Use a performance-and-process milestone instead of a calendar milestone. A solid target is 30–50 trades on one setup with consistent execution and a simple journal.

Final verdict

The best paper trading platform is the one that helps you practice the exact skills you need next.

If you’re chart-first and want fast reps, choose a chart-centric paper environment. If you’re options-focused, choose a workstation built for options workflows. If you want a pro-style environment, pick a platform that supports serious order control and review.

And if your biggest weakness is inconsistent risk and messy exits, a modern demo workflow (TradeLocker-style) that nudges you into defining risk, stop-loss, and take-profit as part of execution can be a smart way to train the habits that keep traders alive.