Day trading has one of the biggest “gap realities” of any skill on Earth.

On one side, you’ll see screenshots of massive wins, “caught the move” highlights, and bold claims about quitting your job. On the other side, you’ll see traders saying day trading is a trap, that “only brokers win,” and that the entire industry is built on selling courses.

Here’s the cleanest way to say it:

Day trading can be profitable. But it’s not reliably profitable for most people who try it, especially beginners who underestimate costs, overtrade, and don’t have a real process.

This post will help you answer three questions with brutal clarity:

- What does “profitable” actually mean in day trading (and which definition matters)?

- Why do most day traders lose money even when they’re “right” a lot of the time?

- How can you test whether you have a real edge before you risk serious capital?

What “Profitable” Really Means (Most People Use the Wrong Definition)

When people ask, “Is day trading profitable?”, they usually mean one of three things. And mixing them up is how traders lie to themselves (without realizing it).

Profitable Tier 1: You made money (net) over a period of time

This is the “I ended the month up” definition. It’s the lowest bar and the easiest to fake with a lucky streak.

Profitable Tier 2: You’re consistently profitable across many months

This is the real skill bar. It means you’re profitable across different market conditions, not just when your favorite setup happens to work.

Profitable Tier 3: You can live off it

This is where day trading becomes a business. It means you can cover living expenses, taxes, and down months without blowing up your psychology or your account.

Here’s a quick way to see the difference:

| Profitability level | What it looks like | Why it’s harder than it sounds |

| Tier 1: Net positive | “I’m up this month.” | Luck can mimic skill for a long time. |

| Tier 2: Consistent | “I’m profitable most months.” | Costs + drawdowns punish inconsistency. |

| Tier 3: Living income | “I can pay bills and grow my account.” | You need enough edge and enough capital. |

The Real Answer: Is Day Trading Profitable?

Yes—for a small minority.

But the more important question is: Is it likely to be profitable for you?

That depends on whether you can build four things that most people never build:

- A repeatable edge (something that gives you positive expectancy over a large sample)

- Risk rules (so one bad day doesn’t erase two good weeks)

- Cost control (fees, spreads, slippage, and overtrading)

- Execution quality (fast, accurate order placement and consistent position sizing)

If any one of those is missing, profitability becomes a coin flip. And coin flips don’t survive real-world costs.

Why “The Stats” Look So Bad (and Why That Still Matters)

If you’ve browsed Reddit or Quora threads about day trading profitability, you’ve probably seen a common theme: “Most traders lose.” That skepticism exists for a reason.

Large datasets and long-term analyses tend to show two uncomfortable patterns:

First, many traders are unprofitable net of costs. Even if they win some trades, the math can still be negative once you include spreads/commissions and slippage.

Second, consistent profitability is rare. A trader might have a good month, then give it back. Or they might do well in one market regime and fail when volatility changes.

Now, here’s the nuance most articles skip:

A lot of these datasets include everyone—new traders, undercapitalized traders, impulsive traders, and traders who treat day trading like entertainment. That pushes the averages down.

But that doesn’t “save” day trading.

It simply means the industry is full of people trying to win a game without learning the rules. If you want to be in the profitable minority, you have to act like the minority from day one.

The Profitability Equation (This Is the Only Truth That Matters)

You don’t become profitable by wanting it more. You become profitable when your numbers support it.

Day trading profitability can be reduced to one line:

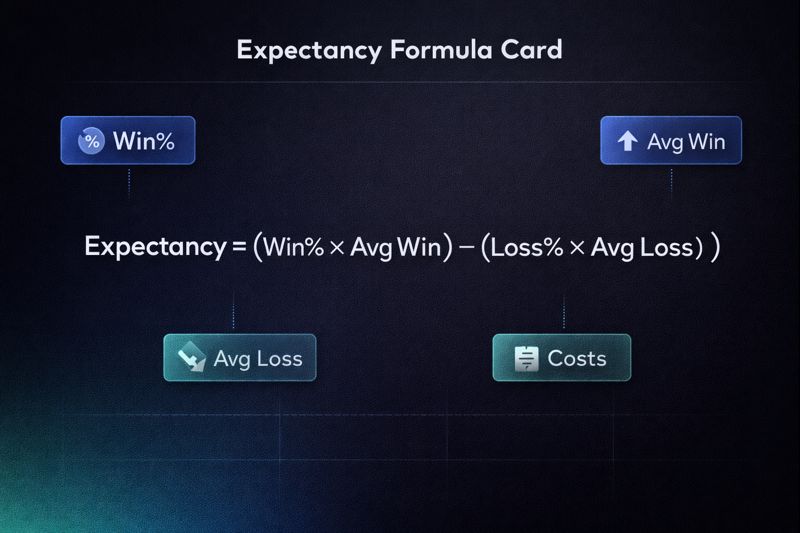

Expectancy = (Win% × Avg Win) − (Loss% × Avg Loss) − Costs

That last part—costs—is what makes day trading different from most other skills. Because the more you trade, the more you pay. And if you’re “kind of okay,” costs can turn “kind of okay” into “guaranteed loser.”

Why a high win rate can still lose money

A trader who wins 70% of the time feels unstoppable. But if their average win is small and their average loss is large, they can still bleed out slowly.

This is why “I’m right a lot” isn’t a strategy.

Your job is not to be right.

Your job is to run a process where the average outcome over 100+ trades is positive.

The 7 Levers That Determine Whether Day Trading Is Profitable

Most traders obsess over entries. Profitable traders obsess over the levers that actually move the outcome.

1) Edge (strategy)

An edge is not a pattern you like. An edge is a behavior you can define, repeat, and measure.

2) Risk per trade

Risk is the steering wheel. If you can’t control it, you can’t control anything.

3) Your win/loss distribution

This is the relationship between average wins and average losses. It matters more than your “best trade.”

4) Frequency (overtrading)

Overtrading is the easiest way to destroy expectancy. The market can’t “save you” from bad selectivity.

5) Costs (spreads, commissions, slippage)

Costs are death by a thousand cuts. The more you chase tiny moves, the more they matter.

6) Execution quality

This is where your platform and workflow quietly shape your results. If position sizing is slow, if placing SL/TP is clunky, or if you’re constantly adjusting orders manually, you’re leaking performance.

This is also why traders who treat platforms as interchangeable often stagnate. Tools don’t create an edge, but they absolutely affect whether you can execute your edge consistently.

7) Psychology and consistency

You don’t need monk-level discipline. You need a system that reduces decision fatigue and prevents “one bad decision” spirals.

“How Much Do Day Traders Make Per Day?” (The Question That Traps People)

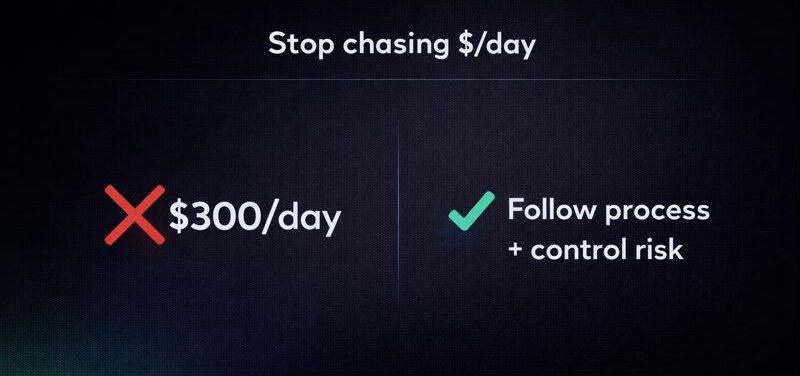

If you search this topic, you’ll find posts trying to put a dollar amount on daily profit. It’s understandable—people want a tangible outcome.

But targeting “$X per day” is one of the fastest ways to sabotage your trading.

Daily profit targets encourage forcing trades. They turn trading into a scoreboard instead of a process. And they make you size up on the days when the market is giving you the least clarity.

A healthier lens is: How much am I risking, and how well am I following my rules?

Here’s a simple example of why this matters: if you risk too much, one emotional trade can erase weeks. If you risk too little, you can’t learn because every trade feels meaningless and you start gambling for stimulation.

Your goal is to pick a risk level that lets you take enough trades to learn, without risking account-ending damage.

Why Most Day Traders Fail (And How to Avoid the Same Fate)

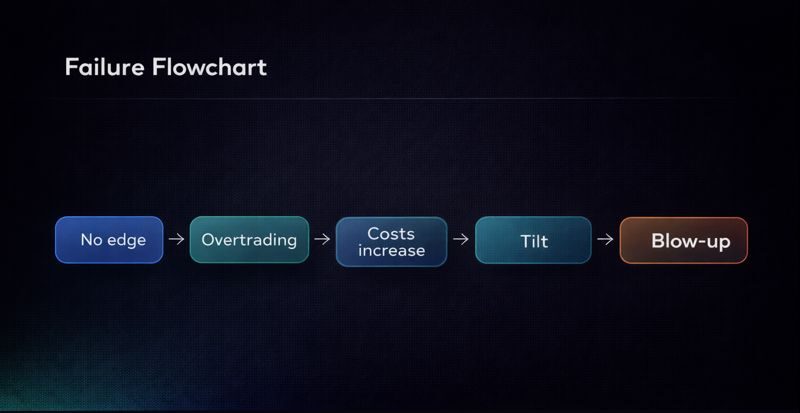

This is the part that Reddit gets right: the failure modes are predictable. And most of them have nothing to do with intelligence.

Overtrading is the silent killer

Overtrading isn’t just “too many trades.” It’s trading when you don’t have a real setup, trading because you’re bored, or trading because you want to get back to even.

Overtrading amplifies costs and amplifies mistakes. It’s a multiplier on everything bad.

Most traders don’t have risk rules they can’t break

Saying “I’ll use a stop loss” is not a rule. It’s a hope.

A rule is something like: “If I hit my max daily loss, I stop trading. No exceptions.” Or: “I never move my stop further away.”

Rules exist to protect you from a version of yourself that shows up under stress.

Strategy hopping prevents statistical confidence

If you change your approach every week, you never build enough sample size to know what works. You end up confusing randomness for insight.

Bad execution creates unnecessary losses

This one is underrated. If your workflow makes it hard to set stop loss and take profit quickly, or if you’re constantly doing position sizing math under pressure, you’re increasing error rate.

That’s why many traders lean toward platforms that make risk-based execution feel natural. For example, TradeLocker includes an order panel with SL/TP and a risk calculator so you can size positions around defined risk instead of gut feel. It won’t make you profitable by itself, but it can remove avoidable mistakes that quietly bleed accounts.

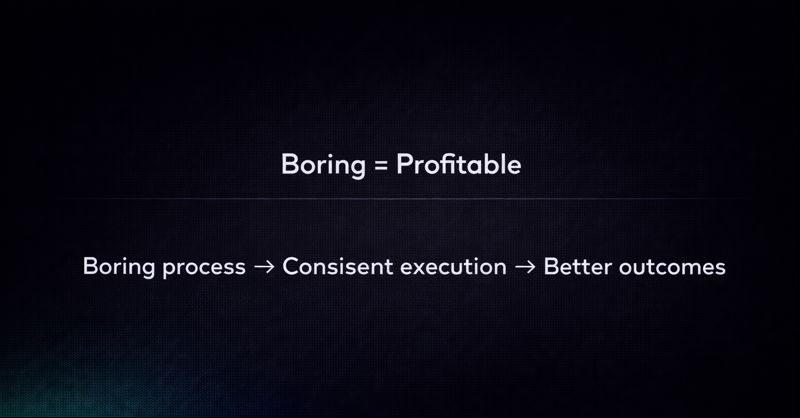

What Profitable Day Traders Do Differently (No Hype, Just Patterns)

Profitable day traders aren’t superheroes. They’re boring in the right ways.

They trade less than you think. They focus on a small set of setups. They know what a “good trade” looks like before the day starts. And they review their behavior like an athlete reviews game film.

They also build risk systems that run even when emotions are loud. That can look like preset SL/TP, break-even rules, and trailing stop logic that prevents winners from turning into losers.

The big difference is this: losing traders try to be “right.” Profitable traders try to be consistent.

The 30-Day Test: How to Find Out if You Can Be Profitable (Before You Scale)

Instead of debating day trading profitability in theory, you can run a controlled test that answers the question in practice.

This is the same idea serious businesses use: don’t scale what you can’t measure.

Step 1: Lock your variables

For 30 days, you pick one market, one session window, and one strategy. You do not switch tools, add indicators, or reinvent your approach mid-test. The goal isn’t to be “creative.” The goal is to gather clean data.

Step 2: Trade small enough to stay rational

If you’re emotional, your data is garbage. The point is to learn whether the strategy and execution work, not whether your nervous system can survive a rollercoaster.

Many traders practice with micro lots or very small position sizes specifically to reduce stress while they build consistency.

Step 3: Track the metrics that matter

You want to know whether your trading is improving in a measurable way. That means tracking:

- expectancy (average outcome per trade),

- average win and average loss,

- maximum drawdown,

- and the number of “rule breaks.”

Even if you’re down money in the first 30 days, improvement in rule breaks and expectancy is often a stronger signal than raw P&L.

Step 4: Only scale when your process is stable

Scaling too early is how traders turn a small leak into a flood. You scale when your behavior is consistent and your results make sense over a meaningful sample size.

If you want to make the test easier to execute, use tools that reduce friction. For example, if your platform makes it quick to define risk, set SL/TP, and manage positions on-chart, you’ll spend less mental energy on mechanics and more on decision quality. TradeLocker is built around that kind of modern, risk-first workflow (especially useful for traders who want fewer clicks between analysis and execution).

[Image suggestion — “30-Day Scorecard Template”: A printable table layout with columns: Date, Setup type, Planned risk (R), Result (R), Mistakes (Y/N), Notes. Make it look like a clean Notion/Sheet template.]

Table you can include in the blog (and offer as a download):

| Day | # Trades | Expectancy (R) | Avg Win (R) | Avg Loss (R) | Max DD (R) | Rule breaks | Notes |

| 1 | |||||||

| 2 | |||||||

| … | |||||||

| 30 |

“If Day Trading Is Profitable, Why Are There So Many Gurus?”

Because selling information scales better than trading.

Trading income is volatile. Education income can be recurring. And marketing tends to reward confidence more than competence.

That doesn’t mean every educator is a scam. It means you should evaluate educators like you evaluate trades: by evidence and process, not by vibes.

A good educator teaches a repeatable framework, emphasizes risk, shows losing periods, and encourages small, measurable testing. A bad educator promises easy money, leans on lifestyle imagery, and avoids specifics about risk and drawdowns.

Day Trading vs Swing Trading vs Investing (What You Should Do Instead)

If your goal is steady long-term wealth with minimal screen time, day trading is usually not the best tool. Investing or swing trading tends to match that goal better.

Day trading is most suitable when you actually want a performance skill that requires practice, fast decision-making, and routine. It’s closer to a competitive discipline than a passive income method.

Here’s a clean comparison:

| Style | Holding time | Time required | Stress level | Main advantage | Main downside |

| Day trading | Minutes to hours | High | High | Frequent opportunities | Costs + decision fatigue |

| Swing trading | Days to weeks | Medium | Medium | Less noise | Slower feedback loop |

| Investing | Years | Low | Low | Compounding | Requires patience |

Bottom Line: Is Day Trading Profitable?

Day trading is profitable for some people, but it’s not “automatically” profitable—and it’s not reliably profitable for most beginners.

If you want a real answer for your situation, stop arguing with opinions and run the 30-day test. If your expectancy improves, your rule breaks drop, and your execution becomes consistent, you’re building something real. If you’re random, emotional, and overtrading, the market will eventually collect tuition.

And if you’re serious about giving yourself a fair shot, reduce friction wherever you can—especially around risk and execution. A clean workflow, fast SL/TP placement, and risk-based sizing (the stuff TradeLocker is designed for) won’t replace skill, but it can help you practice skill without unnecessary mistakes.