What “risk management” actually means in active trading

In plain terms, risk management is how you control three things: how much you can lose on one trade, how much you can lose in one day, and how much exposure you’re carrying at once. If those three are defined and enforced, your strategy gets room to work. If they’re vague, your account becomes the strategy.

The 12 best risk management techniques for active traders (quick overview)

Table: Technique → what it prevents → when to use it

| Risk management technique | What it prevents | When you use it |

| 1) Fixed risk per trade (in % or $) | Oversized losses | Every trade |

| 2) Position sizing based on stop distance | “Guess sizing” | Before entry |

| 3) Non-negotiable stop-loss rule | Catastrophic loss | Every trade |

| 4) Stop placement method (structure/volatility/time) | Random stop placement | Every trade |

| 5) Minimum risk:reward requirement | Low expectancy trades | Before entry |

| 6) Leverage cap (hard limit) | Margin spiral | Always |

| 7) Daily maximum loss limit | Revenge trading | Intraday |

| 8) Cool-down rule after losses | Emotional decisions | Intraday |

| 9) Max trades per day | Overtrading | Intraday |

| 10) Volatility/news filter | Slippage + whipsaw | Around events/fast markets |

| 11) Correlation & concentration limits | “Hidden one big bet” | Multi-position |

| 12) Weekly review in R (not $) | Repeating mistakes | Weekly |

Technique #1: Set a fixed risk per trade (so losses stay small by design)

The fastest way to destroy an active trading account isn’t being wrong—it’s being wrong with too much size. A fixed risk per trade solves that because it gives every trade the same “impact” on your account.

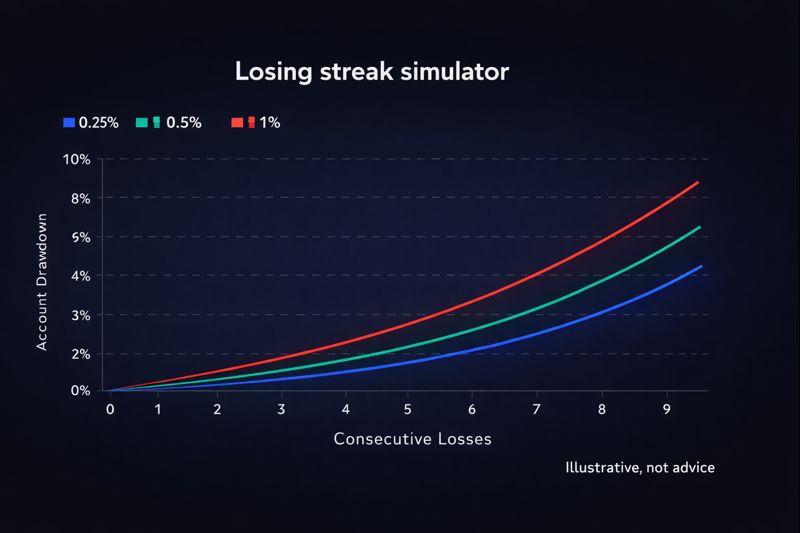

Most active traders choose a small percentage (or a fixed dollar amount) and stick to it. What matters is not the exact number; it’s that your risk per trade is low enough that a normal losing streak doesn’t push you into panic or rule-breaking.

If you’ve never tracked losing streaks, assume you’ll eventually face one that feels unfair. Your risk setting should survive that week without forcing you to “make it back.”

Technique #2: Use position sizing based on your stop (stop distance decides size)

Active traders often do the stop-loss “sort of right” but size “totally wrong.” They place a stop… then they choose size based on gut feel, or on how confident they are.

That’s backwards. Your stop distance should determine your position size so your risk stays constant.

A practical way to think about it is: you’re not deciding “how many shares” or “how many lots.” You’re deciding how much you’re willing to lose if proven wrong, and then sizing around that.

Position sizing formula (simple and usable)

Position size = (Account risk amount) ÷ (Stop distance)

If your stop is wider, size goes down. If your stop is tighter, size can go up. Either way, your risk remains controlled.

Table: Position sizing examples (copy the structure, don’t obsess over the numbers)

| Account size | Risk per trade | Risk amount | Stop distance | Conceptual position size |

| $10,000 | 0.5% | $50 | $0.50/share | 100 shares |

| $10,000 | 0.5% | $50 | $1.00/share | 50 shares |

| $25,000 | 0.25% | $62.50 | 25 pips | Size depends on pip value |

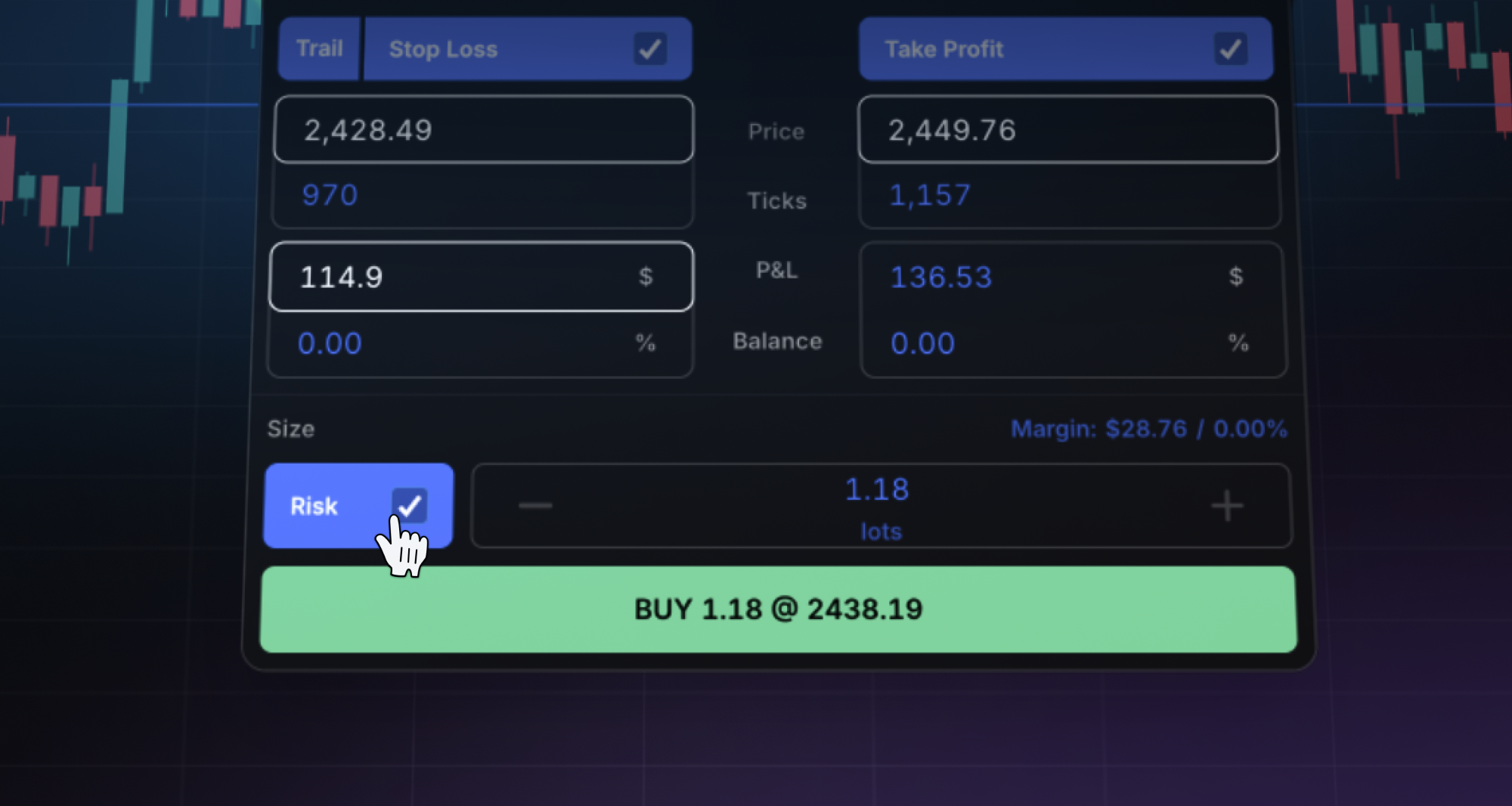

This is where tools help. If your platform shows risk clearly before you place the trade, you avoid “accidental oversizing” when the market is moving fast. TradeLocker, for example, leans into fast execution with clear SL/TP workflows and risk-friendly order entry, which is exactly what you want when you’re trying to be consistent rather than heroic.

Technique #3: Make the stop-loss non-negotiable (and define what “stop” means)

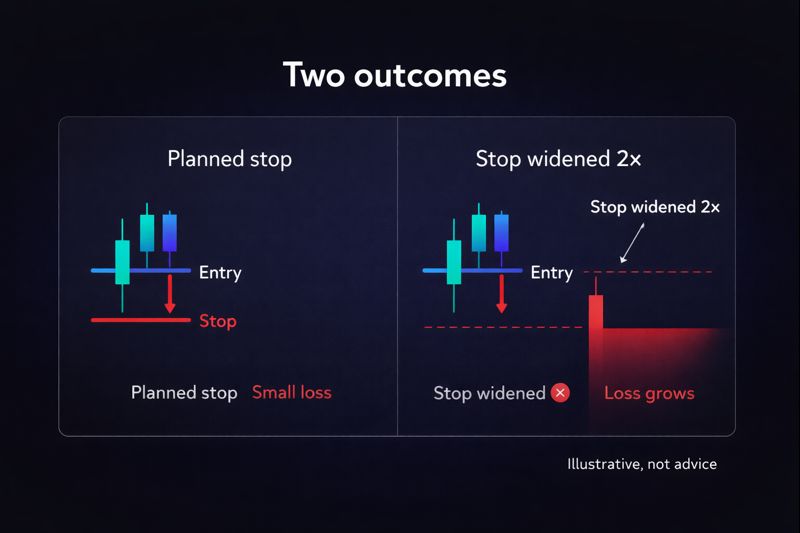

A stop-loss isn’t a “maybe.” It’s the point where your trade idea is invalid. If you treat stops as optional, you’re not managing risk—you’re negotiating with it.

What active traders need is not just “use a stop,” but a rule that answers: Do I ever move the stop farther away? Do I ever remove it? Do I ever re-enter immediately after being stopped?

If you want one high-impact rule to adopt today, it’s this: Never widen a stop to avoid taking a loss. You can re-enter when conditions make sense. But widening a stop is a fast way to turn a planned small loss into an unplanned large one.

Technique #4: Use a stop placement method (structure, volatility, or time)

Random stop placement is a silent account killer because it creates inconsistent outcomes. Pick a stop method that matches how you trade.

Structure-based stops sit beyond meaningful highs/lows or support/resistance. They’re often more “logical,” but can be wider, which means smaller size.

Volatility-based stops adapt to market movement (many traders use ATR-like logic). They can reduce random stop-outs during higher volatility.

Time-based stops exit a trade that doesn’t work quickly. This is underrated for active traders because opportunity cost is real: a trade that goes nowhere can drain focus and invite bad decisions.

The best method is the one you can execute consistently and size correctly around.

Technique #5: Set a minimum risk:reward requirement (so wins can pay for losses)

Risk:reward is often taught like a slogan. In reality, it’s a filter that prevents you from taking trades with limited upside.

You don’t need a magical ratio that works for everyone. You need a minimum threshold that matches your strategy and market conditions. If you scalp tiny moves, your ratio might be tighter and your win rate might need to be higher. If you trade trends, your ratio can be larger because you’re trying to capture bigger moves.

The key is consistency. If you take low-upside trades because they feel “easy,” you can end up with a lot of small wins that can’t absorb a few normal losses.

Technique #6: Cap leverage (because leverage turns mistakes into emergencies)

Leverage is a tool. Uncapped leverage is a trap.

A leverage cap gives you a hard ceiling on how aggressive you can be, even when you feel confident. It also protects you from the worst-case scenario: getting hit by a fast move plus slippage plus widened spreads at the same time.

If you trade multiple markets, consider a leverage cap by instrument type, and remember that correlated positions multiply risk. You can be “within your leverage” on each trade and still be overexposed overall.

Technique #7: Use a daily max loss limit (the rule that prevents blow-up days)

Most traders don’t blow up from one trade. They blow up from what happens after a trade goes wrong.

A daily max loss limit is your circuit breaker. It’s the rule that says: today is over. You stop trading, you protect your capital, and you live to trade tomorrow.

A clean way to define this is in R. If 1R is your planned risk per trade, you might set a daily stop like -2R or -3R. The number is less important than the enforcement.

This rule is especially powerful for active traders because intraday decision fatigue is real. The longer you trade, the easier it is to rationalize bad setups.

Technique #8: Add a cool-down rule after losses (so emotions don’t choose your next trade)

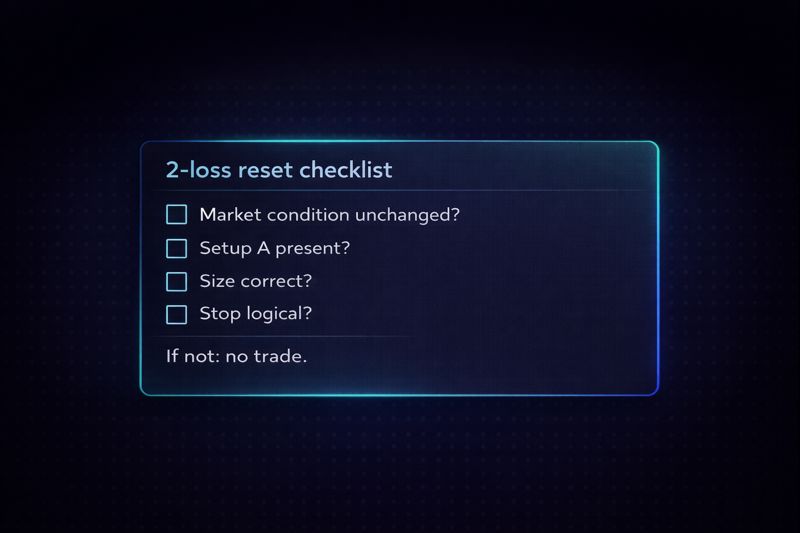

A cool-down rule is the missing link between “knowing what to do” and “actually doing it.”

If you take two losses in a row, you don’t need more screen time—you need a reset. You step away briefly, review whether market conditions changed, and confirm your next trade is genuinely your A-setup, not a reaction.

This sounds soft. It’s not. It’s a performance rule, like a pitcher stepping off the mound.

Technique #9: Set a maximum number of trades per day (overtrading is risk)

Spreads, slippage, commissions, and mental fatigue are part of active trading. They compound with volume.

A maximum trades-per-day rule forces selectivity. You stop “doing something” and start waiting for conditions that actually fit your plan. Most traders discover that when they cut trade count, their average quality rises sharply.

This is one of the most objective risk rules you can add because it doesn’t rely on mood. It’s a hard constraint.

Technique #10: Use a volatility/news filter (avoid trading conditions your edge doesn’t cover)

Volatility isn’t bad. Surprise volatility is.

A volatility/news filter gives you pre-defined rules for when you reduce size, widen stops (with adjusted size), or avoid trading entirely. It’s especially relevant for active traders because fast markets can cause worse fills and sudden swings that make “perfect” setups behave unpredictably.

The goal is not to avoid hard markets forever. The goal is to trade them intentionally, with adjusted risk, not with the same settings you use on a quiet day.

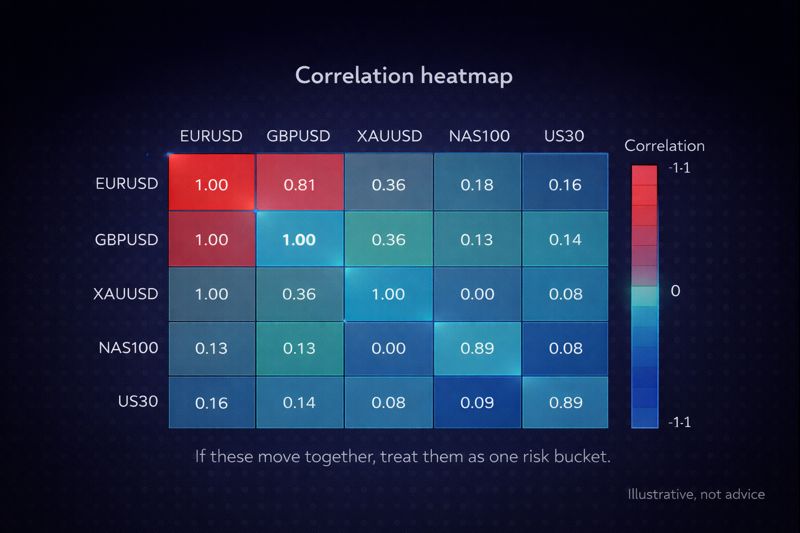

Technique #11: Control correlation and concentration (multiple trades can still be one bet)

Correlation is the risk that hides behind “diversification.”

If you take three positions that tend to move together, you can end up with a combined exposure that behaves like one large position. When the market shifts, all three get hit at once.

A practical approach is to define a maximum combined risk across correlated positions. If you risk 1R per trade, you might treat two highly correlated positions as a shared risk bucket rather than independent bets. That keeps your portfolio risk honest.

Technique #12: Review weekly in R (risk management improves when it’s measured)

If you only look at dollars, you’ll confuse risk management with account size changes. If you look at results in R, you’ll see whether your decisions are improving.

A weekly review doesn’t need to be complicated. You’re looking for patterns: where your biggest losses come from, which setups perform, and which mistakes repeat.

This is also where journaling becomes practical instead of annoying. You’re not journaling your feelings. You’re documenting the inputs and outputs of your process so you can tighten it.

A copy/paste “Risk Management Plan” for active traders

At this point you understand the techniques. Now you want a short plan you can follow without thinking.

Here’s a simple template you can paste into a doc and fill in:

Your risk per trade is % (or $).

Your daily max loss is R (or $), and once hit you stop trading for the day.

Your weekly max drawdown is ____R (or ____%), and once hit you reduce size or pause.

Your maximum trades per day is ____.

After ____ consecutive losses, you take a ____ minute break and only return for your A-setup.

Your stop method is (structure / volatility / time), and you never widen stops.

Your default profit-taking method is (fixed target / scale-out / trailing stop), and you apply it consistently.

Your leverage cap is ____, and you avoid stacking correlated positions beyond ____R combined risk.

You review results weekly in R and track rule violations separately from normal losses.

If your platform makes it easier to set SL/TP quickly and see risk before entry, this plan becomes easier to execute. That’s one reason traders prefer modern, chart-first tools (TradeLocker included): the less friction there is between “my rules” and “my order,” the fewer mistakes slip in.

Three worked examples (how this looks in real trading)

To make this concrete, here are three examples of how the same risk rules can apply across common active trading styles. These are illustrative only; the point is the process.

Example 1: Fast intraday trade (tight stop)

You define a fixed risk amount first, then you choose a stop based on structure or volatility, and finally you size the position so that stop-out equals your planned risk. The trade either hits your target or stops out small, and your daily max loss prevents you from spiraling if conditions are choppy.

Example 2: Day trade with volatility stop

You choose a wider stop because the market is moving more, but your position size decreases automatically to keep the same risk. This is the exact moment most traders blow it—because they widen the stop but keep the same size. Doing both increases risk quietly.

Example 3: Trend day with trailing stop

You enter with a defined stop, take partial profit or not depending on your plan, and trail the remainder using a rule (structure or volatility). Your job is not to predict the top; your job is to follow your trailing rule without tightening it emotionally.

The bottom line

The best risk management techniques for active traders aren’t complicated. They’re specific, measurable, and enforced. Your edge doesn’t need you to be right all the time—it needs you to keep losses small, avoid blow-up days, and stay consistent long enough for probabilities to work.

If you implement only one improvement this week, make it position sizing based on stop distance and a daily max loss rule. Those two changes alone will eliminate most account-threatening mistakes—and they make every other technique in this guide far easier to apply.