A quick truth most traders learn late

Two traders can trade the exact same setup and get completely different outcomes. Not because one found a better indicator, but because one has the skills to size correctly, wait for the right moment, execute cleanly, and accept the outcome without “fixing” it mid-trade.

That’s why this guide is built around trading skills, not strategies. You can borrow a strategy in an afternoon. Skills take practice, but they compound. The goal is to help you build the small set of abilities that directly influence your P&L.

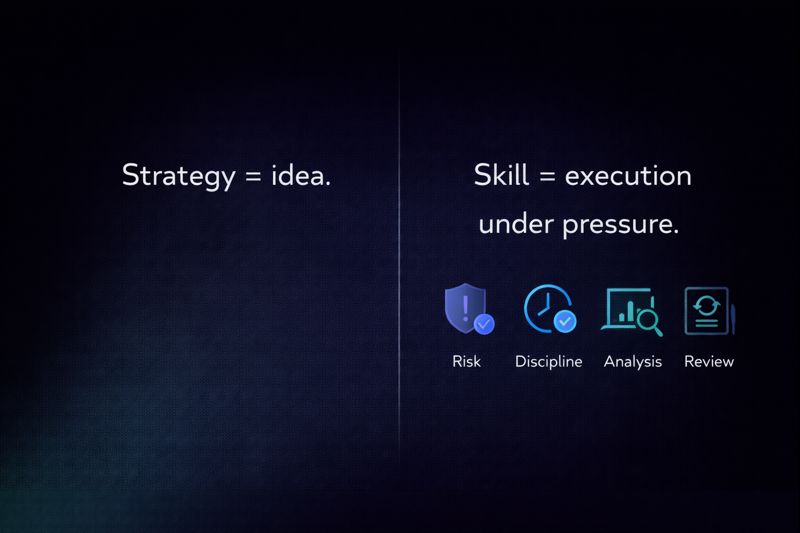

Trading skills vs. trading strategies (and why most people mix them up)

A strategy is a set of rules. A skill is the ability to follow those rules consistently in real conditions: fast markets, slow markets, losing streaks, winning streaks, distractions, and time pressure.

Most traders don’t actually lose because their strategy is “bad.” They lose because their process breaks at the exact moments it matters most: a stop gets moved, position size creeps up, the plan gets skipped, or the journal gets ignored. Those are skill failures.

The fastest way to improve is to build your “skill stack” in the right order.

The Trading Skill Stack (build bottom-up)

Start with the foundations, then move up. If you skip the bottom layers, the top layers collapse.

- Risk control (so one trade can’t ruin your month)

- Planning (so you know what you’re doing before emotions show up)

- Execution (so you enter/exit the way you intended)

- Review (so you learn from reality, not memory)

- Adaptation (so you evolve without randomness)

The 12 core trading skills (and how to practice each one)

Here’s the part that separates a useful guide from a generic list: each skill includes a practical drill you can do in 10–20 minutes. If you only read this post, you’ll understand the skills. If you do the drills, you’ll actually build them.

Skill scoreboard table (use this to self-diagnose fast)

| Trading skill | Why it matters | A simple drill | Common failure mode |

| Risk management | Keeps you in the game | “1R-only week” | Oversizing after wins/losses |

| Trade planning | Prevents emotional decisions | Write 10 plans (no trading) | Entering without a clear invalidation |

| Discipline | Makes results repeatable | Checklist gate | “Just this once” exceptions |

| Emotional control | Stops revenge/FOMO cycles | 90-second reset | Trading to “get it back” |

| Market context | Filters bad setups | Label 50 charts | Treating every day like a trend day |

| Edge clarity | Removes confusion | 1-sentence edge test | Copying setups you can’t explain |

| Execution quality | Reduces slippage/errors | Replay + timed entries | Hesitation or chasing |

| Journaling & review | Turns experience into progress | 5-minute EOD review | “I’ll remember it” |

| Patience | Protects quality | 2-trade max/day | Overtrading boredom |

| Focus | Improves decision speed | One market, one session | Too many tabs/assets |

| Adaptability | Survives regime change | Rules-based filter | Random strategy-hopping |

| Practice design | Builds skill efficiently | Sim → micro → normal | Paper trading without rules |

1) Risk management (position sizing, stops, and loss limits)

Risk management is the skill that makes everything else possible, because it protects your account while you’re still learning. It’s also the skill that keeps competent traders from blowing up during a rough week.

A strong baseline is simple: you decide your maximum loss per trade, your maximum loss per day, and you commit to hard invalidation points (not “hope-based” stops). Then you size your position so that if the stop hits, the loss is exactly what you planned.

Drill: the “1R-only week.”

For five trading days, you risk the same fixed amount (or percentage) on every trade and never change it mid-week. You’re training consistency, not maximizing returns. Most traders discover that their biggest leak isn’t their entries—it’s how they size when they feel confident or frustrated.

If you want to make this easier, use a platform that makes risk visible at order time. For example, TradeLocker includes an order panel with SL/TP and a risk calculator so you can set the stop and see sizing impact immediately, which helps you avoid “oops” position sizes when you’re moving quickly.

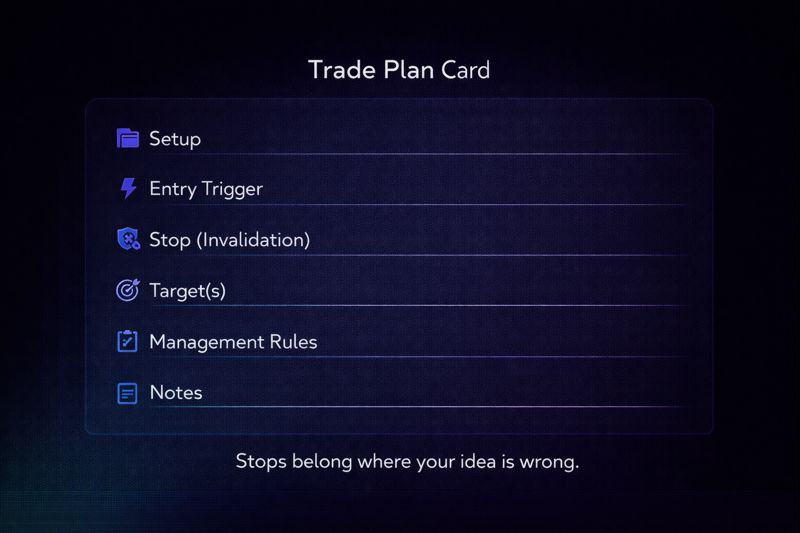

2) Trade planning (entry, invalidation, exits, and contingencies)

Planning is where you do your thinking when you’re calm, so you don’t have to think when the market is loud.

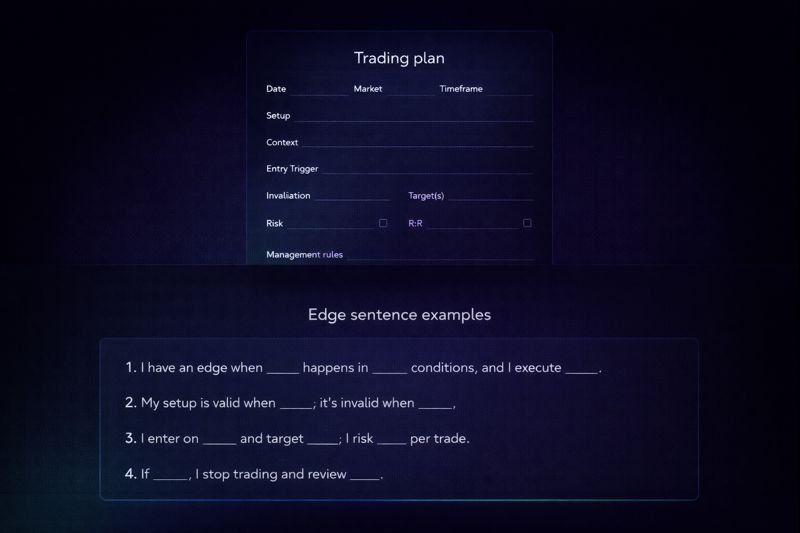

A complete plan answers five questions in plain language: What setup am I trading? What triggers the entry? Where is the trade invalidated? Where do I take profit (and why)? What do I do if price chops, spikes, or gaps?

Drill: write 10 trade plans without taking trades.

Open charts, pick a setup you understand, and write ten plans as if you were going to trade them. Don’t execute. Your only job is to build the habit of clarity. You’ll also learn quickly whether your “strategy” is actually defined enough to plan.

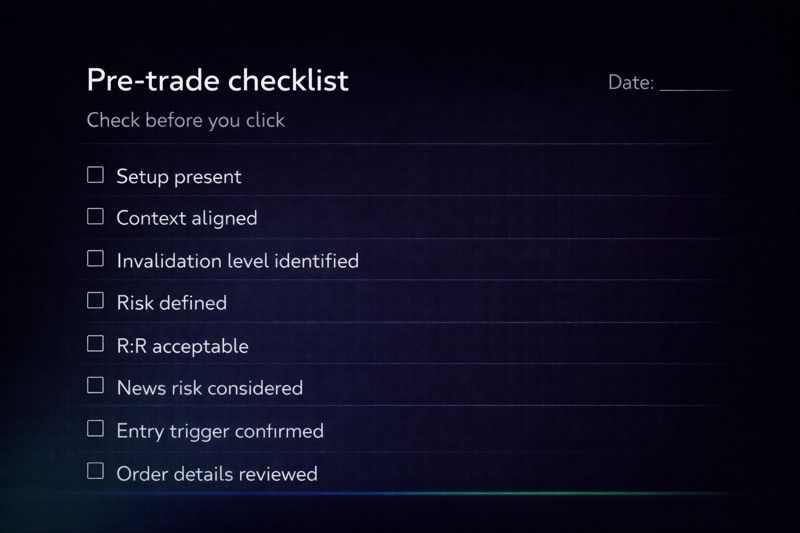

3) Discipline (following the plan when it’s uncomfortable)

Discipline isn’t a personality trait. It’s a system. The simplest discipline system is a gate: if the checklist is not satisfied, you don’t trade.

This matters because almost every costly mistake sounds reasonable in the moment. “It’s close enough.” “I’ll use a tighter stop.” “I’ll make it back on the next one.” Discipline is the skill that prevents your worst ideas from becoming real trades.

Drill: the checklist gate.

You must physically check off your entry conditions before clicking buy/sell. If one box isn’t checked, you pass. This feels strict at first, but it creates a standard—and standards are what build consistency.

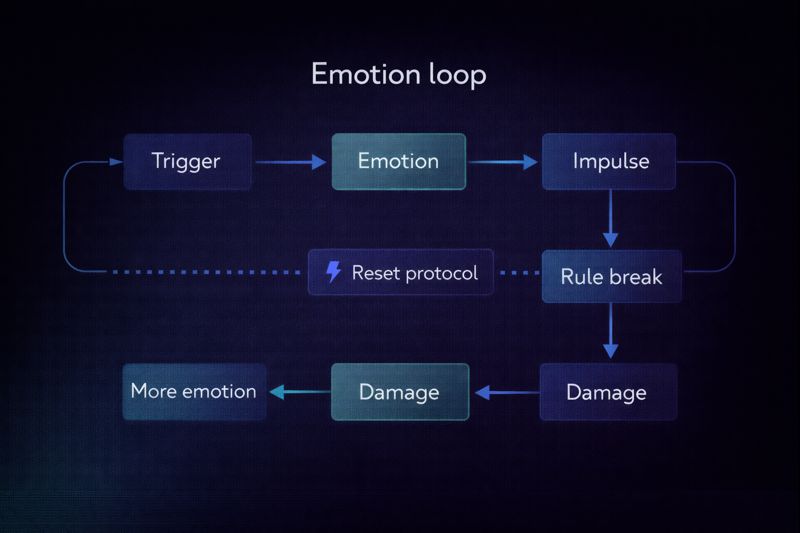

4) Emotional control (staying neutral after wins and losses)

You don’t need to be emotionless. You need to be non-reactive. Emotional control is the skill of feeling the outcome without needing to “do something” about it.

The most dangerous moments are immediately after a big win (overconfidence) and immediately after a painful loss (revenge). In both cases, the brain tries to reduce discomfort by taking action, not by making good decisions.

Drill: the 90-second reset.

After every exit, set a 90-second timer. During that time, you do nothing: no chart hopping, no new order, no “quick look.” You breathe, write one sentence about what happened, and only then decide if you’re allowed to look for the next trade.

5) Market context (trend, range, and transition)

Context is what stops you from using the right tool in the wrong situation. A clean breakout strategy can struggle in a choppy range. A mean-reversion approach can get steamrolled in a strong trend.

Instead of trying to predict, your job is to label. Is the market trending, ranging, or transitioning? Then you apply the approach that fits.

Drill: label 50 charts.

Open historical charts and label each day or session as trend, range, or transition. Don’t trade. You’re building pattern recognition without financial consequences.

6) Edge clarity (knowing why your setup should work)

If you can’t explain why your trade idea should work, you won’t know when it stops working. “It usually bounces here” is not an edge. An edge is a repeatable condition with a logical reason and a measurable outcome.

You don’t need academic proof, but you do need clarity: what behavior are you exploiting, and what would convince you it’s not there?

Drill: the one-sentence edge test.

Write one sentence that explains your setup without indicators. Example structure: “When X happens in Y context, price tends to do Z within N bars because ____.” If you can’t fill the blank, you’re guessing.

7) Execution quality (entering and exiting the way you intended)

Execution is where good plans go to die. The most common execution problems are hesitation (missing the entry), chasing (entering late), and improvising exits (turning a planned trade into an emotional one).

Your goal is not perfect timing. Your goal is consistent behavior. If your execution is consistent, you can refine it. If it’s random, you can’t.

Drill: replay + timed entries.

Use bar replay (or recorded sessions) and practice executing your trigger within a defined window, like 3–5 seconds after confirmation. You’re training decisiveness, not speed for its own sake.

Platforms that reduce friction can help here. For example, TradeLocker’s on-chart trading and one-click execution can make it easier to practice clean execution without bouncing between panels—useful when your drill is specifically about “do the thing you planned.”

8) Journaling and review (turning experience into improvement)

Experience is not the same as learning. Journaling is how you convert messy market reality into clean feedback.

A good journal focuses on a few fields you can actually act on: your setup type, context, your planned risk, your execution quality, and whether you followed rules. Then you look for patterns like: “I lose money mostly when I trade outside my session,” or “I break rules after two losses.”

Drill: the 5-minute end-of-day review.

At the end of the session, write: (1) your best trade and why, (2) your worst trade and why, (3) one rule you followed well, and (4) one rule you will protect tomorrow. Five minutes is enough if you do it daily.

9) Patience (waiting for A+ conditions)

Patience is a profit skill because it protects your quality. The market offers endless mediocre trades. Your job is to wait for the few that fit your plan.

Most impatience is disguised as productivity. It feels like you’re “working” because you’re clicking. In reality, you’re adding noise.

Drill: the 2-trade maximum.

For two weeks, you can take a maximum of two trades per day. This forces selection. It also reveals whether you actually have two high-quality opportunities—or whether you’re manufacturing trades.

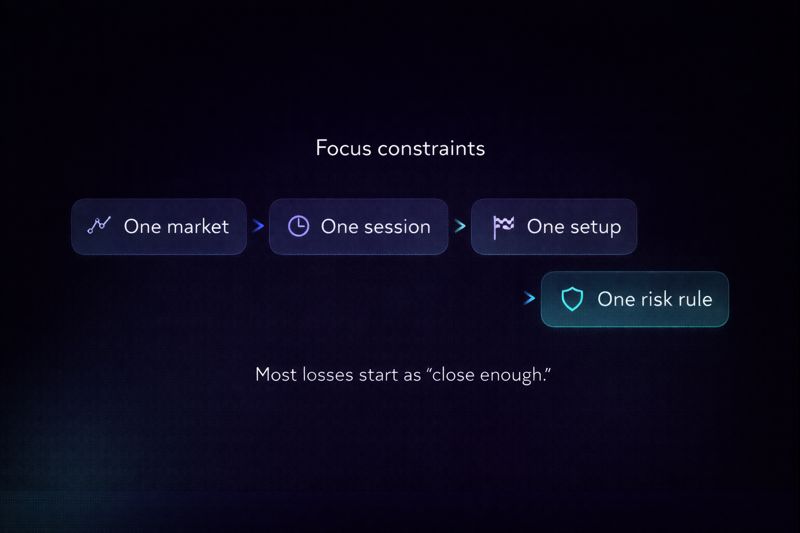

10) Focus (attention is a limited resource)

Focus is the skill that makes every other skill easier. When you watch too many markets, you increase decisions while reducing decision quality.

A simple focus rule is to trade one market, one strategy, one session for a defined period. That’s not limiting. That’s how you build mastery.

Drill: one market, one session.

Pick one instrument and one time window each day for two weeks. Outside that window, you don’t trade. You’re training rhythm and reducing temptation.

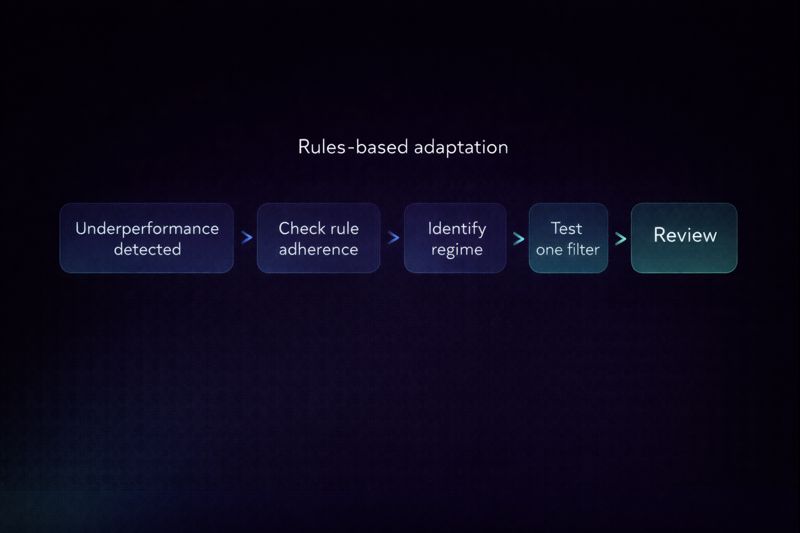

11) Adaptability (evolving without strategy-hopping)

Adaptability is not changing your approach every time you lose. Real adaptability is rules-based adjustment when conditions change, and you have evidence that your edge is underperforming in a specific regime.

If you adjust based on feelings, you’re gambling. If you adjust based on data, you’re learning.

Drill: one filter, one month.

Pick one simple filter (for example: only trade your setup in trend context, or only in a specific session). Run it for a month. Compare results to the same setup without the filter. You’re training controlled experimentation.

12) Practice design (how to train like an athlete)

The best traders practice on purpose. They isolate a skill, train it in a low-stakes environment, then gradually increase difficulty.

A practical progression is: simulated practice to learn mechanics, micro size to train emotional realism, then normal size once rule adherence is stable.

TradeLocker’s micro lots can support this progression because you can keep your practice realistic while reducing financial pressure. The point is not the platform—it’s the practice structure. The platform just makes it easier to follow.

Drill: the 20-trade promotion system.

You only “rank up” size after 20 trades where you followed rules at a high standard (for example, 18 out of 20 trades with no rule breaks). If you break rules repeatedly, you go back down.

The 30-day trading skills plan (simple, realistic, effective)

If you want a plan you can actually complete, focus on a small number of skills at a time. This schedule keeps daily work short and directs your attention toward process, not outcomes.

30-day plan table (copy this into your notes)

| Week | Focus | Daily (15–30 min) | “Done” criteria |

| Week 1 | Risk + planning | Write a plan before every trade; fixed 1R risk | No oversize trades; every trade has a stop/target |

| Week 2 | Execution + discipline | Checklist gate; replay drill 10 min/day | No impulse entries; entries match your trigger |

| Week 3 | Review + journaling | 5-min EOD review; tag mistakes | You can name your top 2 recurring mistakes |

| Week 4 | Context + adaptation | Label regime; test one filter | You can explain when your setup works best |

This plan works because it trains the skills that create stability first. Once stability is present, speed and sophistication come naturally.

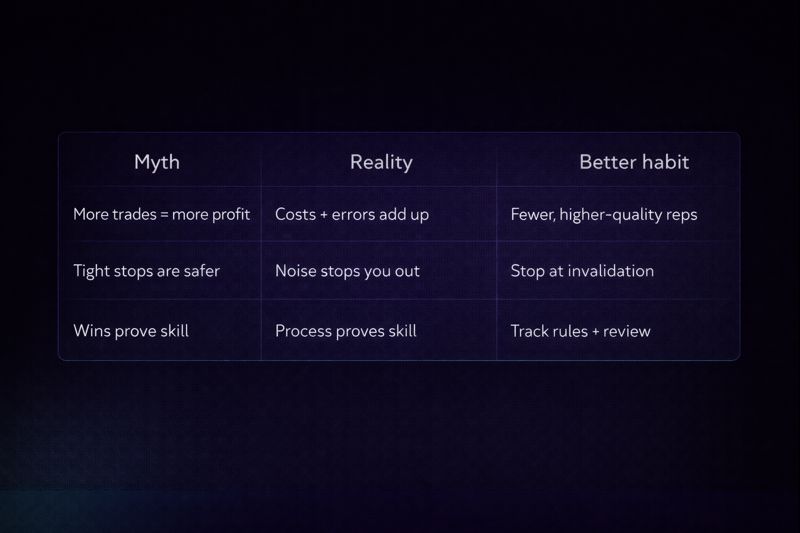

Common myths that keep traders stuck (and what to do instead)

Many traders get trapped by myths that sound logical but produce bad behavior. The most common one is believing you need more indicators, more trades, and more complexity to improve. In practice, improvement usually comes from fewer variables and better repetition.

Another myth is that a losing day means your strategy is broken. Often it means you traded outside context, sized poorly, or deviated from the plan. That’s not failure—it’s feedback.

A third myth is that journaling is optional. If you don’t review, you repeat. And if you repeat without awareness, you burn time.

Key trading terms (keep them simple)

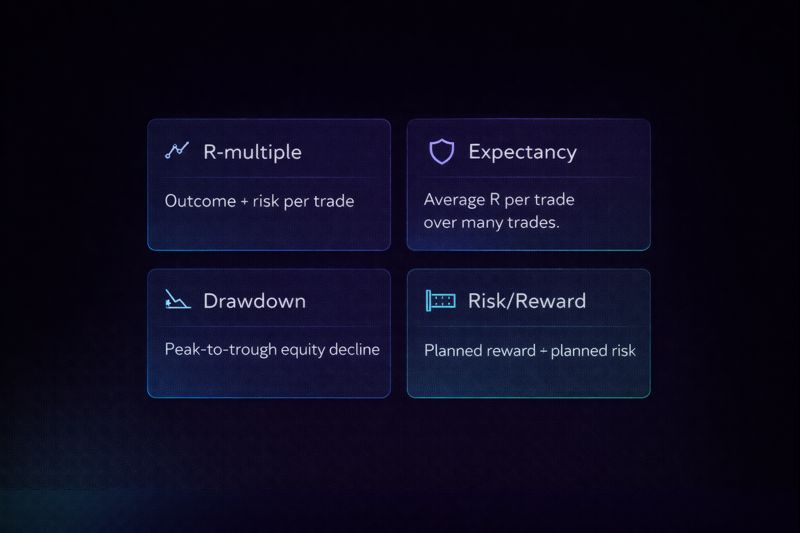

You’ll hear terms like R-multiple, expectancy, drawdown, and risk/reward constantly. Don’t let jargon slow you down. R-multiple is simply your result relative to risk. Expectancy is the average outcome of your system over many trades. Drawdown is what you lose from peak to trough. Risk/reward is the relationship between what you can lose and what you can gain on a trade.

The goal isn’t to memorize definitions. It’s to use these concepts to manage risk, evaluate performance, and stay consistent.

Final takeaway: the one sentence that matters

Trading skills are not “nice to have.” They are the difference between a strategy that works on paper and a process that works in real life. Build risk control first, then planning, then execution, then review—and your results will start to look less like luck and more like skill.

If you want a practical next step, pick two skills from this post and train them daily for two weeks. Keep everything else the same. Consistency beats intensity.