If you’ve been around trading content for more than five minutes, you’ve probably seen the phrase: “CFD trading.”

And if you’re here, you’re likely asking the real question:

What is CFD trading… and what am I actually doing when I place a trade?

Because the confusing part isn’t the definition. The confusing part is what sits underneath it: the way profits and losses are calculated, why costs matter more than most beginners expect, and why leverage can make a “normal” market move feel huge.

Here’s the straightforward answer:

CFD trading is a way to speculate on price movement using a Contract for Difference — without owning the underlying asset.

You’re not buying the asset. You’re trading the change in price between the moment you open the trade and the moment you close it. If price moves in your favor, you profit. If it moves against you, you lose.

That sounds simple — and it is. But once you add real-world details like spread, overnight funding, margin, and stop losses, the instrument becomes powerful… and potentially dangerous if you treat it casually.

This guide will break down CFD trading in plain English, with examples, costs, and the practical risk rules most people skip.

Quick risk note: CFDs are leveraged products in many cases. Leverage can magnify gains, but it also magnifies losses. This article is educational, not financial advice.

What is CFD trading?

A Contract for Difference is an agreement that settles the difference between an asset’s price when you enter the trade and its price when you exit the trade.

That’s where the name comes from:

- Contract: it’s an agreement between you and the provider.

- Difference: the profit or loss is the difference between entry and exit price.

When you trade a Contract for Difference, you’re getting exposure to a market’s price movement without taking ownership of the underlying asset.

So if you trade a share CFD, you don’t own the shares.

If you trade a gold CFD, you don’t own gold.

If you trade an index CFD, you don’t “own” the index.

You’re trading price movement — up or down.

The simplest way to think about it

A Contract for Difference is like saying:

“I believe price will move from here to there. Pay me (or I pay you) the difference when I close the trade.”

That’s why CFD trading is commonly used for shorter-term strategies. Ownership isn’t the point — price movement is.

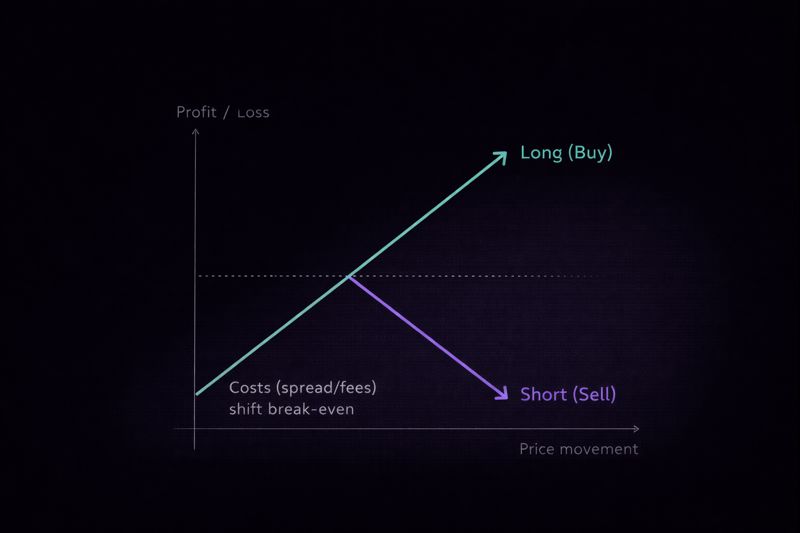

Long vs short in CFD trading

One reason CFDs are popular is that they make it easy to express a view in either direction:

- Go long (buy) a Contract for Difference if you think the price will rise.

- Go short (sell) a Contract for Difference if you think the price will fall.

Both positions work the same way mechanically: you open a trade, price moves, you close the trade, and the difference is settled.

How does a Contract for Difference work?

Let’s walk through the lifecycle of a CFD trade in a way that matches what you actually do on a trading platform.

Step 1: Choose a market

In CFD trading, you typically choose a market like:

- a forex pair (e.g., EUR/USD),

- an index (e.g., a major stock index),

- a commodity (e.g., gold or oil),

- a share CFD (e.g., a listed company),

- or another instrument offered by the provider.

The important thing is: the Contract for Difference tracks the price of that market.

Step 2: Decide direction (buy or sell)

You choose whether you want to buy (long) or sell (short).

This is where many beginners get tripped up. A “sell” in CFDs is not necessarily “closing a trade.” It can be a directional position (a short).

Step 3: Choose your position size

Position size is not “how confident you feel.” It’s the exposure you are taking.

In a Contract for Difference, the same price move affects you more when your position is bigger.

Step 4: Margin and leverage (if used)

Many CFD trades are opened “on margin,” meaning you deposit a portion of the trade value rather than paying the full amount up front.

That’s leverage.

Leverage is best understood as a volume knob:

- turn it up, and your outcomes get louder (profits and losses),

- turn it down, and your outcomes get quieter.

Step 5: Manage the trade

Risk management tools like stop loss and take profit exist for a reason. More on that soon.

Step 6: Close the trade and settle the difference

When you close a Contract for Difference trade, your result is calculated as the difference between your entry price and exit price (adjusted for costs).

What can you trade with CFDs?

A Contract for Difference can provide exposure to many markets — depending on the provider and your jurisdiction.

Typical CFD categories include:

- Forex (currencies)

- Indices (stock indices)

- Commodities (gold, oil, etc.)

- Shares (share CFDs)

- Crypto (availability varies widely)

- ETFs or other instruments (depending on offering)

Here’s the practical point:

CFDs are flexible because the provider can create a Contract for Difference around a reference price feed — giving you a way to trade price movement without needing ownership mechanics.

That flexibility is a feature… but it’s also why you must understand the provider’s product details, costs, and policies.

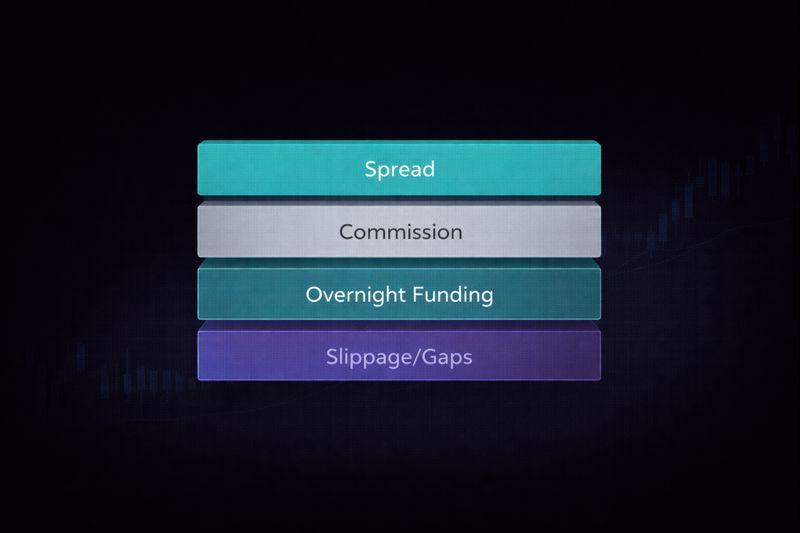

The costs of CFD trading

Most people approach CFD trading as if the only thing that matters is direction.

Direction matters. But cost structure is what determines whether a strategy can survive reality.

A Contract for Difference usually comes with costs that fall into four buckets:

1) Spread

The spread is the difference between the buy price (ask) and sell price (bid).

If you buy a Contract for Difference, you enter at the ask. If you immediately closed, you would close at the bid — which is worse — so you start slightly negative.

That’s normal. It’s not a “fee you pay separately.” It’s embedded in the price.

Why spread matters:

- The smaller your target, the bigger spread is relative to the trade.

- If you trade frequently, spread compounds quickly.

2) Commission (sometimes)

Some Contract for Difference markets are “spread-only.” Others charge commission — often seen with share CFDs.

Commission itself isn’t automatically bad. What matters is your all-in cost.

Two providers can advertise different structures and still produce the same total cost. You care about what happens to your net outcome after costs.

3) Overnight funding (financing)

This is a big one.

If you hold a Contract for Difference position overnight, a financing adjustment may apply. The exact formula and rate varies, but the concept is consistent:

- You’re effectively paying (or receiving) an interest-like adjustment for maintaining leveraged exposure.

This is why CFDs are often used for shorter-term strategies. Holding a Contract for Difference for days or weeks can change the trade math — especially if your expected move is modest.

4) Slippage and gaps

Markets move. Liquidity changes. News happens.

In fast conditions, your order may fill at a different price than expected. Stop losses may not always execute exactly at the level you set during gaps.

This matters more in leveraged products because your “room for error” can be smaller.

A practical framework: before placing a Contract for Difference trade, estimate your total cost and compare it to your expected move. If costs eat a meaningful chunk of the trade idea, your edge is weaker than you think.

Leverage and margin in CFD trading

If you want to understand CFD trading properly, you need to understand one truth:

Leverage changes the rate at which you experience outcomes.

A small move can feel large. A normal drawdown can become a big equity hit.

What is leverage?

Leverage means you can control a position larger than your deposit.

Example (simple concept, not provider-specific):

- You deposit a small amount as margin.

- You gain exposure to a larger notional value.

- Your profit/loss is based on the full exposure, not your margin.

This is why leverage can be attractive: it’s capital-efficient.

And this is why leverage is dangerous: it amplifies mistakes.

What is margin?

Margin is the amount required to open and maintain a position.

Margin comes in different forms, but the key idea is:

- if your account equity falls below requirements, the provider may close positions to limit further losses.

This is often called a margin close-out or liquidation event.

A responsible way to think about leverage

Don’t think “How much leverage can I get?”

Think:

- “How small can I trade while still executing my plan properly?”

- “How much can I lose on this trade and still trade tomorrow?”

- “What happens if price moves fast against me?”

CFD trading rewards discipline. It punishes casual sizing.

A step-by-step Contract for Difference example

Let’s do what most “what is CFD trading” articles avoid: walk through a trade like a trader.

Example 1: Index CFD trade (simple math)

Assume you’re trading an index Contract for Difference.

- Entry (buy): 5,000

- Exit (sell to close): 5,020

- Position size: $1 per point

- Spread cost equivalent: 2 points (example)

Your gross profit:

- (5,020 − 5,000) × $1 = $20

Spread cost impact:

- 2 points × $1 = $2

Net (before any other costs):

- $20 − $2 = $18

Now flip it. Same size, wrong direction.

If price moved down to 4,980:

- Gross loss: (4,980 − 5,000) × $1 = −$20

- Spread effect: −$2

- Net: −$22

Notice what’s happening:

- Your win is slightly smaller than the move suggests.

- Your loss is slightly larger than the move suggests.

That’s why spread matters.

Example 2: Share CFD trade (what changes)

Now imagine a share Contract for Difference.

Mechanically, it’s the same: you trade the price difference.

But you should be aware of practical differences:

- share CFDs may have commission,

- holding may involve financing,

- and corporate actions can create adjustments.

For example, if the underlying share pays a dividend, the Contract for Difference may have a dividend-related adjustment depending on whether you’re long or short.

You don’t need to memorize formulas to understand CFD trading.

You need to understand the categories:

- price movement is the core,

- costs and adjustments shape the net result,

- leverage changes the intensity of outcomes.

Why traders use CFDs

CFD trading isn’t “good” or “bad.” It’s a tool.

The question is: what is the tool useful for?

1) Trading both directions easily

Going short can be operationally simpler with a Contract for Difference than with traditional cash markets.

That doesn’t mean it’s easy to profit. It means expressing the view can be straightforward.

2) Capital efficiency (with discipline)

Leverage can allow a trader to deploy capital efficiently, but only if risk is controlled.

When people blow accounts, it’s rarely because they used CFDs.

It’s because they used too much leverage, too frequently, with too little structure.

3) Access to multiple markets through one approach

CFDs are often presented as a way to trade multiple market types using the same trading workflow.

For active traders, that consistency can be valuable.

4) Shorter-term strategies

Because Contract for Difference positions can include financing when held overnight, many CFD strategies are naturally short-to-medium term.

That doesn’t mean you can’t hold longer.

It means you must factor costs into your plan.

When CFDs are NOT ideal

This is worth saying clearly, because it builds trust and helps readers self-select.

A Contract for Difference may not be ideal if:

- you want long-term ownership,

- you want to hold for years and collect dividends directly,

- you want to avoid financing adjustments,

- you prefer exchange-traded instruments with a specific structure.

CFD trading is often most aligned with:

- active trading,

- tactical exposure,

- and strategies where entries/exits are deliberate and risk-managed.

The instrument isn’t the villain. But the mismatch between instrument and intention causes problems.

The real risks of CFD trading

Most losses in CFD trading aren’t caused by one dramatic mistake.

They’re caused by repeated small mistakes amplified by leverage.

Risk #1: Leverage magnifies errors

If you oversize a Contract for Difference position, even a normal pullback can hit hard.

Leverage doesn’t create risk out of thin air.

It accelerates the consequences of being wrong.

Risk #2: Costs can become the strategy’s “hidden opponent”

If you scalp tiny moves all day, spread matters a lot.

If you hold overnight often, financing matters a lot.

Costs are not “background noise.” In CFD trading, they can be the difference between a viable strategy and a losing one.

Risk #3: Volatility and gaps

Stops help. But stops don’t control the market.

During fast moves or gaps, execution can differ from what you expect. That’s true in many markets — but leverage can make it feel harsher.

Risk #4: Behavioral risk (the silent killer)

The most common failure pattern looks like this:

You take a loss.

You increase size to recover.

You take another loss.

You widen the stop or remove it.

You get liquidated.

The solution is not a better indicator.

The solution is a process:

- predefined risk per trade,

- maximum daily loss,

- and consistency.

CFD trading vs stocks, futures, and options

People asking “what is CFD trading” are often trying to compare it to other ways of trading.

Let’s keep this simple and practical.

CFDs vs stocks (investing)

Stocks typically involve ownership of the underlying shares (in a cash account).

A Contract for Difference typically does not.

That changes:

- ownership rights,

- how dividends are handled,

- and how holding costs work.

If your goal is long-term investing and ownership, CFDs may not be the best tool.

If your goal is short-term price movement exposure (long or short), a Contract for Difference can fit — provided you manage risk.

CFDs vs futures

Futures are standardized contracts traded on exchanges with specific expiry structures.

CFDs are typically offered by providers with their own contract specifications.

This isn’t about “better.” It’s about structure, transparency, and what you’re comfortable with.

CFDs vs options

Options have defined characteristics like premium, strike, and time decay.

CFDs do not have time decay in the same way, but they often have financing costs when held.

Options can be excellent for defined-risk strategies.

CFDs can be efficient for directional trading — but discipline is mandatory.

The simplest takeaway:

If you want:

- ownership → stocks

- standardized exchange contracts → futures

- defined-risk asymmetric payoff → options

- flexible directional exposure (often leveraged) → Contract for Difference / CFDs

Is CFD trading legal?

This depends on where you live and which provider you use.

Different jurisdictions have different rules around:

- who can offer CFDs,

- how leverage can be applied,

- what disclosures are required,

- and what protections exist for retail clients.

So instead of giving a one-size-fits-all answer, here’s the best approach:

How to check legality and suitability responsibly:

- Confirm your provider is authorized/regulated in your jurisdiction.

- Read the product disclosure / risk disclosure for CFDs.

- Understand what protections apply (and what doesn’t).

- If you’re unsure, don’t trade live until you are.

CFD trading is not the place to guess.

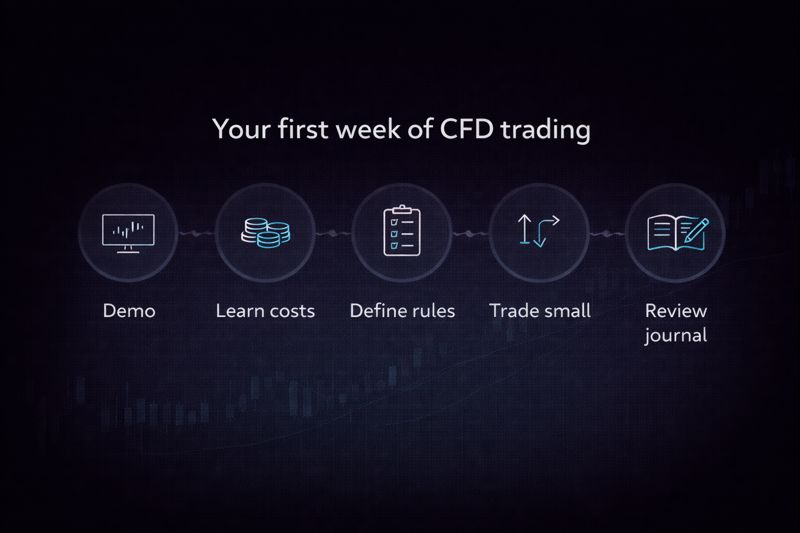

How to start CFD trading responsibly

Most beginners don’t need more information.

They need a clear path that prevents predictable mistakes.

Here’s a practical progression.

1) Start with a demo (or minimum size)

Your first job is learning execution and risk mechanics.

A demo helps you learn:

- how the Contract for Difference price moves,

- how spread affects entries/exits,

- how stops behave,

- and how your strategy performs without emotional pressure.

Then, when you go live, keep size small enough that you can follow rules.

2) Build a trading plan before scaling

A plan isn’t a 40-page document.

A good plan can fit on one page:

- What markets you trade

- When you trade

- What a valid setup looks like

- Where your stop goes (and why)

- How you take profit

- How much you risk per trade

- Your maximum loss for the day/week

Most “bad trades” are trades without a plan.

3) Use position sizing as your main risk tool

In CFD trading, position sizing often matters more than the entry.

Two traders can take the same entry:

- one sizes responsibly and survives,

- one oversizes and gets wiped out.

4) Journal and review weekly

If you don’t measure it, you can’t improve it.

Your journal should capture:

- why you entered,

- whether you followed your rules,

- how you managed the trade,

- and what you’d do differently next time.

You’re not just tracking performance.

You’re tracking discipline.

Risk management for CFD traders

I’ll keep bullets minimal — but this section needs one short checklist because it’s the most copy-pasteable value in the entire article.

Before opening a Contract for Difference trade, confirm:

- You know the exact price level that proves you wrong.

- Your stop loss is placed for logic, not emotion.

- Your position size matches a fixed risk amount.

- You understand how costs affect break-even.

- You have a max daily loss rule, and you’ll stop when you hit it.

Now let’s turn those into real behavior.

Rule 1: Decide your loss before you decide your profit

Most beginners choose profit targets first.

Pros choose risk first.

Set the maximum loss per trade in money terms (not vibes), and let that drive size.

Rule 2: Keep leverage as a tool, not a lifestyle

You don’t need high leverage to trade.

You need consistent execution.

Using lower effective leverage gives you room to learn without one bad day ending your progress.

Rule 3: Stop trading when you’re not thinking clearly

Revenge trading destroys accounts.

If you feel:

- rushed,

- angry,

- “I need to make it back,”

you’re not trading — you’re gambling with leverage.

Close the platform. Review later.

Rule 4: Don’t confuse activity with progress

More trades does not mean more improvement.

In CFD trading, overtrading is a cost amplifier:

- you pay more spreads,

- you take more random losses,

- you tilt faster.

Better to take fewer trades with clearer structure.

Common CFD order types

Understanding order types makes CFD trading less stressful because you stop improvising in the moment.

Market order

A market order aims to fill immediately at the best available price.

This is useful when you need to get in/out fast or you accept that price may vary slightly.

Limit order

A limit order only fills at your price (or better).

This is useful when you want precision or you don’t want to chase.

The trade-off is that you might not get filled.

Stop order

A stop order triggers when price reaches a certain level.

This can be used for: entering breakouts, or managing exits (stop loss).

Stop losses deserve special respect in CFDs because fast markets can change execution.

The goal isn’t to find the “perfect” order type. The goal is to choose the type that matches your plan.

The biggest mistakes new CFD traders make

If you’re new to Contract for Difference trading, avoiding these mistakes will save you months.

Mistake 1: Trading size based on confidence

Confidence is not a risk metric.

Size must be based on: stop distance, risk per trade, and account tolerance.

Mistake 2: Ignoring overnight funding

If your strategy holds positions overnight, you must include financing in your expectations.

Some strategies “work” in theory but fail after realistic holding costs.

Mistake 3: Moving stops because you don’t want to be wrong

Being wrong is part of trading.

Moving the stop turns a small controlled loss into a large uncontrolled one.

In leveraged Contract for Difference trading, this mistake is expensive.

Mistake 4: Switching strategies after a small drawdown

Every strategy has drawdowns.

If you switch after 5–10 trades, you’re not evaluating a strategy. You’re reacting to noise.

Mistake 5: Overtrading

Overtrading is what happens when you trade emotions, boredom, or FOMO instead of setups.

With CFDs, overtrading is especially damaging because costs stack and leverage accelerates losses.

Where TradeLocker fits

Important clarification: TradeLocker is a trading platform, not a broker.

Your broker (or prop firm) provides the trading account and access to CFDs. TradeLocker is the platform layer — where you analyze, plan, execute, and manage risk.

So why does platform choice matter in Contract for Difference trading?

Because most CFD losses are not “market mysteries.” They come from:

- poor execution,

- inconsistent risk,

- messy workflows,

- and decision fatigue.

A platform should reduce friction — especially when leverage is involved.

Here’s how a modern platform approach supports CFD trading behaviors that actually matter:

Faster analysis-to-execution flow

When the workflow is clean, you’re less likely to miss levels, mis-size orders, or rush entries.

Risk-first execution tools

CFD traders should think in risk terms first:

- “How much am I risking?”

- “Where is my stop?”

- “What is my size?”

A risk calculator and clear SL/TP workflow make that easier to do consistently instead of occasionally.

Charting that doesn’t fight you

In CFDs, timing and clarity matter.

Good charting helps you see structure, map scenarios, and execute without second-guessing.

One platform, multiple devices

Trading is not always done from one place.

Being able to monitor and manage responsibly across devices can reduce “set and hope” behavior.

FAQs

Is CFD trading the same as investing?

No. Investing usually implies ownership of the underlying asset. CFD trading uses a Contract for Difference to speculate on price movement without ownership.

Can you make money with CFDs?

It’s possible, but outcomes depend heavily on risk management, costs, and discipline. Leverage can magnify gains, but it also magnifies mistakes.

Are CFDs beginner-friendly?

They can be if you start small (or demo), learn cost mechanics, and treat risk management as the main skill. High leverage and frequent trading are where beginners tend to get hurt.

What matters more in CFD trading: entries or risk?

In most cases, risk management matters more. Two traders can take the same entry and get radically different outcomes based on sizing and discipline.

Conclusion

CFD trading is trading price movement through a Contract for Difference — not buying the underlying asset.

The mechanics are simple: open a position, price moves, close the position, settle the difference.

What makes CFDs powerful is also what makes them risky. Costs like spread and overnight funding affect net outcomes, and leverage changes how quickly profits and losses hit your account.

If you take one lesson from this guide, make it this: Treat CFD trading like a process, not a prediction game.

Size properly. Use stops logically. Respect costs. Journal your decisions. And build consistency before you scale.

Disclaimer: This article is educational and not financial advice.