Economic indicators play a crucial role in assessing the health and performance of a nation’s economy. They are vital tools for investors, policymakers, and businesses, providing valuable insights into various aspects of economic activity. In this comprehensive guide, we will delve into the world of economic indicators, exploring what they are, the different types, and how to interpret them effectively.

What Are Economic Indicators?

Economic indicators are statistical data points that provide information about various economic activities within a country. They serve as barometers for the overall economic health and can help stakeholders make informed decisions.

Types of Economic Indicators

There are several types of economic indicators, each offering a unique perspective on different aspects of the economy. These can be broadly categorized into three main groups:

1. Leading Indicators

Leading indicators are the harbingers of future economic trends. They provide early signals about where the economy might be heading. Some common leading indicators include:

a. Stock Market Performance

The performance of stock markets can indicate investor confidence and expectations for future economic growth. Rising stock prices often signify optimism

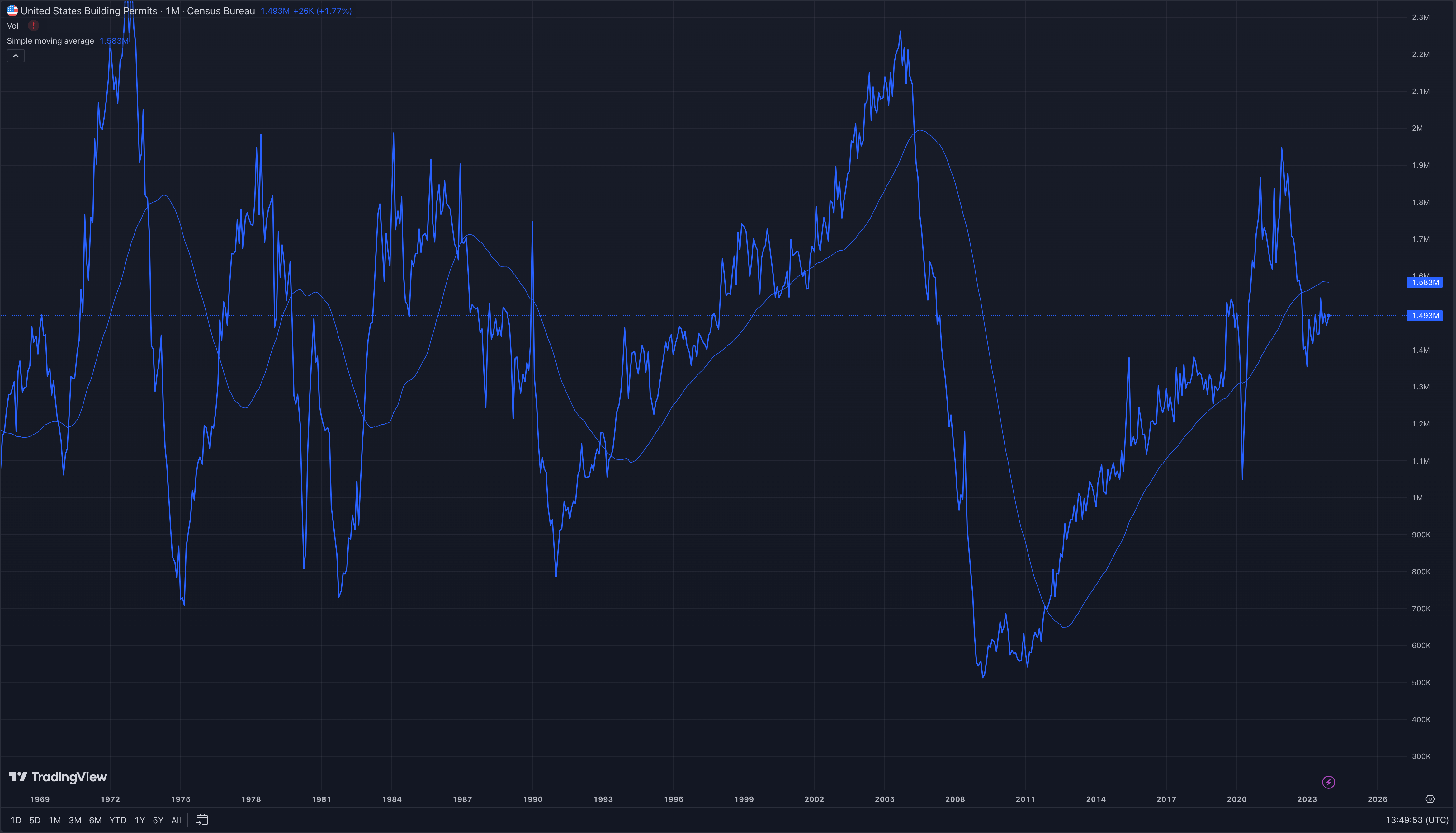

b. Building Permits

The number of building permits issued is a leading indicator for the construction industry. An increase in permits suggests potential economic expansion.

2. Lagging Indicators

Lagging indicators confirm trends that have already occurred, offering a retrospective view of the economy’s performance. Examples of lagging indicators include:

a. Unemployment Rate

The unemployment rate, while important, typically lags behind economic changes. A rising unemployment rate may indicate a recent economic downturn.

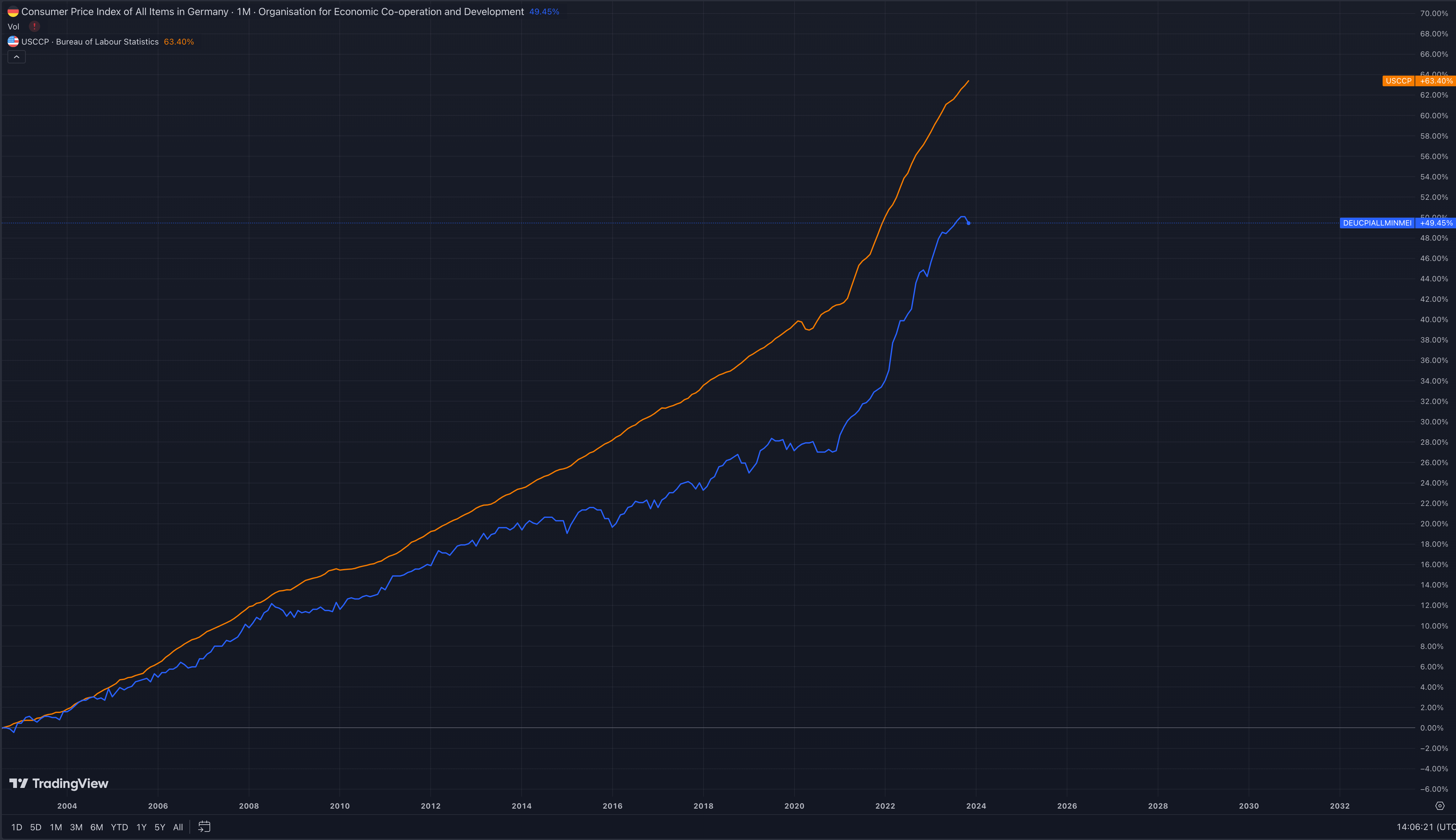

b. Consumer Price Index (CPI)

CPI measures the average change in prices over time, reflecting inflation or deflation trends. It often lags behind actual price movements.

3. Coincident Indicators

Coincident indicators move in conjunction with current economic conditions. They provide real-time insights into the economy’s present state. Key coincident indicators include:

a. Industrial Production

Industrial production data reflects the current output of the manufacturing sector. A decline may signal economic contraction.

b. Retail Sales

Retail sales figures offer a snapshot of consumer spending, directly impacting the current economic climate.

Interpreting Economic Indicators

Interpreting economic indicators requires a nuanced understanding of their context and relevance. Here are some key tips for effective interpretation:

Consider Multiple Indicators

It’s essential to analyze a combination of leading, lagging, and coincident indicators to form a comprehensive view of the economy. Comparing current data to historical trends can provide insights into whether economic conditions are improving or deteriorating. Economic indicators should be viewed in the context of the broader economic landscape. External factors, such as geopolitical events, can influence their significance.

Recognize Revisions

Economic data is often revised as more accurate information becomes available. Stay updated with revisions to ensure accurate analysis.

Conclusion

In conclusion, economic indicators are indispensable tools for anyone looking to navigate the complex world of economics. They provide valuable insights into the past, present, and future of an economy, helping individuals, businesses, and governments make informed decisions. By understanding the different types of economic indicators and how to interpret them effectively, you can enhance your ability to gauge economic trends and make sound financial choices.