What Is Initial Margin?

Initial margin is essentially the down payment you need to make when using a margin account to purchase securities. It’s expressed as a percentage of the total purchase price. The Federal Reserve Board’s Regulation T sets the minimum initial margin requirement at 50%, but some brokerage firms may require a higher percentage.

How Does Initial Margin Work?

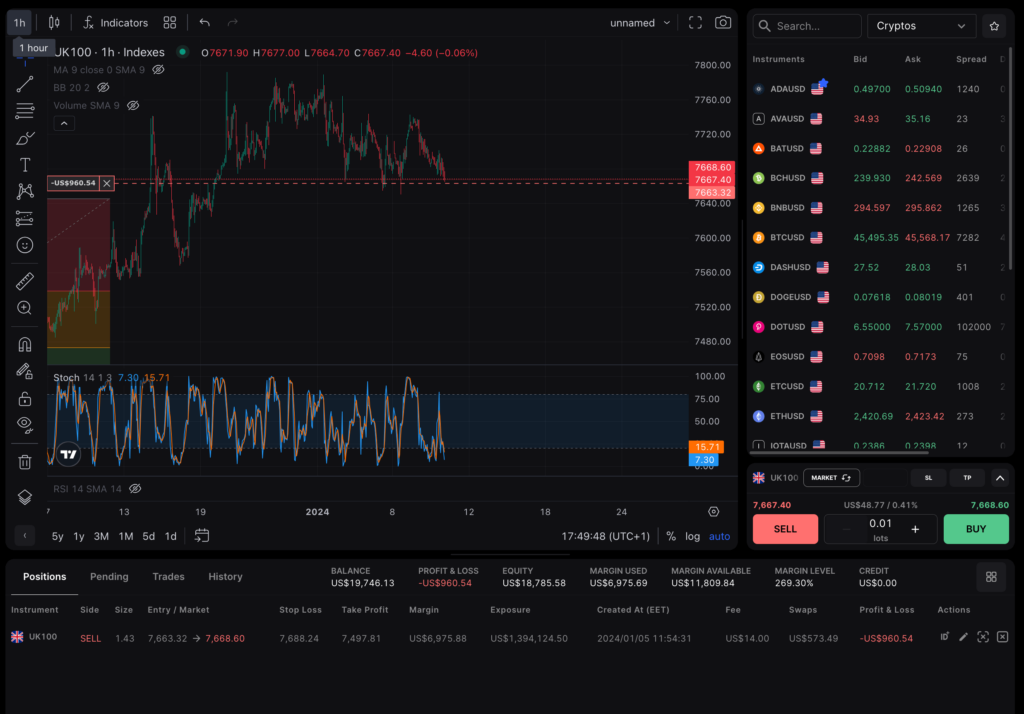

To open a margin account, you need to deposit cash, securities, or other collateral as the initial margin requirement. A margin account allows you to leverage your trades by using borrowed funds to purchase securities with a value greater than the cash balance in your account. In TradeLocker you will see that cash balance highlighted in your order panel as Exposure. Think of it as a line of credit where you pay interest on the borrowed amount.

The securities in your margin account act as collateral for the loan provided by your brokerage firm. This arrangement allows you to potentially increase your profits, but it also exposes you to higher losses. If the securities in your margin account decline to zero value, you’ll need to deposit the full initial value of the securities in cash or other liquid collateral to cover the loss.

Futures and Initial Margin

When it comes to futures contracts, initial margin requirements can be as low as 5% or 10% of the contract value. For example, if a crude oil futures contract is priced at $100,000, you only need to post $5,000 as initial margin, which equals 5% of the contract value. This means you can use a leverage factor of 20x.

During periods of high market volatility, futures exchanges have the power to increase initial margin requirements to any level they see fit. This gives them the ability to match the margin levels set by brokerage firms for equities.

Initial Margin vs. Maintenance Margin

It’s important to understand the difference between initial margin and maintenance margin. While both relate to the amount of cash or collateral required, they serve different purposes.

Initial margin is the amount needed to actually purchase securities and is set at a minimum of 50% by Regulation T. In other words, you can’t borrow more than half the price of the investment.

On the other hand, maintenance margin is the ongoing equity required in your margin account. Regulation T sets the minimum maintenance margin requirement at 25%. This means you need to maintain enough cash or collateral to cover at least 25% of the value of the securities you own. Maintenance margin helps ensure that your collateral stays intact in case the value of your securities drops.

Some brokerage firms may set higher margin requirements for certain securities, especially those with high volatility.

Example of Initial Margin

Let’s say you want to purchase 1,000 shares of Meta, Inc. (META), formerly known as Facebook, which is priced at $200 per share. In a cash balance account, the total cost would be $200,000.

However, if you open a margin account and deposit the 50% initial margin requirement, which amounts to $100,000, your purchasing power increases to $200,000. This means that your margin account has a leverage factor of two-to-one.

Remember, using margin increases the potential for both profit and loss. It’s essential to fully understand the risks involved and carefully consider your financial situation before utilizing margin accounts.