When you’re learning to trade, two terms you’ll hear often and need to fully understand are stop loss and stop out.

While they sound similar, they serve very different purposes.

One is your personal risk control tool, and the other is your broker’s emergency response to protect your account.

Let’s break them down so you can trade with more clarity and control.

What is a Stop Loss?

A stop loss is a predefined price level where your trade will automatically close to limit your losses if the market moves against you.

It limits potential losses and reduces overall risk in the trade.

This helps traders control their losses in case the market moves unfavorably.

Example: If you buy EURUSD at 1.1000 and set a stop loss at 1.0950, the platform will close your trade if the price drops to 1.0950. This prevents further losses if the market keeps going down.

Stop loss is customizable. You decide the level based on your strategy and risk tolerance.

However, stop loss isn’t just for cutting losses, it can help lock in profits too.

If a instrument you bought at $2 rises to $5, you could set a stop loss at $3. That way, if the price reverses, you still walk away with a $1 profit.

How to Set a Stop Loss on TradeLocker?

On TradeLocker, you can set your stop loss easily:

- Use the SL&TP Calculator on the Order panel to define it by price, dollar amount, or pips.

- Or simply drag the SL line on your chart.

Learn how to place a stop loss on TradeLocker here.

Why Use a Stop Loss?

- Automatically limits losses without needing manual action.

- Helps manage risk and protect your account balance.

- Ensures your trade is closed once the stop price is hit.

- Can be used to lock in profits as prices move in your favour.

- Works well with trailing stops to adjust automatically with market movement.

- Saves time by allowing traders to step away from the screen without losing control.

What to Watch out for

- If the market gaps past your stop loss, your trade may close at a worse price than expected.

- In volatile markets, your stop loss might trigger just before the price reverses, causing missed profit.

To reduce these risks, traders often use a trailing stop loss, which moves with the market to protect gains while still limiting losses.

What is a Stop Out?

A stop out is triggered by your broker or prop firm, not you. It refers to a protective measure where your broker automatically closes your open positions.

The stop-out level is the point where your margin level gets so low that your broker starts closing your trades automatically to protect your account from going into a negative balance. This is called liquidation and it happens because your trading account can no longer support the open positions due to a lack of margin.

If your margin level (Equity ÷ Used Margin) drops too low, say below 20%, your broker starts closing your trades, starting with the most unprofitable ones. This is done to prevent your account from going into a negative balance. Remember: The margin level threshold is set by the broker

Example:

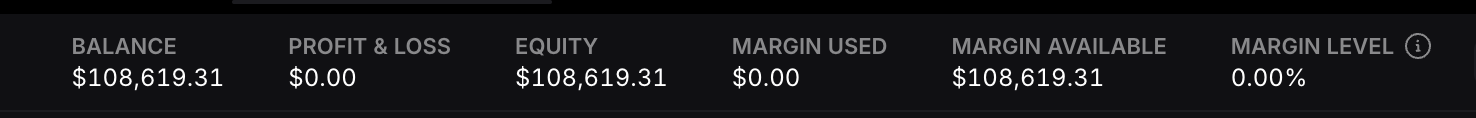

Your account has $1,000

You’re down 960 pips at $1 per pip = –$960

Your Equity = $40

Margin used = $200

The difference between a stop-loss and a stop-out might seem small at first, but it can have a big impact on how you manage risk.

Stop Out on TradeLocker

Unlike other platforms that close your whole position during a margin call, TradeLocker takes a different approach.

By default, the margin level is calculated as the margin used divided by equity, ranging from 0% to 144% (stop-out level).

The feature only reduces your position slightly, by 0.01 lots, giving you a chance to recover and possibly turn the trade around. This gives you more flexibility in tough market conditions. It’s a unique feature that provides traders with more flexibility during challenging market conditions.

How to avoid a stop out

- Always monitor your margin level in the TradeLocker platform

- A well-placed stop-loss can prevent losses from hitting your margin.

- Don’t put all your capital in one trade or one type of asset.

- Be aware of news and market movements that could affect your trades.

- More leverage = more risk. Make sure your position sizes are realistic for your balance.

Learn more about how stop outs work here.

Final recap

- Stop loss – proactive. Helps you stay in control and plan your risk.

- Stop out – reactive. Happens when you don’t manage your trades properly and the margin gets too low.

| Feature | Stop Loss | Stop Out |

| Who sets it | You | Broker / Prop Firm |

| Purpose | To limit losses on individual trades | To protect your account from margin risk |

| Control | Full control (optional) | No control (automatic) |

| Triggers when | Price hits your set SL level | Margin level falls below the threshold |

Conclusion

The difference between a stop loss and a stop out might seem small at first, but it can have a big impact on how you manage risk.

A stop loss is something you set. It helps you stay in control, limit your losses, or even lock in profits. A stop out is what happens when things go too far and your broker steps in to protect your account by closing trades.

If you’re using stop loss orders properly and keeping an eye on your margin, you’ll likely avoid most stop out situations.

It’s all about being prepared instead of reacting too late.

TradeLocker gives you the tools to do exactly that. From easy stop loss settings to trailing stops and a more flexible stop out system that doesn’t wipe out your full position.

Understanding the difference helps you trade better.

Remember: Smart traders always use stop loss to avoid getting stopped out in the first place.