Day trading is a fast-paced, high-stakes industry that demands precision, speed, and cutting-edge tools. Choosing the right platform can be the difference between success and missed opportunities. Here’s a list of the top good trading platforms for day trading in 2025, tailored for traders who prioritize swift execution, real-time analytics, and robust risk management.

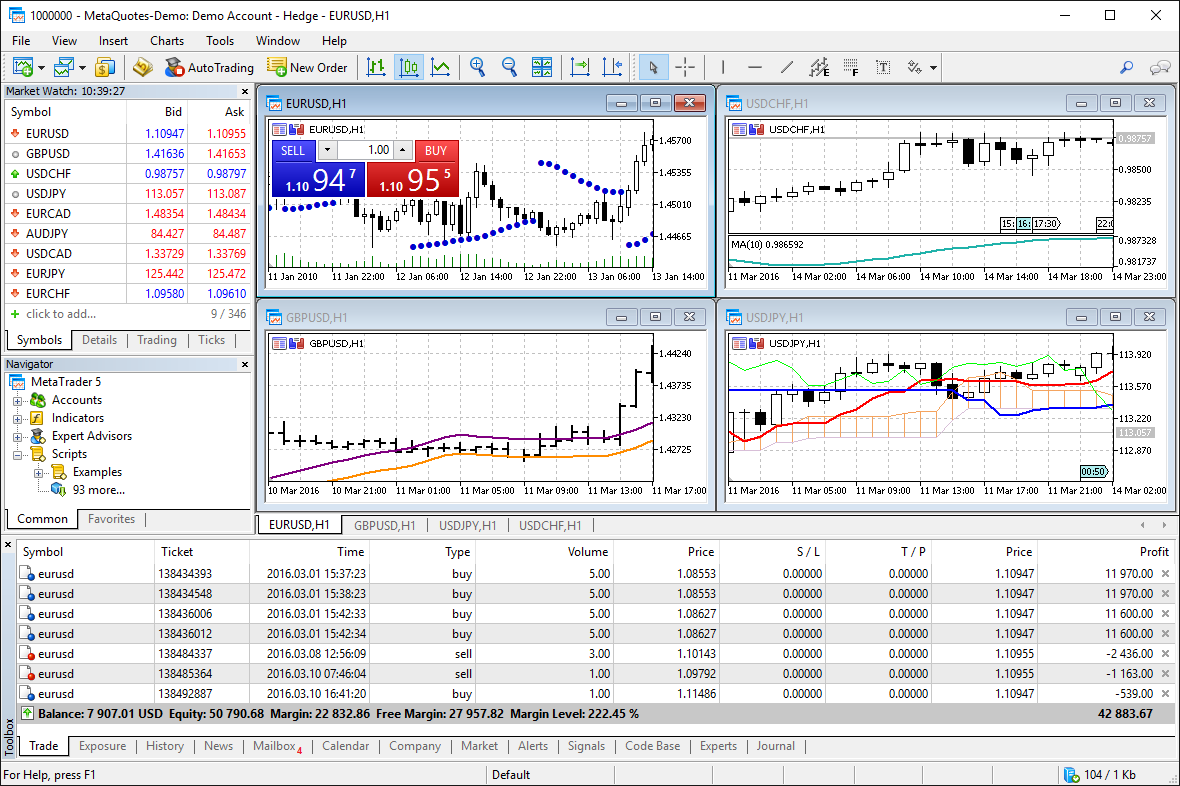

1. MetaTrader 5 (MT5)

MT5, an evolution of MT4, is designed for traders seeking a robust, feature-rich environment. Research suggests it excels in versatility, offering more time and order settings, making it suitable for diverse strategies beyond forex, including stocks and commodities.

Benefits

- Enhanced Features: MT5 includes additional timeframes and order types, enhancing flexibility (scored 5/5 for indicator libraries per Best Forex Brokers Comparison).

- Diverse Asset Classes: Expands trading options to include stocks, commodities, and indices, appealing to diversified portfolios.

- Economic Calendar: Integrates fundamental analysis tools, aiding informed decision-making.

- Mobile Accessibility: The mobile app, compatible with iOS and Android, offers good charting tools and live quotes, ensuring on-the-go trading.

- Educational Resources: Extensive materials and access to the MetaTrader Market for strategies and indicators support continuous learning.

Cons

- Learning Curve: Transitioning from MT4 can be challenging due to new features, potentially deterring existing users.

With its expansive broker support and robust ecosystem, x remains a go-to choice for day traders who value customization and reliability.

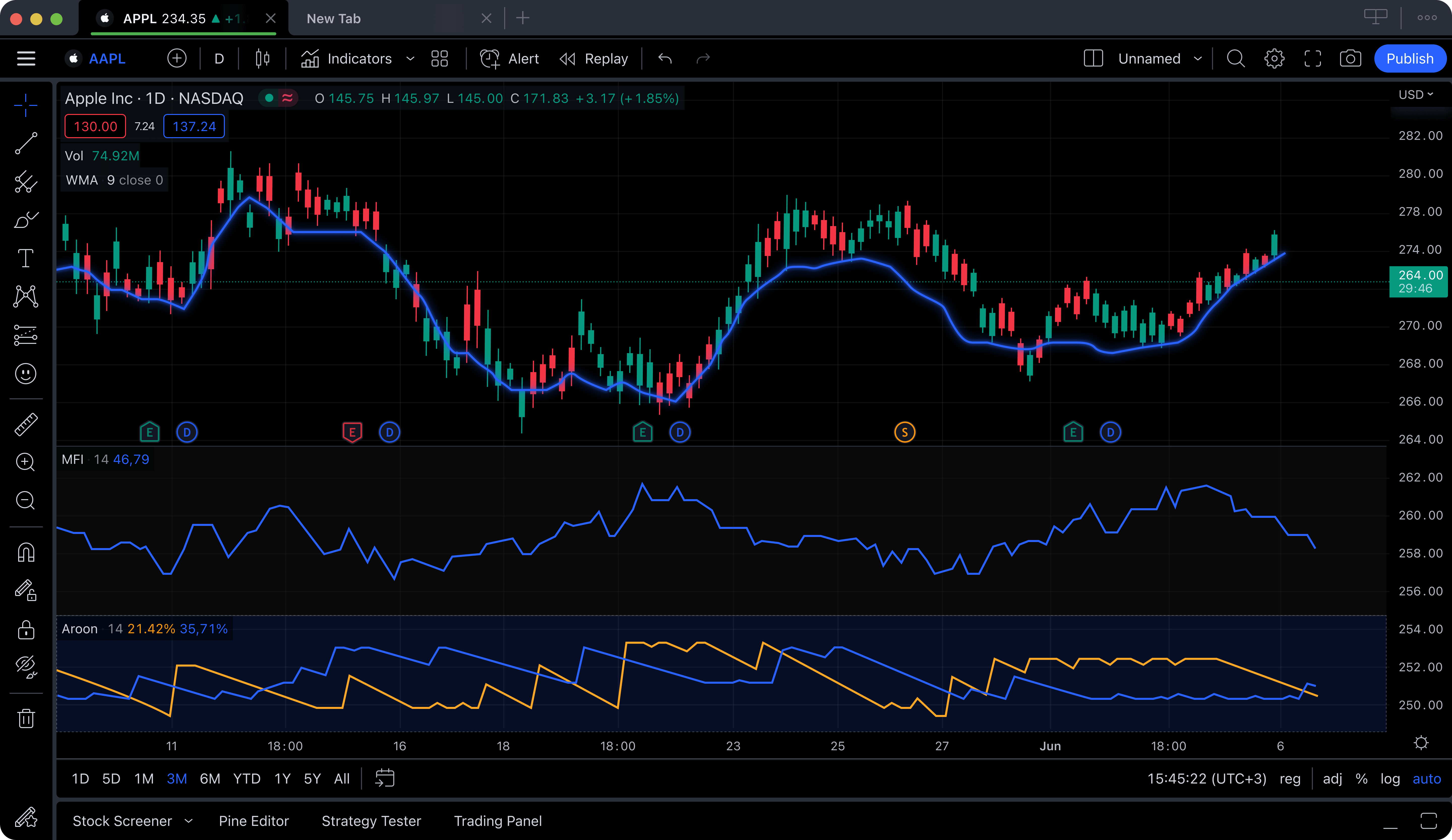

2. TradingView

TradingView is a web-based platform renowned for its social trading features and powerful charting capabilities, making it a favorite among community-oriented traders.

Benefits

- Advanced Charting: Offers a rich set of drawing tools, custom chart templates, and an extensive library of indicators, both built-in and user-contributed (4/5 score). Integration with brokers like IG (ForexBrokers.com TradingView Brokers) enhances access to over 19,000 instruments.

- Social Trading: Facilitates collaboration through sharing analyses and community interaction, fostering a vibrant trading ecosystem.

- Mobile App: Provides real-time data, smart automation, and access to diversified asset classes, ensuring mobility for traders.

- Educational Content: A wealth of community-contributed content and live webinars supports learning, with brokers like InteractiveBrokers offering enhanced features like multi-timeframe analysis.

Cons

- Indicator Limitations: Some users desire more built-in technical indicators, as the current library, while extensive, may not meet all advanced needs.

- Regulation Dependency: Security and regulatory compliance depend on the broker, not TradingView itself, introducing potential risks.

TradingView’s versatility and web-based access make it an excellent option for day traders who require mobility and instant insights

3. TradeLocker

TradeLocker, a newer platform, has gained traction for its modern interface and community-driven development, positioning itself as a strong MetaTrader alternative amid license revocations

Benefits

- Modern Interface: Features a sleek, user-friendly design, appealing to both novice and experienced traders.

- Diverse Assets: Supports trading in stocks, commodities, and other assets, offering a comprehensive trading experience.

- Fast Execution: Scored 5/5 for order execution speed, crucial for dynamic market conditions, with swift trade processing.

- Integration with TradingView: Leverages TradingView’s charting for access to 500+ assets, position history, and multi-device trading.

- Educational Resources: Includes accessible materials and a How To Guides, with customer support available weekdays 12pm–9pm EST, responding within 30 minutes.

- Community Feedback: Developed with input from over 2.5 million traders, ensuring continuous updates based on user needs, fostering reliability and accessibility.

Cons

- Indicator Range: Compared to MT4, it has a smaller range of technical indicators, which may limit advanced technical analysis capabilities.

With its focus on speed and user-friendly tools, TradeLocker is an excellent choice for day traders looking to modernize their trading experience.

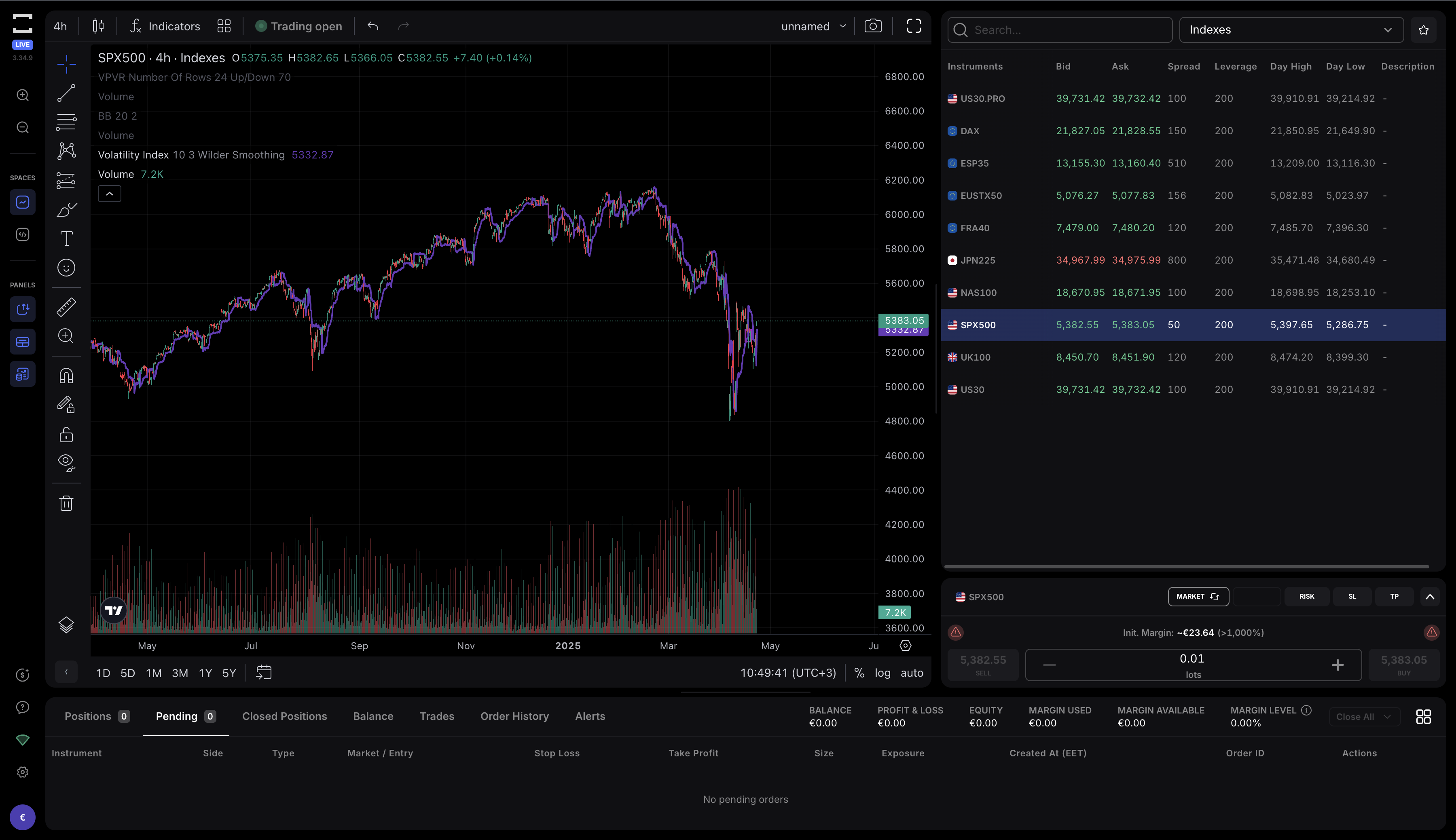

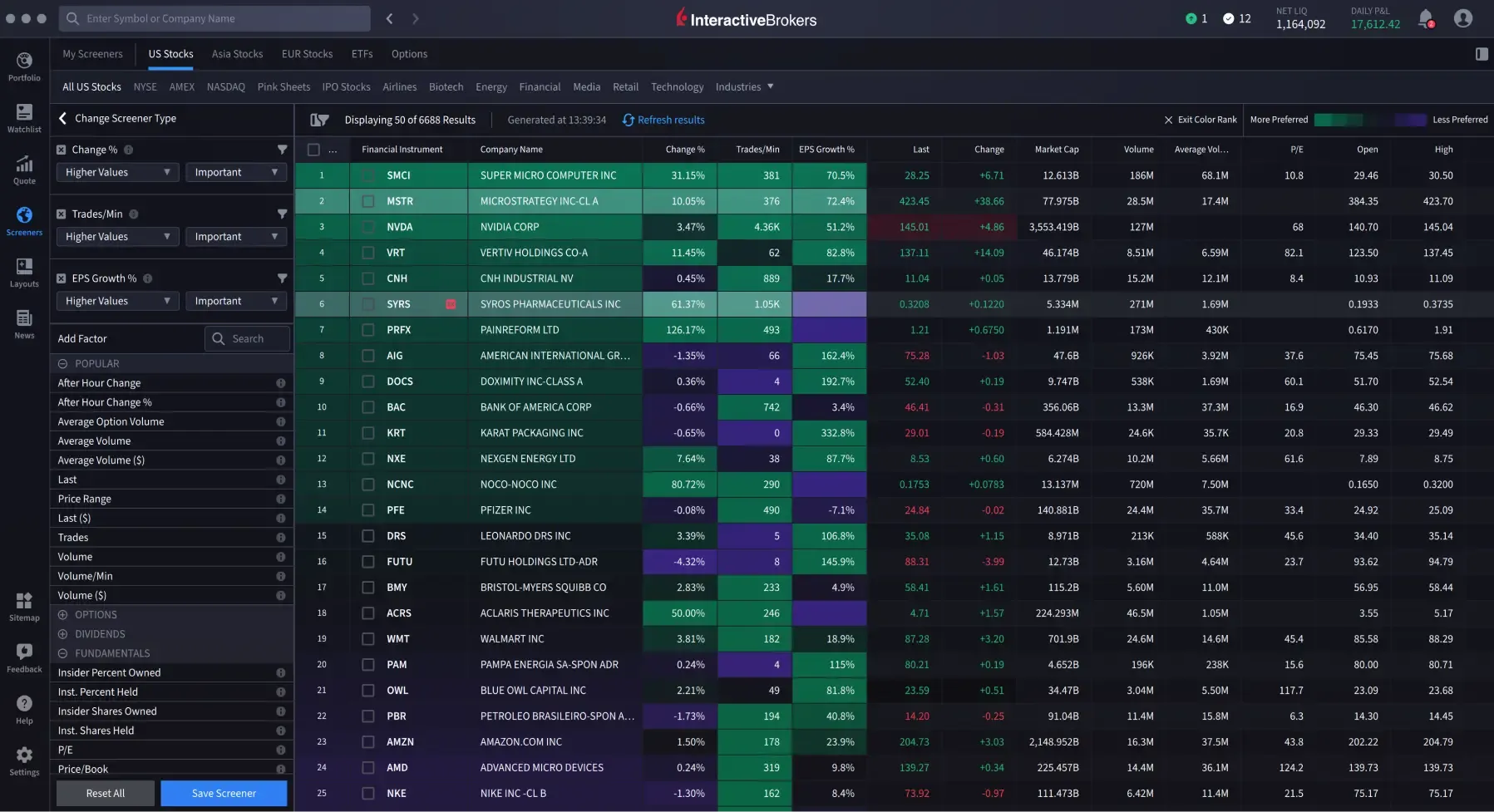

4. Interactive Brokers (IBKR)

InteractiveBrokers is known for its global market access and advanced trading tools. Catering to professional traders seeking comprehensive research and execution capabilities.

Benefits:

- Global Reach: Access to over 130 global exchanges, enabling portfolio diversification across various markets, with charts powered by TradingView offering 98 indicators.

- Research Tools: Provides integrated news, economic calendars, and fundamental analysis reports, enhancing decision-making (low costs with EUR/USD average spread 0.59 pips, minimum $2 commission per trade).

- Mobile Trading: The mobile app supports advanced order types, research tools, and global access, compatible with iOS and Android.

- Educational Offerings: Regular webinars, an extensive knowledge base, and articles/guides support trader education.

- Regulation: Regulated by multiple financial authorities globally, ensuring robust security protocols and trust.

Cons:

- Complexity: The interface can be complex for beginners, requiring a steeper learning curve, potentially overwhelming new users.

- Fees: While commissions are low, additional fees may apply, impacting overall trading costs.

Interactive Brokers is a strong contender for experienced day traders seeking professional-grade tools.

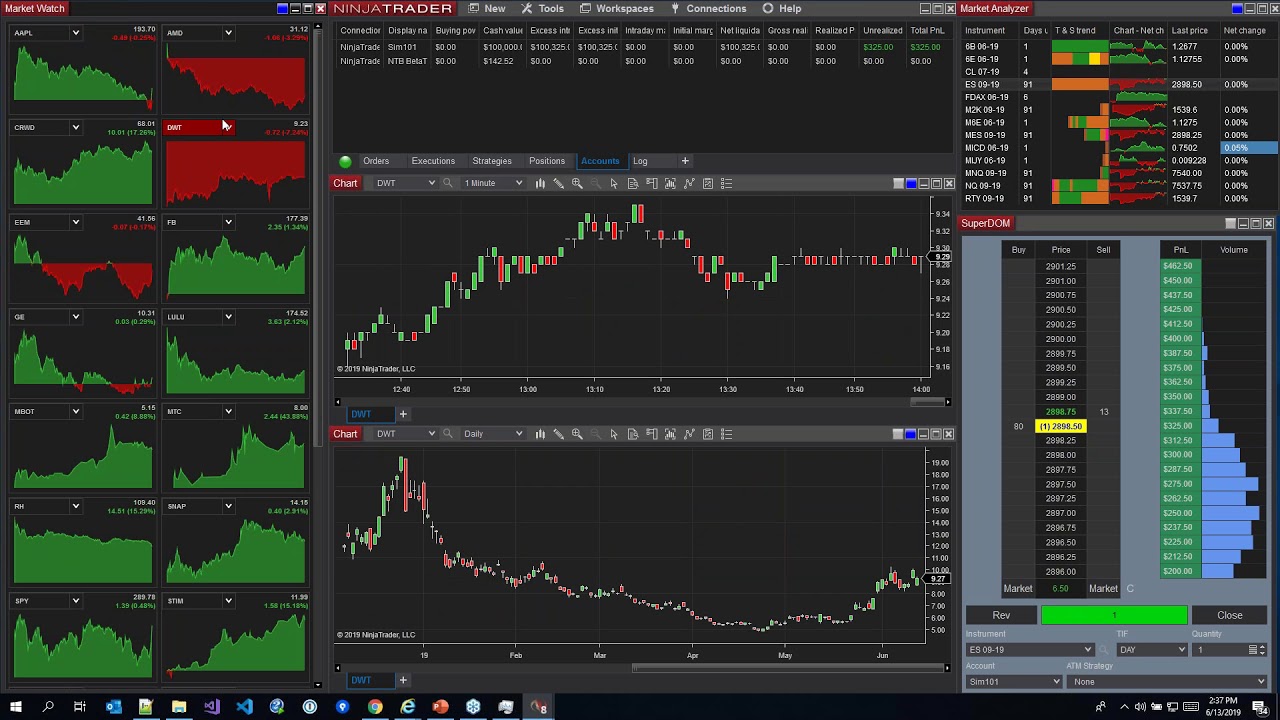

5. NinjaTrader

NinjaTraders is tailored for active traders, offering advanced customization and algorithmic trading capabilities. It appeals to those seeking a highly personalized trading experience.

Benefits:

- Customization: Extensive charting and customization options allow traders to tailor their environment, with customizable indicators and access to over 1000 third-party tools (4/5 score for indicator libraries).

- Algorithmic Trading: Supports development and implementation of automated strategies via NinjaScript, ideal for systematic traders.

- Mobile App: Offers charts and instant orders, ensuring connectivity on iOS and Android devices.

- Educational Resources: Regular webinars, in-depth user guides, and documentation support learning, helping traders maximize platform potential.

Cons:

- Learning Curve: New users may find the platform challenging to navigate initially due to its advanced features, requiring time investment.

- Regulation Dependency: Like TradingView, regulatory compliance depends on the broker, not the platform itself, introducing potential regulatory risks.

NinjaTrader remains a top choice for futures-focused day traders due to its technical capabilities and competitive pricing../