Weekly Market Recap: Sept 29-Oct 5, 2025

Markets move higher as inflation eases, with US and European stocks climbing last week. Bond yields stayed steady, oil prices dropped, and crypto posted strong gains, setting a positive tone heading into Q4.

Equity Markets

- US30: +1.1%

- SPX500: +1.1%

- NAS100: +1.3%

- MSCI EAFE: +1.7%, helped by Europe and Japan

- 10-Year US Treasury Yield: down slightly to 4.12%

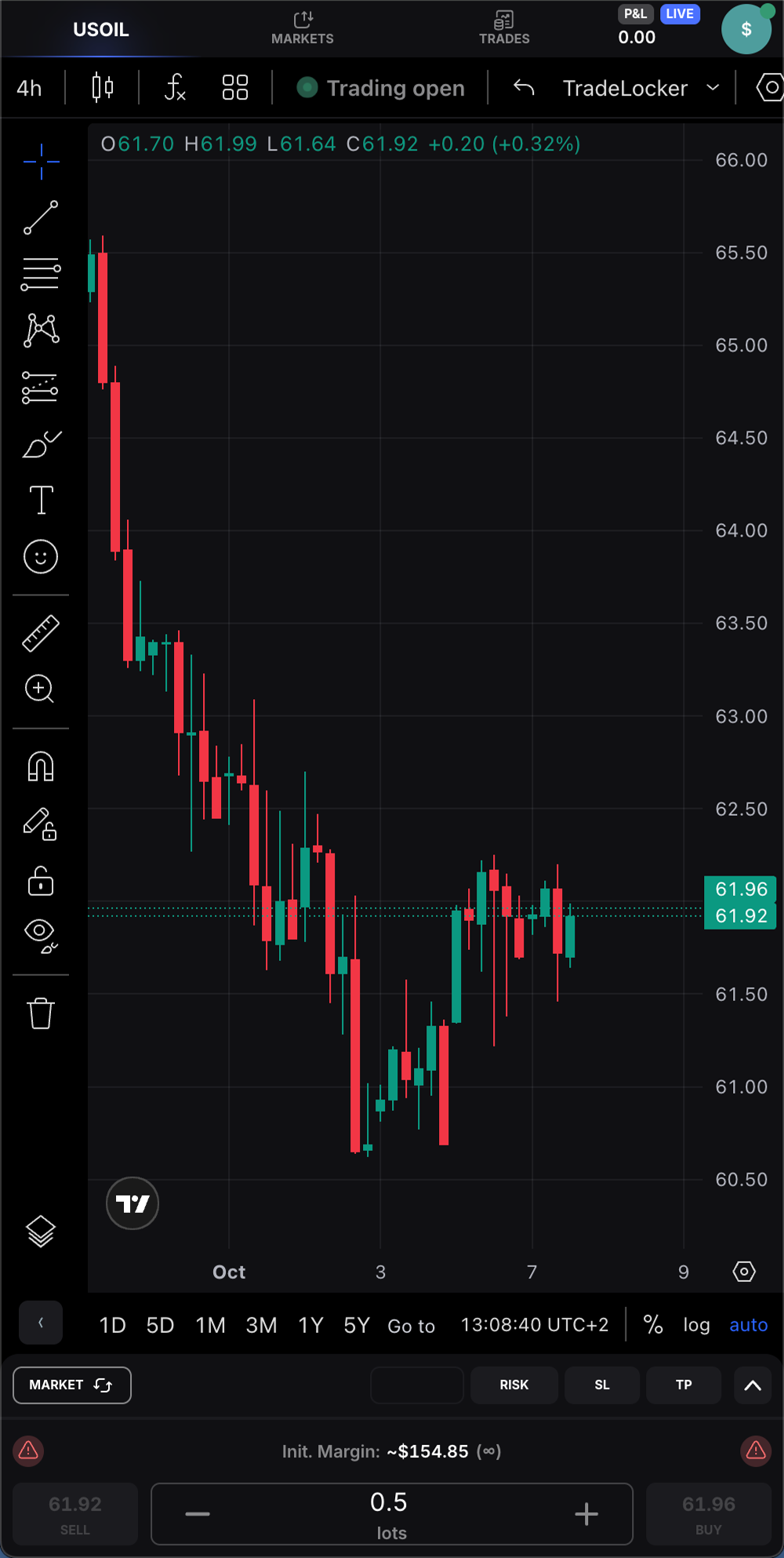

- Oil: fell nearly 8% to $60.67

- Bonds: edged down a little

Stocks went up across the US and globally, with Europe and Japan doing especially well. Oil fell sharply, partly because of growth concerns and changes in supply.

Macroeconomics

Economic reports showed some calm but with mixed signals. China’s manufacturing stayed below growth level but improved a little. In Europe, inflation slowed overall, though Germany and France had slightly higher readings.

In the US, job openings stayed steady, manufacturing picked up slightly and Japanese business confidence stabilized.

Crypto Markets

Cryptocurrencies did well last week:

- Bitcoin (BTCUSD): up 10% to $123,500

- Ethereum (ETHUSD): up 9% to $4,515

Global Markets

There were no major earnings reports last week. The Reserve Bank of Australia kept rates the same at 3.6%. European stocks benefited from slower inflation, while weaker energy prices affected commodity-linked currencies.

Conclusion

The week closed on a positive note, with equities firm, bonds stable and crypto outperforming. Softer inflation and resilient data kept investors confident, setting a constructive backdrop for the start of Q4.

Disclaimer: This content is for informational purposes only and is not financial advice.