Weekly Market Recap: September 23-29, 2025

Global markets cooled last week as US data showed surprising strength while Europe continued to weaken. Stocks pulled back, bond yields edged higher, and oil made a sharp recovery. Crypto fell, with Ethereum underperforming Bitcoin once again.

Equity Markets

- NAS100: fell 0.7%

- SPX500: slipped 0.3%.

- US30: eased 0.1%.

- Global Stocks (MSCI EAFE): down 1.0%, reversing the prior week’s flat close.

- 10-Year US Treasury Yield: moved up to 4.18%.

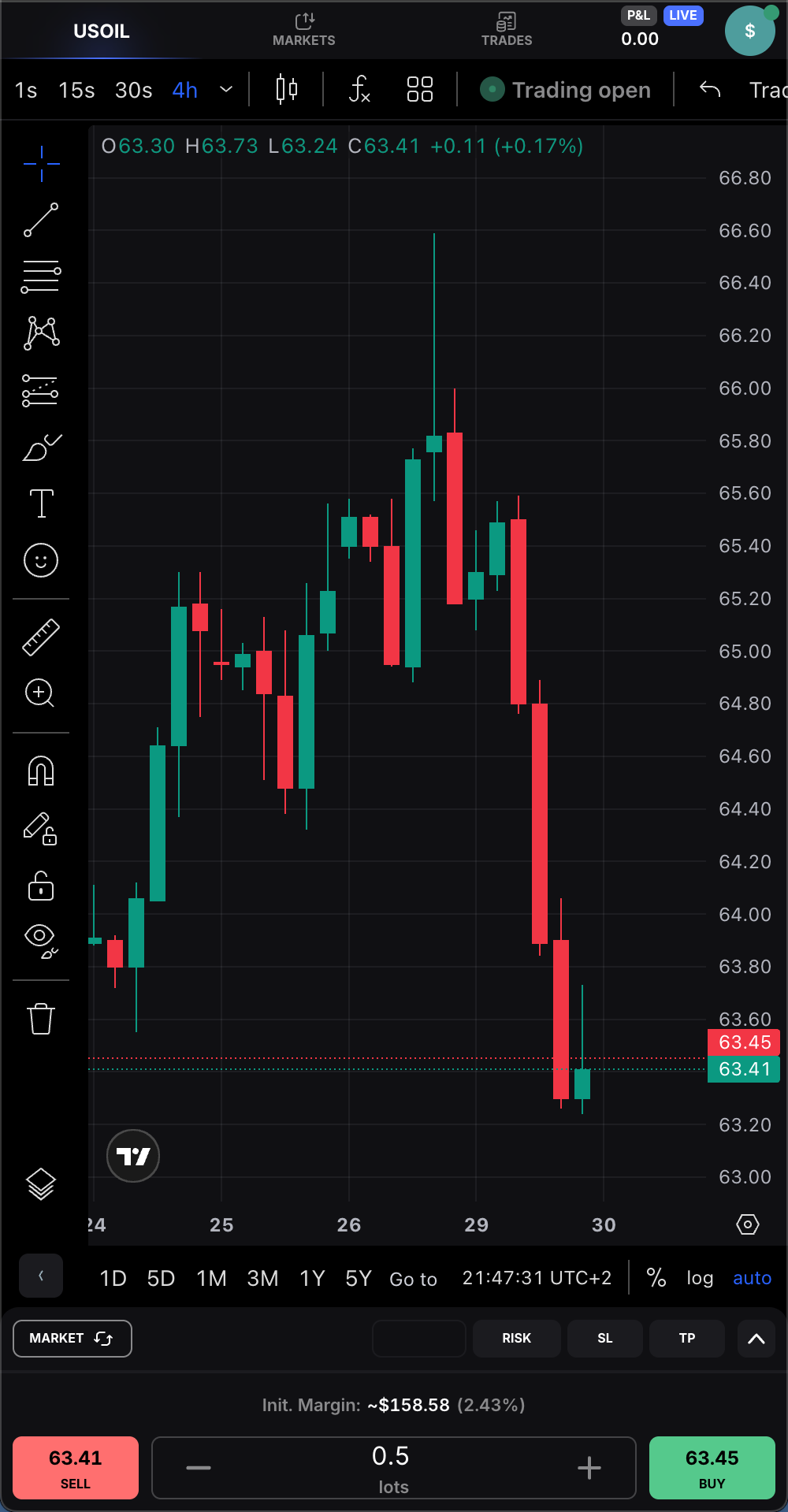

- Oil: surged nearly 5% to $65.36, bouncing back after weeks of weakness.

- Bonds: dipped 0.2% as investors stayed cautious heading into Q4.

Stocks gave back some gains, while oil stood out as the week’s biggest mover.

Macroeconomics

The US economy showed resilience last week. Inflation held steady, which means prices are still climbing but at a more manageable pace. Consumers kept spending even as income growth leveled off, showing households are still supporting the economy.

A sharp upward revision to Q2 GDP confirmed that growth was stronger than first thought, while a rebound in durable goods orders pointed to healthier business activity. Housing, on the other hand, stayed stable, suggesting that higher borrowing costs haven’t slowed the market much further.

In Europe, the story was weaker. Germany reported falling business confidence, gloomy consumer sentiment, and slower factory activity which are clear signs that growth is losing steam. The UK also showed softer data, with both manufacturing and services cooling. This split between strong US momentum and sluggish European numbers was a key theme for markets.

Crypto Markets

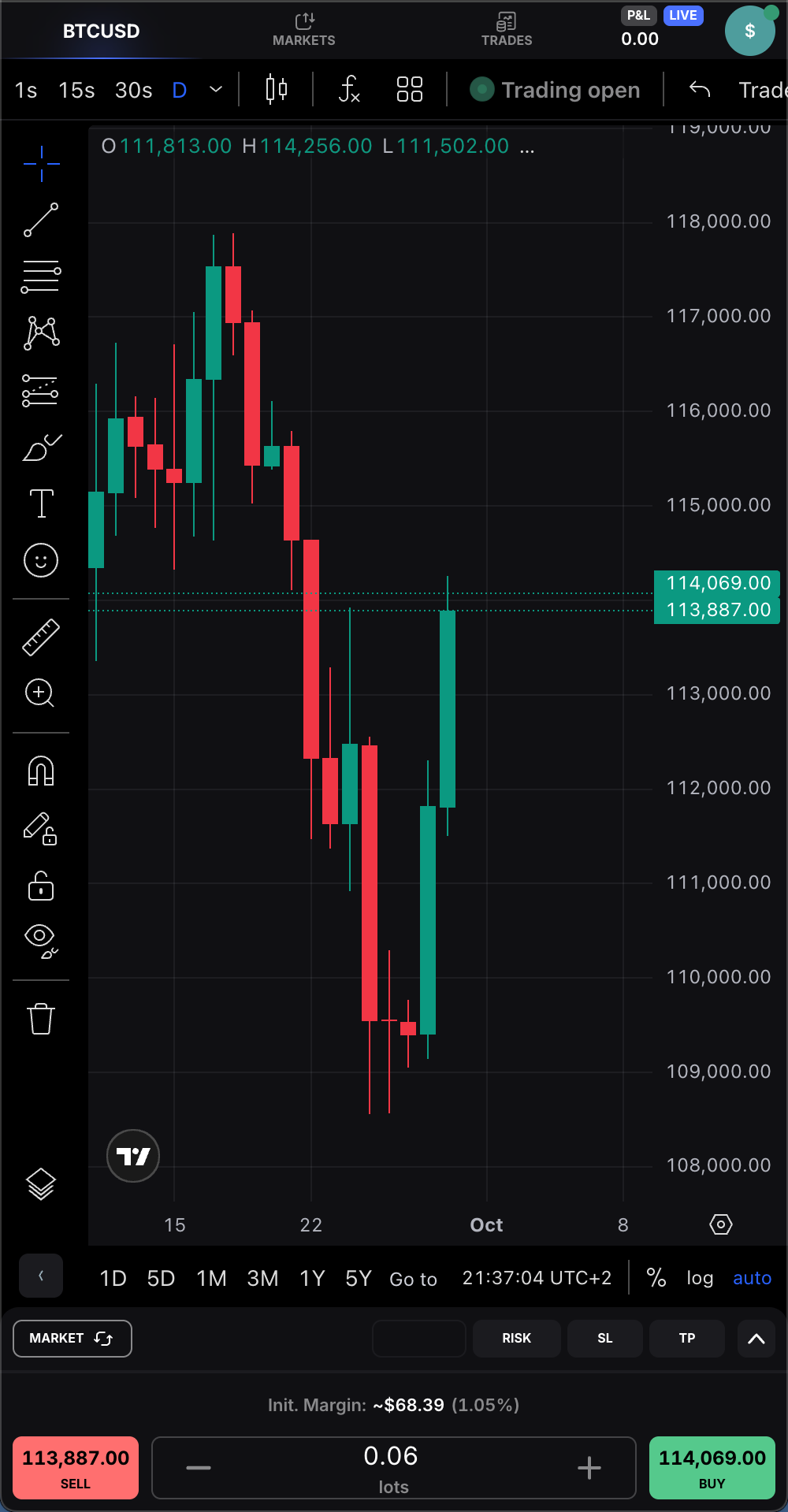

Crypto followed the risk-off tone in equities.

- Bitcoin (BTCUSD): fell 2.7% to close near $112K.

- Ethereum (ETHUSD): dropped nearly 7% to $4,143, continuing to lag behind.

Global Markets

Central banks were quiet, with no major policy changes. Powell’s speech in the US kept a neutral tone, offering little new guidance.

Conclusion

Last week showed a clear divide: the US economy is holding up better than expected, while Europe is slipping further. Stocks cooled, crypto weakened, and oil rallied hard. With Q4 starting, traders are watching how this divergence plays out in markets.

Disclaimer: This content is for informational purposes only and is not financial advice.