Proprietary trading, or prop trading, is becoming an increasingly popular way for traders to access capital without risking their own funds. Prop firms allow traders to trade using the firm’s capital after passing a series of tests or “challenges” designed to assess trading skill and discipline. But where can you buy a prop challenge, and how do these challenges work?

In this guide, we will break down the prop trading model, the structure of a typical prop firm challenge, and the best places to purchase one to get started on your journey toward becoming a funded trader.

What is Prop Firm Trading?

Prop firm trading is a model where traders use the firm’s capital to trade in various financial markets, such as forex, stocks, and commodities. Unlike retail trading, where traders are limited by their own capital, prop traders gain access to significant funds, allowing them to maximize their profits.

The catch? You need to prove your skills first by passing a prop firm challenge, which tests whether you can manage risk and generate profits. First you need to buy a prop challenge, and once you pass, the firm provides you with access to their capital, typically on a profit-sharing basis.

What are the requirements to pass the Challenge?

Whilst there is no unique requirement, there are certain parameters that are necessary to pass. These rules are crucial to ensuring the trader can consistently generate profits while managing risk—essential traits for any prop firm. Some companies will share 40%, while others might go to 90%.

Profit Target

One of the primary requirements in most prop firm challenges is reaching a specified profit target within a certain period. This target can range from 5% to 10% of the account balance, depending on the firm and the type of challenge. For example: A trader might be required to grow a $50,000 account by 10%, meaning they need to generate $5,000 in profit during the evaluation phase. Achieving the target requires both skill and discipline, as traders must strike a balance between generating returns and managing risk.

Maximum Daily Loss

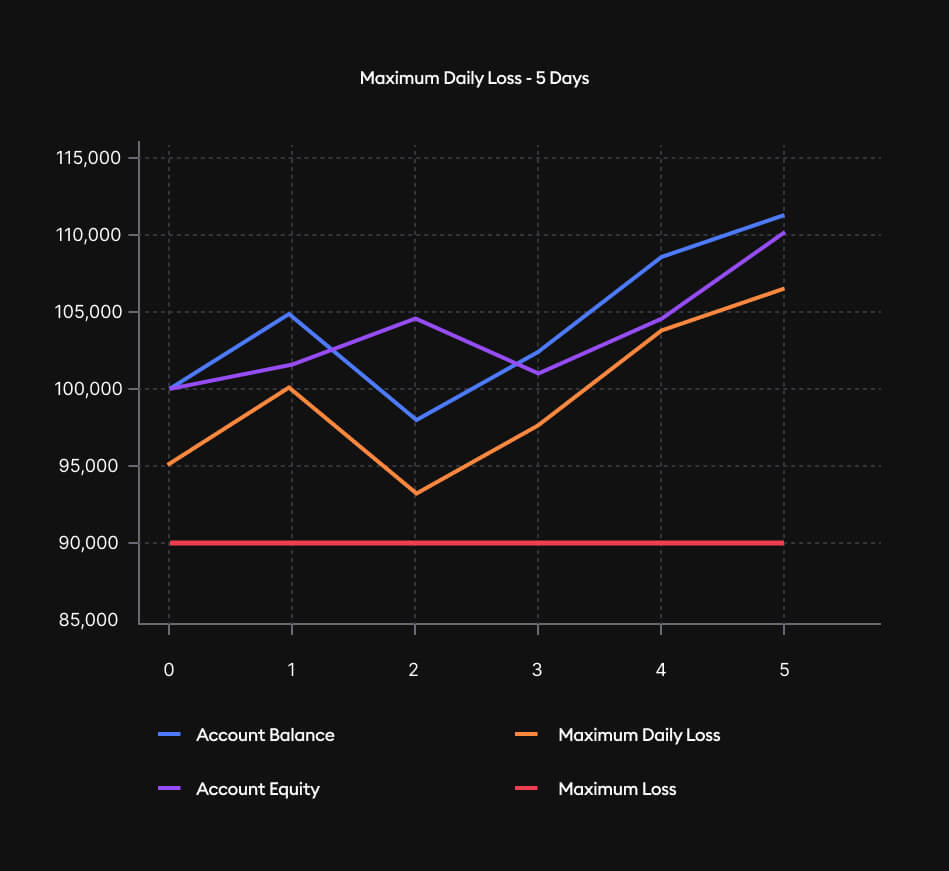

Prop firms impose a daily loss limit to ensure traders are not taking excessive risks. This rule caps the amount of money a trader can lose in a single day, helping to protect the firm’s capital. Typically, the daily loss limit ranges between 3% and 5% of the account balance.

On a $100,000 account, a daily loss limit of 5% would mean that the trader cannot lose more than $5,000 in a single trading day. Traders must carefully manage their positions and avoid large drawdowns, which requires precise risk management and emotional control.

Maximum Overall Loss

In addition to the daily loss limit, prop firms set a total drawdown limit, which is the maximum amount of capital a trader can lose over the entire challenge. This is often set at around 10% of the account balance. If the total drawdown limit is 10% on a $50,000 account, a trader can lose up to $5,000 in total before failing the challenge. This rule encourages traders to maintain consistent profitability and avoid large, risky trades that could wipe out their account.

Consistency Rule

Many prop firms enforce a consistency rule to ensure that traders demonstrate stable, repeatable performance rather than relying on a few large, high-risk trades to pass the challenge. This rule typically requires that a trader’s largest winning day or week doesn’t exceed a certain percentage of their total profit, ensuring that gains are spread out over time.

If a trader makes $10,000 in profit during the evaluation phase, and the firm’s consistency rule states that no single day’s profit can exceed 30% of the total, then the trader must not have made more than $3,000 in any one day.

Time Limits

Most prop firm challenges come with a set time frame, usually 30 to 60 days, within which traders must hit the profit target while respecting all other rules. Time limits add an extra layer of pressure and require traders to remain disciplined and efficient in their trading.

How Do Prop Firm Challenges Work?

A prop firm challenge is essentially an evaluation process. The firm assesses whether a trader can meet specific profit targets and manage risk. These challenges often consist of two phases:

- Phase 1 – Evaluation: Traders must reach a set profit target while adhering to risk management rules, such as not exceeding a daily loss limit.

- Phase 2 – Verification: In this phase, traders have to continue showing consistency by reaching another profit target, though the requirements are usually less stringent than Phase 1.

Once both phases are passed, you’re given access to the firm’s capital.

Where to Buy a Prop Challenge

We are committed to providing our traders with the best opportunities to grow and succeed. That’s why we’ve partnered with some of the most reputable and well-established prop firms in the industry, offering a range of challenges to suit every trading style and experience level. Each of these firms provides a clear and structured pathway to becoming a funded trader, ensuring that you have the resources and backing needed to succeed in the markets. You can buy a prop challenge at any of these companies:

Brands with TradeLocker

1,159 adopters

721 adopters

753 adopters

400 adopters

140 adopters

54 adopters

15,778 adopters

157 adopters

0 adopters

2,562 adopters

892 adopters

838 adopters

698 adopters

651 adopters

28 adopters

2,593 adopters

127 adopters

255 adopters

227 adopters

640 adopters

965 adopters

94 adopters

0 adopters

161 adopters

5,416 adopters

1,543 adopters

5,316 adopters

208 adopters

336 adopters

0 adopters

963 adopters

25 adopters

374 adopters

95 adopters

139 adopters

20 adopters

60 adopters

31 adopters

27 adopters

Brands without TradeLocker

Brands with TradeLocker

If you would like to start trading with real capital you can check our list of brokers here.

Why is Prop Trading great for beginners

Prop trading is one of the best ways to get started with trading. It allows you to access significantly more capital than you currently have for a fraction of the cost. For example, you can control $5,000 for $80, or even $100,000 for $600. If you pass these challenges, the upside is substantial—you can earn large sums of money and quickly recoup your initial investment. Prop challenges encourage careful trading, aiming for small, consistent profits, minimizing risk, managing leverage, and cashing out early because profit is key. The entire purpose of the challenge is to train you to become a successful funded trader who continues to generate profits for the prop firm. Think of it like a professional sport—though your dreams of joining the NBA or Champions League may be in the past, now you can pick a prop firm, follow their rules to turn professional, and if you succeed, you enter the big leagues, earning rewards for yourself and the firm. The only downside is that you may lose the fee you paid to enter the challenge, but unlike trading your own money with a broker or making personal investments, prop trading minimizes your financial exposure.

What are good prop firm trading strategies for beginners.

The best strategy we can suggest is to work your way up steadily, little by little. Most successful funded traders pass their challenges by growing their accounts by just 1% or 2% per day. This gradual approach is what we believe to be the most effective strategy. Instead of chasing big swings or trying to identify large gaps in the market and betting big, focus on smaller, more consistent gains. For instance, if you spot an opportunity where you think you can make 20% to 30% on your portfolio, consider scaling that back to a more manageable 2% to 3% profit.

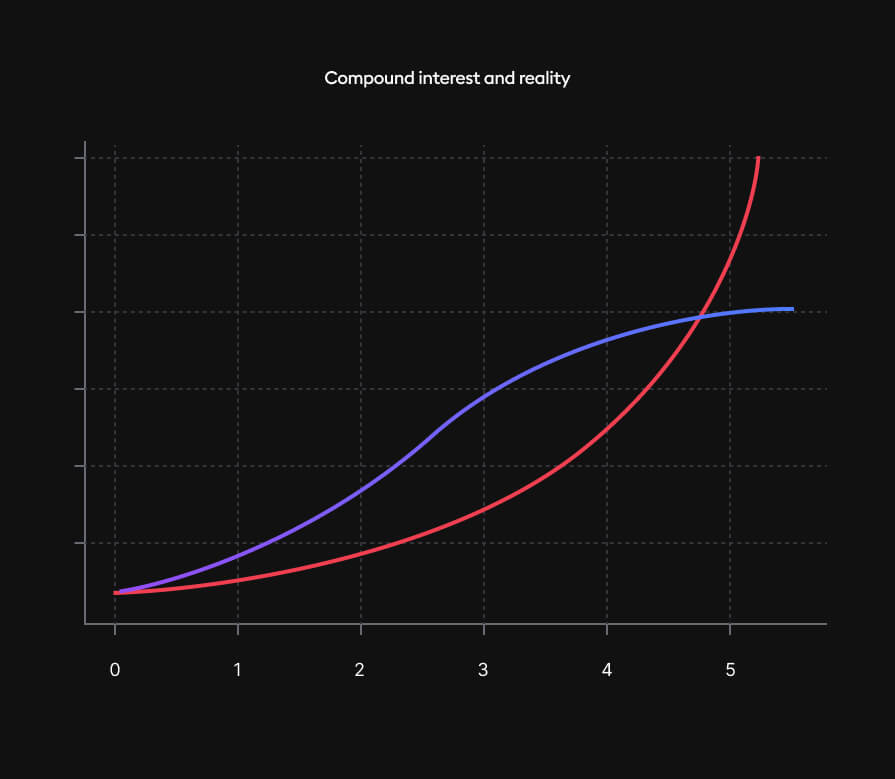

Remember, trading isn’t a sprint—it’s a marathon. Patience and discipline can go a long way. Over time, small, consistent gains can compound, turning $2-$3 into $200, and eventually $2,000. That is why we recommend you to buy a prop challenge. It is the most realistic and sustainable approach we can vouch for. We can’t guarantee immediate profitability, whether on the first or second attempt, but with thorough analysis and a long-term perspective, this strategy can be a game-changer for your trading journey.

Key notes:

- Work your way up steadily taking trades 1% – 2% per day.

- Find large gaps in the market and capitalize on them, but instead of betting big, take profits early.

- Be consistent and watch the compound effect grow your portfolio.

- You can always check some trading strategies on our Astronaut Auditorium.

We don’t want to set unrealistic expectations by claiming you’ll consistently make $10,000 per trade. While the power of compound growth is exponential, many traders experience a plateau at some point. This doesn’t mean that trading is a scam or that you’ve failed. It’s a natural part of the human psyche to become cautious and take profits once you reach an amount you’re comfortable with.

For beginner traders, this is a key lesson: Understand that trading success is not about hitting home runs every time. Instead, it’s about building long-term, sustainable growth. Prop firm trading is a great way to familiarize yourself with the industry because it forces you to develop discipline, risk management, and consistency. Once you make it as a funded trader, the next step is to find a level you’re comfortable operating at. Whether that’s taking small, regular profits or aiming for gradual growth.

The real key to longevity in trading is balancing ambition with the discipline to protect your capital. The compound effect is powerful, but only if you maintain control over your strategy and don’t let short-term wins distract you from long-term goals. It’s about playing the long game, being patient, and gradually increasing your risk as your experience and confidence grow.