In this article, we delve into the essential trading strategies discussed in the IamTP podcast. This podcast, a valuable resource for traders, offers unique insights and practical tips from experienced trader Ty. We’ll summarize the key points and strategies shared, aiming to provide new learning opportunities for traders at all levels.

From $1,147 to $226,000 in a Week

Ty’s journey to becoming a full-time trader is nothing short of remarkable. Starting with just $1,147 in his trading account, he managed to grow his funds to $226,000 within a week. This was achieved through a series of strategic trades in Ethereum and other assets. His success was fueled by his understanding of market swings and liquidity targets, allowing him to make significant gains in a short period.

I had about $1,147 left in my trading account, that was really all I had to my name at that time from like a $3,000 account, so I kind of just blew $2,000 overnight with GJ, but I pivoted, you know, went to sleep with like three lots open, woke up at $1,000, was at like $8,000, and I was like, all right, here we go, you know?

Strategies and Lessons Learned

The key to Ty’s success lies in his disciplined approach and strategic use of lot sizes. He emphasizes not to push his strategy as a one-size-fits-all but instead stresses the importance of understanding market direction and liquidity targets. His ability to pivot quickly and stack positions effectively played a crucial role in his impressive gains.

How to find a good trade?

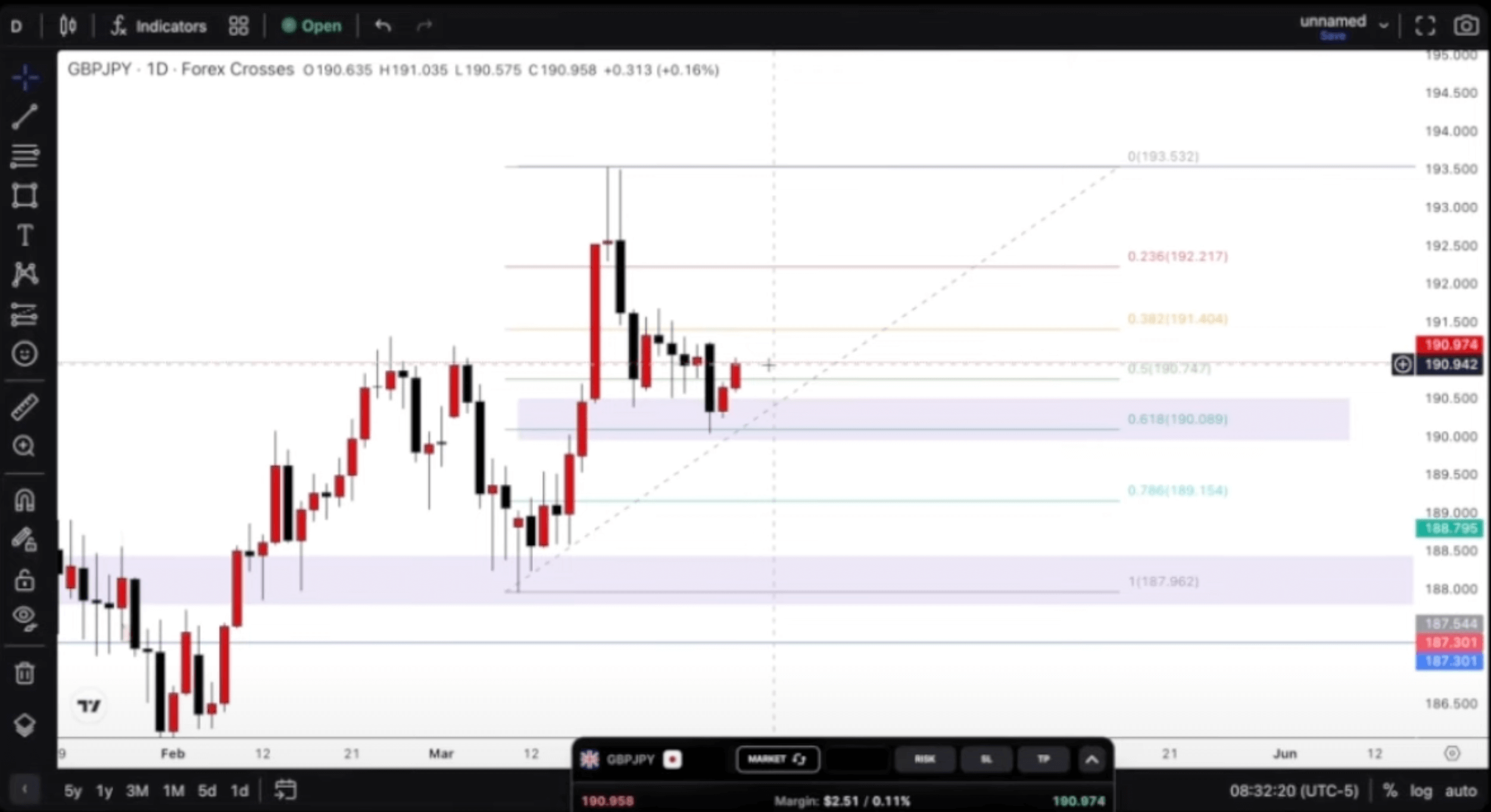

Top Down Analysis

One of the key tips to locate a successful trade is Top-down analysis which entails examining the forex trade market from micro and macro perspective, such as daily, weekly, monthly, and intraday charts. Ty explained this on a GBPJPY chart.

So, basically, recognizing that the market pivoted right here, all right? So, we’re at the top of the market, so ideally, of course, everybody is aiming here, right? Everybody’s aiming here. We’re not there yet, we’re far from there, we’re like 200 pips away. And actually, we just hit TP4 on my chat, right?

Ty explains that weekly top-down analysis is his strategy to identify the good trades because it provides the idea of market moves and previous price action. It helps you predominantly identify where the market is most likely to go towards.

There are two types of traders in Forex; Retail traders and Institutional traders. The retail traders sell and buy the financial assets, called securities, for individual or personal accounts and focus on the wicks. On the other side, the institutional traders sell and buy the financial assets for the institutes and groups, concerning where the liquidity resides and orders are filled.

I look at a lot of the closing and opening of bodies because retail focuses on wicks, but the institutional, they focus on the area where they’re opening and closing. That’s where a lot of the liquidity resides, a lot of orders are filled.

Ty shared another crucial tip to find a good market trade, stating that you should know your range and the discount when buying, as the discount occurs when the forward exchange rate is less than the spot rate and you will be above the premium.

You should be buying drawdown and selling drawdown, meaning you will buy the down candle when the market is going down and you strategically move to the smaller time frame, breaking the failure structure.

So, now, we’re above the premium. So, ideally, who’s trying to buy right now? Everybody, because they see they’re moving up. I teach my chat, we buy drawdown, we sell drawdown, meaning when the market is going down and you’re looking to buy, why are you buying the up candle?

The same goes for the selling, as you should buy the up candle when the market is moving up. Every candle, every space, and every peak and trough has a meaning and purpose on the FIB chart.

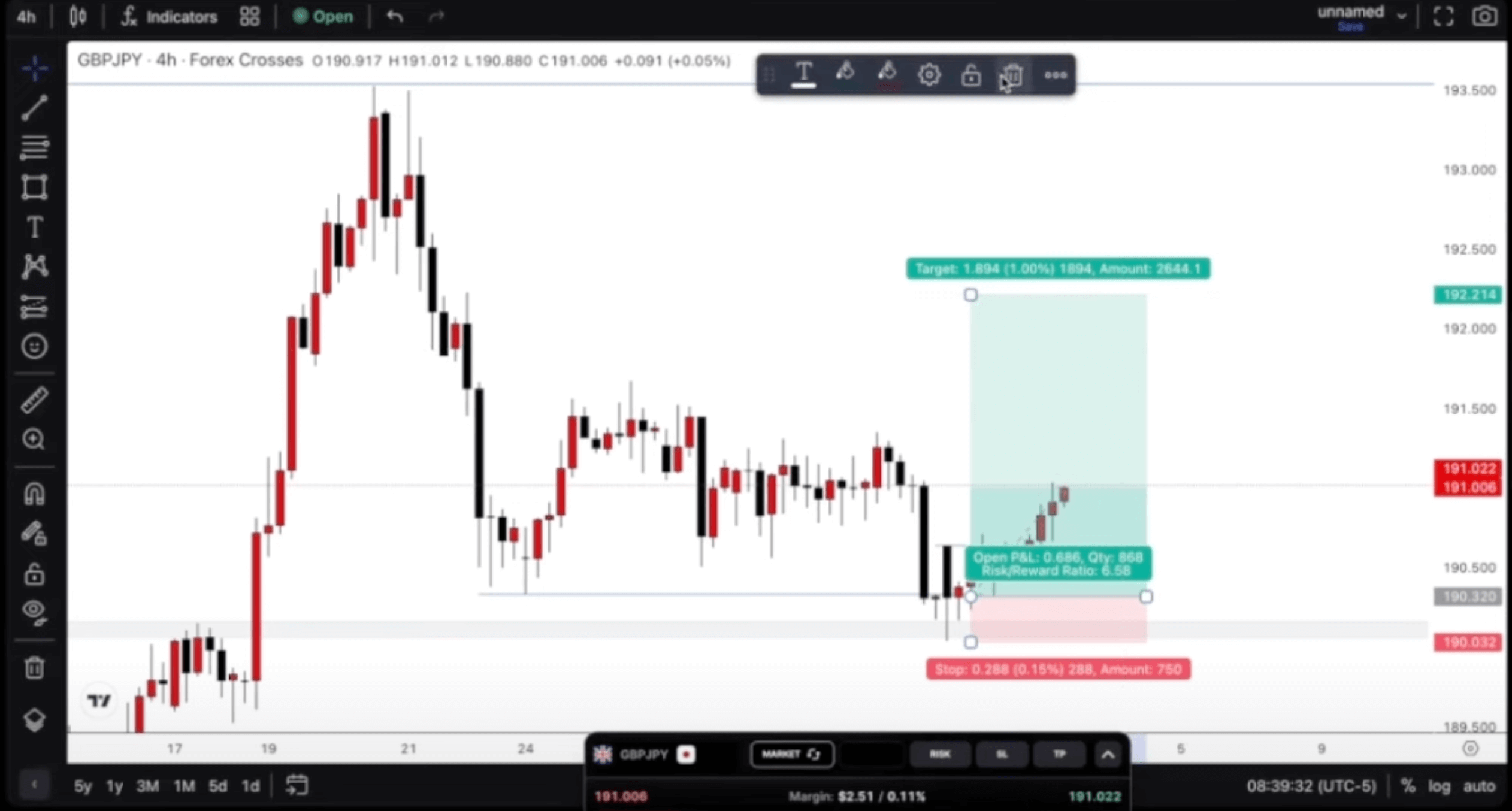

Liquidity void

I closed G like two weeks ago, caught like over 400 pips, something like that, I don’t know, but anyway, once we ran sales side, I play the runs off of liquidity. That’s my way of trading, in simple terms. Once you recognize the run on liquidity, you have to pivot to a smaller timeframe. So, I basically operate from the four-hour to the one-minute. I know that’s a strange range, but that’s how I read the market. Because once you run a dominant sell side or a dominant buy side, you have to look for a swing of people who are buying it up and people who are selling it down.

The rationale behind focusing on certain areas within the market is to allow for liquidity to be sought, as evidenced by the presence of multiple wicks in these zones. The take profit (TP) was set at 19,120, following a strategy that typically aims for 80 to 100 pips per trade. After securing an initial 100 pips, additional TP swings are often added, though the main focus remains on achieving consistent, substantial gains. The current target, after reaching TP4, is based on the expectation that, after hitting a high, the price will likely retrace back into the daily area for a rebound.

On the 4-hour timeframe, the progress has been steady, and while many traders might have been uncertain or focused on smaller timeframes, the key is understanding the larger picture. The initial reaction to market movements, especially on a Sunday known for gaps and uneven candle openings, can be misleading. Recognizing these gaps and the imbalance they create is crucial. The strategy involves waiting for the price to fill the void and continue in its intended direction. This approach allowed for precise entries without needing to consult multiple timeframes, focusing instead on the critical area of interest.

Once you reach the run on liquidity, you have to expect a retracement. If you don’t, you risk eating at your profit. So, you risk this market actually countering to come back down here.

The Power of Ty’s Community

Ty actively engages with his community by encouraging them to think critically and discuss their ideas with each other rather than simply relying on him for answers. He frequently receives direct messages on Telegram from members asking for his opinion on market movements, but he prefers to observe their discussions, allowing them to develop their own analytical skills. Ty provides detailed analysis whenever he gives a trading signal, so his community understands his perspective and the reasoning behind his decisions.

If I was a new trader coming into the chat, I can literally click that picture and like, “Wow, I understand why he… okay, now I can see,” and they… you can save images.

Despite this, some members still question his calls, as they may not have the same depth of insight that he has developed over years of experience. Ty’s approach involves thorough preparation; he spends Saturdays recapping the previous week and making decisions for the upcoming week, ensuring he is well-prepared for Sunday’s market open. This process is the result of years of dedication to trading, reflecting his commitment to not only his own success but also to the growth and development of his community.

How to Set a Stop Loss

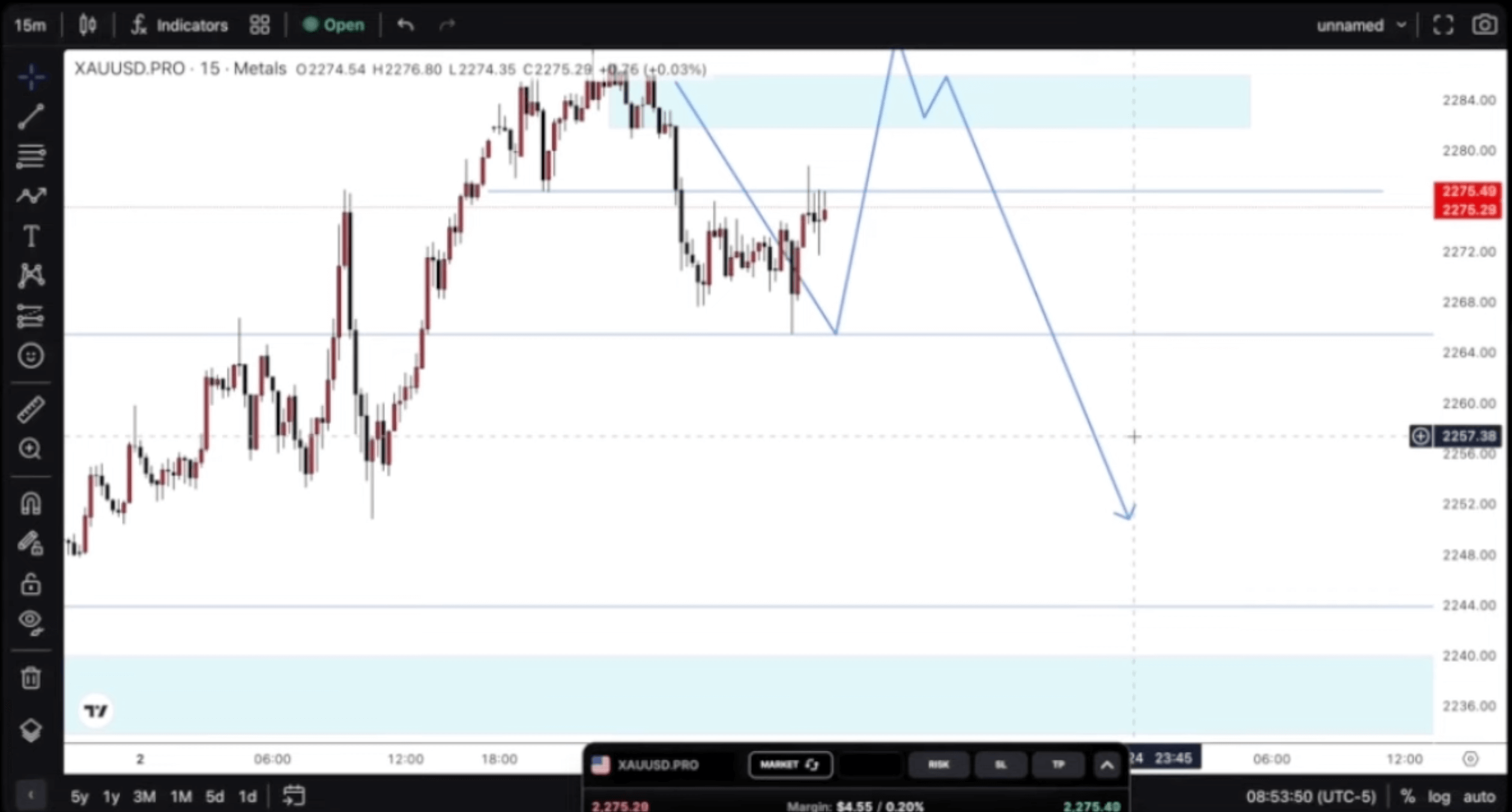

This time Ty has thought us how to set up a stop loss on XAUUSD. First, identify key levels on the one-hour chart. For instance, after a market move into the premium zone, you might observe that the price fails to break a previous high. In such a scenario, many traders place their stop losses within a specific range just below this high. However, if the market runs up again, it’s essential to consider the possibility of the market taking out these stop losses before reversing.

“You want to see if you’re selling, you want to see that rejection right in this area to send it back down.”

- Start by marking the high and low of the recent market move. This will help you establish a range within which the price might fluctuate.

- Place your stop loss just below a significant support level within the identified range. This prevents you from being taken out by minor fluctuations.

- Continuously monitor price action around your stop loss. If the market shows signs of respecting the support level, you can maintain your position. However, if the price breaches this level, it might be wise to reassess your stop loss or exit the trade to minimize losses.

- Be aware of the time of day and potential liquidity traps engineered by market makers. These traps are designed to trigger stop losses and create false signals, so patience and careful observation are key.

- Focus on real-time price action rather than relying solely on patterns or indicators. This approach allows you to adapt to the market’s current behavior and make more informed decisions about where to place your stop loss.

Because once you identify that focus price, which I always give out throughout the day, that price could be the direction for the week.

Where to set Take Profit

Setting up a Take Profit (TP) effectively is crucial for managing your trades and ensuring you lock in profits while minimizing risk. Here’s a step-by-step approach to setting up multiple TPs, using a four-TP strategy that allows for flexibility and maximizes gains.

- Begin by setting up four different TP levels. This gives you the flexibility to take profits at different stages of the trade, depending on how the market behaves. For instance, TP1 might be a more conservative target, while TP4 represents the full potential of the trade.

- After reaching TP1, which should ideally capture around 50 pips, adjust your stop loss to ensure you’re locking in profits. Move your stop loss into profit or at least to break even, securing 80% of the move. This approach helps protect your gains even if the market retraces.

- As the price reaches each TP level, take partial profits. This means securing some of your gains while allowing the remaining position to continue running toward higher TP levels. This strategy reduces the emotional stress of holding the entire position and ensures that you’re consistently booking profits.

- If the price retraces back to your initial entry point after reaching a TP, consider reentering the trade. This can indicate that the market is respecting a key price level, providing another opportunity to profit from the same move.

- Avoid placing your stop loss too close to the current price after reaching TP1. Instead, leave room for the trade to breathe, especially if you believe the market will continue in the desired direction. This approach minimizes the chances of getting stopped out prematurely.

Questions from the audience

Q: What was the biggest obstacle you came across?

A: To overcome the fear of executing trades, you simply have to execute. Every trader, no matter their experience, shares the same hopes and fears—hoping the trade goes well and fearing a loss. The key is to trust your analysis, place the trade, and let the market do its thing. Just like in sports, the more time you spend practicing on the charts, especially on areas where you’re weaker, the more confident you’ll become. My weakness used to be selling, but I focused on improving it. Now, when I sell, I take my profits and move on without trying to overextend the trade. The bottom line is to practice regularly, address your weaknesses, and trust your strategy.

Q: When did you realize you was a good trader?

A: Overcoming the fear of executing trades is something I had to face head-on, just like every trader, no matter how experienced. My advice? You just have to execute. Once you’ve done your analysis, place the trade and let the market do its thing, whether it goes your way or not. I’ve learned that the only way to get over that hump is to accept whatever outcome, knowing you’ve done your homework. For me, it’s like being an athlete—if you want to get better, you have to practice, especially where you’re weak. When I first started trading, I struggled with selling because I entered the Forex market during a bull run in 2021, where everything was about buying. But over time, I focused on improving that aspect, and now I can profit whether the market is going up or down.

The turning point for me was when I started making $1,000 a day consistently. That’s when I knew I had what it takes to do this for a living. Being able to withdraw money and pay my bills just from trading, even while I was still working my day job, was a big confidence boost. I knew I was getting good when I could make more from trading in a few days than I made from my salary in a month.

One of the biggest lessons I’ve learned is to focus on myself and not get distracted by what others are doing on social media. It’s easy to get caught up in lifestyle marketing and make bad decisions because of it. Instead, I concentrate on getting better every day, both on and off the charts. I have a routine—wake up early, hit the charts, and then go about my day, often finishing up before noon. What you do outside of trading impacts how you perform when you’re trading.

Join Ty’s trading course

In addition to trading, I also provide educational resources through my free chat, signal service, and personalized mentorship program. I don’t believe in selling courses; instead, I offer tailored guidance that fits each individual’s needs.