Leverage is one of the most misunderstood ideas in trading.

Some people treat it like a “turbo button.” Others avoid it completely because they’ve heard it “blows accounts.”

The truth is more practical (and more useful):

Leverage is just a tool that changes how much market exposure you can take with a given amount of money. It doesn’t change whether a trade idea is good or bad. It changes how fast your results show up—in either direction.

In this guide, you’ll learn exactly what leverage is, how it works behind the scenes, how to calculate it, what a margin call really means, and—most importantly—how to use leverage without letting it use you.

Key takeaways

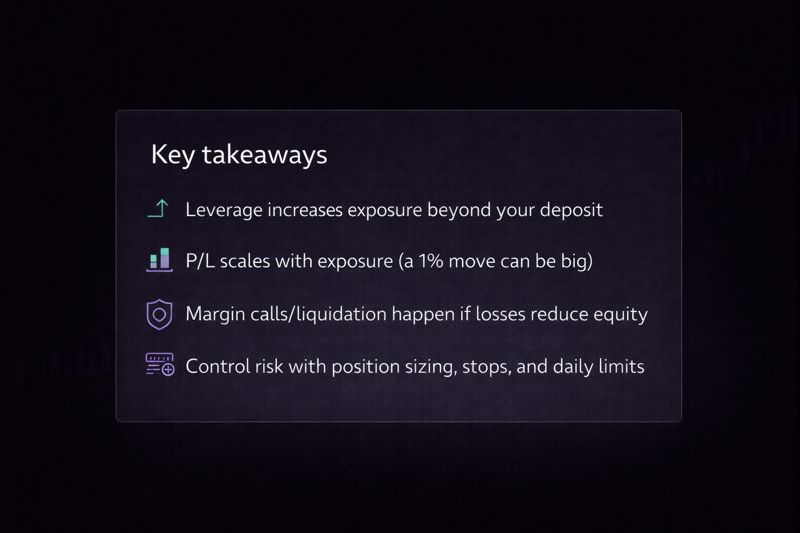

- Leverage = exposure multiplier. It lets you control a larger position with a smaller deposit (margin).

- Profit and loss are calculated on the full position size, not your margin deposit.

- Margin calls happen when your account equity falls too close to the required margin.

- “Safe leverage” is mostly about position sizing and risk per trade, not chasing the highest ratio.

What is leverage in trading?

Leverage in trading means using borrowed buying power (provided through your broker’s margin system) to control a larger position than your cash balance alone would allow.

Here’s the simplest way to think about it:

- You put up a deposit (called margin).

- The broker lets you open a bigger position than that deposit.

- Your profit/loss is based on the full position, not the deposit.

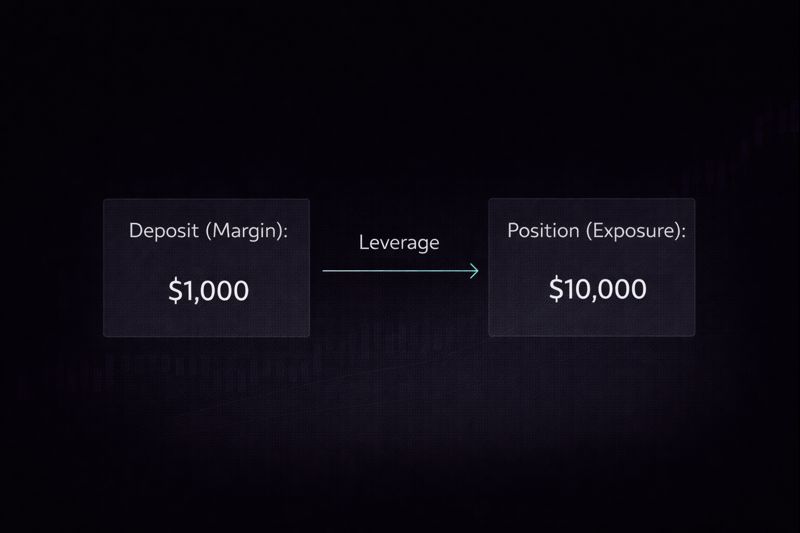

A 10-second example

Let’s say you have $1,000 in your account.

- Without leverage, you can open a position around $1,000.

- With 10:1 leverage, you can control a position around $10,000.

If the market moves +1%, your position gains $100 (1% of $10,000).

If it moves -1%, it loses $100.

Notice what happened: the market only moved 1%. But because your position is larger than your deposit, your account feels that move more sharply.

Leverage vs. margin (people confuse these constantly)

Leverage and margin are connected, but they are not the same thing.

Margin is the money you must set aside to open (and keep open) a leveraged position.

Leverage is the multiplier that tells you how much exposure you can control relative to your deposit.

The relationship (this is the part to remember)

- Higher leverage ⇒ lower margin required (for the same position size)

- Lower leverage ⇒ higher margin required (for the same position size)

Here’s a quick reference:

| Leverage | Margin required (approx.) | What it means |

|---|---|---|

| 2:1 | 50% | Control $2 for every $1 deposited |

| 5:1 | 20% | Control $5 for every $1 deposited |

| 10:1 | 10% | Control $10 for every $1 deposited |

| 20:1 | 5% | Control $20 for every $1 deposited |

| 30:1 | 3.33% | Control $30 for every $1 deposited |

How leverage works

When you place a trade in a leveraged product (like many forex/CFD instruments), you’re typically interacting with a margin system that tracks a few key numbers.

You’ll often see terms like:

- Balance: your account balance excluding open P/L

- Equity: balance plus/minus open P/L

- Used margin: margin locked to support your open positions

- Free margin: equity minus used margin (your buffer)

- Margin level: usually equity ÷ used margin (often shown as a %)

Even if your platform doesn’t show all of these, the broker is still tracking them.

Why this matters

Leverage isn’t dangerous because it exists. Leverage becomes dangerous when:

- your position is large relative to your account, and

- you don’t have enough buffer (free margin) to absorb normal volatility.

That’s how traders end up shocked by a margin call.

A simple leverage example

Let’s use round numbers so you can “feel” it.

- Account balance: $2,000

- You open a position size: $10,000

- Your effective leverage is: $10,000 ÷ $2,000 = 5:1

Now the market moves 2% against you.

- Loss = 2% of $10,000 = $200

- Your account equity becomes $1,800 (before fees)

That doesn’t sound catastrophic. But the important lesson is this: the market moved 2%. Your account moved 10% (because $200 is 10% of $2,000). That’s leverage in action.

Why beginners get trapped here

When a trader is new, they often think:

“The margin required is only $X, so my risk is only $X.”

Not true. Your risk is tied to your position size and how far the market can move before you exit—not the margin deposit alone.

Forex example

Forex is where leverage comes up the most because currency markets often move in small increments—so traders use larger position sizes to make those small moves meaningful.

Let’s keep this example beginner-friendly.

- Account equity: $1,000

- You open a EUR/USD position with notional value: $20,000

- Effective leverage: 20:1

Now EUR/USD moves 0.50% against you.

- Loss = 0.50% of $20,000 = $100

- That’s 10% of your account.

A half-percent move in EUR/USD can happen faster than most new traders expect, especially around economic news.

This is why experienced traders often focus less on “maximum leverage available” and more on:

- the size of their position,

- the distance to their stop loss, and

- how much of their account they’re willing to risk.

How to calculate leverage

There are two calculations that matter most.

1) Effective leverage (the one that actually matters)

Effective leverage = Position value ÷ Account equity

Example:

- Position value: $15,000

- Account equity: $3,000

- Effective leverage: $15,000 ÷ $3,000 = 5:1

This number changes as your equity changes (because open P/L changes your equity).

2) Margin requirement (simplified relationship)

A common rule-of-thumb relationship is:

Margin % ≈ 1 ÷ Leverage

So:

- 10:1 leverage ≈ 10% margin

- 20:1 leverage ≈ 5% margin

- 30:1 leverage ≈ 3.33% margin

Brokers can calculate margin slightly differently depending on product specs, so treat this as a fast mental model—not a legal contract.

Why traders use leverage

Used responsibly, leverage can be useful. Here are the main reasons traders choose leveraged products:

Capital efficiency

Leverage can reduce the cash you need to allocate to a position, leaving more funds uncommitted.

Flexibility in position sizing

In some markets, leverage allows finer control over position size—especially if your account is small and the instrument’s minimum size is relatively large.

Hedging and risk management (advanced)

Leverage can help experienced traders hedge exposure without tying up a large amount of capital.

Here’s the key point:

Leverage can improve efficiency. It does not improve your edge.

If your strategy has no edge, leverage just makes the results show up faster.

The real risks of leverage

Leverage doesn’t create risk out of nowhere. It amplifies what’s already there.

Here are the practical risks you need to understand.

1) Magnified losses

This is the obvious one. If you control a large position, small market moves can have a big impact on your account.

2) Margin calls and forced liquidation

If your equity falls too close to your used margin, the broker may:

- warn you to add funds, or

- reduce/close positions to protect the account.

This can happen at the worst possible time—right before a bounce—because the broker is managing risk, not optimizing your strategy.

3) Overnight costs / financing

Some leveraged products have funding costs when held overnight. These can matter if you hold trades for days or weeks.

4) Gaps and fast markets

Stops are helpful, but in fast markets, price can jump. If liquidity is thin, your exit may not be exactly where you planned.

5) Psychological pressure

Leverage doesn’t just change your P/L. It changes your emotions.

When P/L swings feel huge, traders are more likely to:

- cut winners early,

- move stops,

- revenge trade,

- abandon their plan.

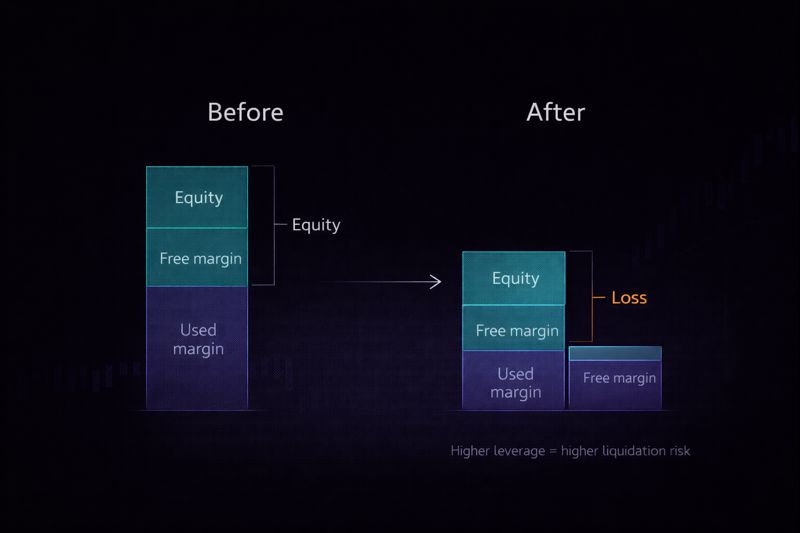

Margin calls and liquidation

A margin call isn’t a moral judgment. It’s a mechanical threshold.

Here’s a simple version:

- You open a leveraged position.

- The broker locks some of your funds as used margin.

- Your trade moves against you. Your equity drops.

- If equity gets too close to used margin, your free margin buffer shrinks.

- At a certain point, the broker may step in.

A short scenario

- Equity: $1,000

- Used margin: $500

- Free margin: $500

Trade moves against you and your floating loss becomes -$400:

- New equity: $600

- Used margin: $500

- Free margin: $100

You’re now running on a thin buffer. If volatility increases, you can hit the broker’s closeout threshold quickly.

Different brokers use different thresholds and rules. But the concept is consistent:

Margin calls happen when your buffer is too small for the position you’re running.

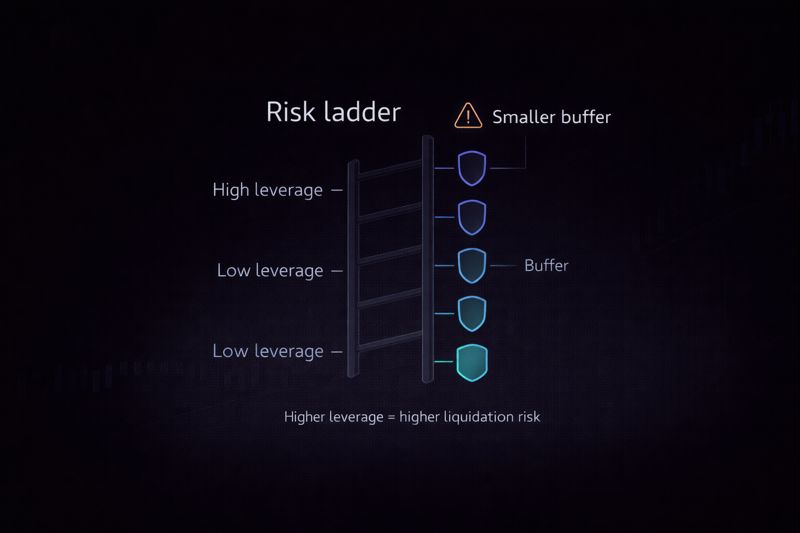

How much leverage is “safe”?

Most traders ask: “What leverage should I use?”

A more useful question is: “How much of my account am I risking if I’m wrong?”

Because leverage is not the primary safety control. Position sizing is.

The two dials you can control

- Dial #1: Leverage available (set by broker/product)

- Dial #2: Your position size (set by you)

You might have access to 30:1 leverage. That doesn’t mean you must trade anywhere near 30:1 effective leverage.

Many disciplined traders intentionally keep their effective leverage low most of the time and only scale position sizes when the setup and risk conditions justify it.

A simple “sanity check”

Before you enter any trade, ask:

- If my stop is hit, how much do I lose (in $)?

- What percent of my account is that loss?

- Is that loss acceptable given my plan?

This reframes leverage from “how big can I trade?” to “how much can I lose if I’m wrong?”

Practical risk controls when using leverage

This is where leverage becomes manageable.

You don’t need 20 rules. You need a few rules you actually follow.

1) Use a stop loss that matches the market (not your feelings)

A stop loss isn’t about being “right.” It’s about defining your maximum loss before emotions take over.

A common beginner mistake is placing stops too tight, getting stopped out by normal noise, then re-entering with bigger size.

Better approach:

- place stops where your trade idea is logically invalidated, and

- adjust position size so that stop distance still fits your risk limit.

2) Size the trade from risk (not from margin)

Try this workflow:

- Decide your max loss per trade (in $).

- Decide where your stop goes.

- Calculate position size so that if the stop hits, you lose that amount.

This one change prevents a lot of leverage disasters because it forces the trade to “fit” your account.

3) Keep a free margin buffer

If you trade with almost no buffer, you’ll eventually get clipped by volatility—especially around news.

A healthy buffer gives you breathing room.

4) Avoid stacking correlated positions

If you’re long EUR/USD, long GBP/USD, and short USD/CHF, you may be running the same idea three different ways: “short USD.”

That can create leverage exposure you didn’t intend.

5) Respect volatility spikes

Leverage and volatility together can turn a normal day into an emotional mess.

If major economic releases are scheduled, either:

- reduce size,

- widen stops and reduce size accordingly,

- or stay flat.

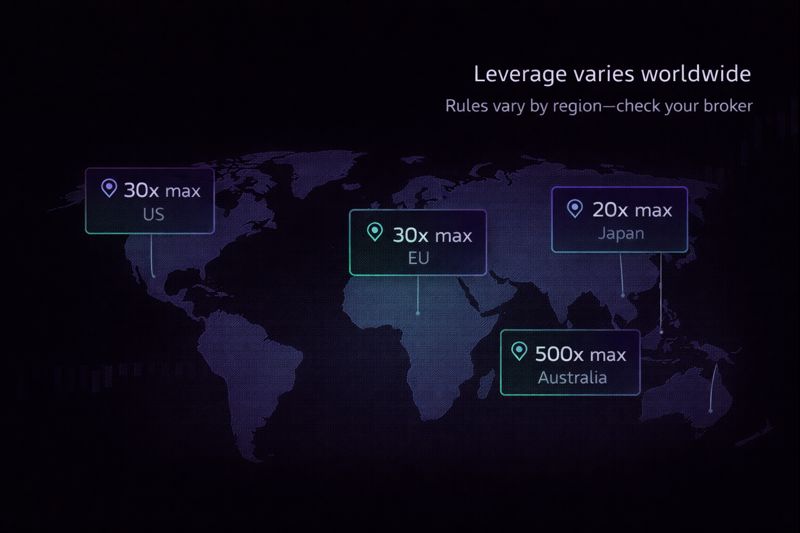

Why leverage looks different by market

Leverage isn’t a universal number. It varies based on:

- the instrument (forex vs indices vs crypto vs stocks),

- the broker’s risk policy,

- and local regulation.

So if you’ve ever wondered why one broker offers a different maximum leverage than another, it’s usually due to differences in product structure and risk requirements—not because one is “better.”

Practical takeaway: don’t build your plan around the maximum leverage you can get. Build it around the effective leverage you choose to use.

Leverage mistakes beginners make

You only need to make one or two of these mistakes to learn them the hard way—so it’s worth reading this section carefully.

Mistake #1: Using maximum leverage by default

Fix: Decide your risk per trade first, then size accordingly.

Mistake #2: Confusing margin required with maximum loss

Fix: Always calculate potential loss to stop (and consider gaps).

Mistake #3: Moving stops when the trade goes against you

Fix: If you move a stop, do it according to a rule (not panic).

Mistake #4: Overtrading because “there’s free margin available”

Fix: Set a max number of open positions or max total exposure.

Mistake #5: Ignoring correlation

Fix: Track your exposure by currency/sector/theme, not by number of trades.

How TradeLocker helps you stay in control

Leverage becomes much easier to handle when your platform makes risk visible and execution straightforward.

TradeLocker is built around a simple idea: keep trading tools modern, clear, and practical—so traders can focus on process and decision-making instead of fighting clunky interfaces.

Here are a few ways TradeLocker supports disciplined leverage use:

Risk-first order placement

Instead of guessing position size, a risk calculator workflow can help you align trade size with a defined stop loss and risk amount.

On-chart trading with clear SL/TP

Placing and adjusting stop loss and take profit levels directly on the chart makes your risk obvious—and reduces the chance of “fat-finger” mistakes.

Multi-device consistency

If you manage trades across devices, consistent layouts and controls help you avoid execution errors when it matters most.

Clean interface

When you’re using leverage, clarity matters. A cleaner workflow reduces stress and helps you stick to the plan.

Optional internal link placements (add in CMS):

- Internal link: Forex trading basics

- Internal link: How to build a trading plan

- Internal link: Position sizing guide

- Internal link: Stop loss & take profit explained

FAQ

What does 10x leverage mean?

It means your position size is about 10 times your margin deposit. If you post $1,000, you might control ~$10,000 of exposure (depending on margin rules).

Is leverage the same as margin?

No. Margin is the deposit required. Leverage is the exposure multiplier you get from that deposit.

Can I lose more than my deposit?

It depends on the product and your broker’s protections. Even if losses are limited in some setups, fast markets and gaps can cause larger-than-expected losses. Always read your broker’s risk disclosures and use risk controls.

Does higher leverage mean higher profit?

Not automatically. Higher leverage means bigger swings—profit and loss. Your edge determines expectancy. Leverage determines how quickly the results compound (or unravel).

What leverage do professional traders use?

There’s no single number. Many experienced traders focus on risk per trade and keep effective leverage modest most of the time. The big difference is consistency and risk control.

How do I know my effective leverage right now?

Use: Position value ÷ Account equity.

If you have $5,000 equity and a $25,000 position, you’re at 5:1 effective leverage.

Why do I get stopped out more when I use leverage?

Often it’s not leverage itself—it’s position size. Bigger size increases emotional pressure, and tight stops become harder to tolerate. The fix is usually better sizing and stop placement.

Is leverage good for beginners?

Leverage can be used by beginners, but only if they treat it as a risk management topic, not a profit topic. Start small, focus on process, and use strict position sizing.

Conclusion

If you remember only one thing from this article, make it this:

Leverage changes exposure. Position sizing controls risk.

Leverage can make trading more flexible—but it also reduces your margin buffer and increases how quickly losses can escalate if you oversize.

So treat leverage like you’d treat speed on a wet road:

- you can go fast,

- but only if you’ve earned control,

- and only if the conditions support it.

If you want leverage to work for you, build a process around it: define risk, place stops logically, size positions from that risk, and keep enough buffer to survive normal volatility.

Disclaimer: This article is educational and not financial advice.