In the high-stakes world of trading, overtrading is a pervasive issue that can quickly erode profits and destabilize even the most experienced traders. CoachT, a seasoned trader and respected figure in the financial community, recently shared his insights at the Astronaut Auditorium on how he overcame this challenge through disciplined strategy and meticulous planning.

“I had a problem of overtrading. So, tweaking my strategy to where I’m trying to look for one or two trades has definitely allowed me to not overtrade.”

CoachT Golden Rules

Power of Limiting Strategies

CoachT’s golden rule of three trades a day has been pivotal in his journey toward disciplined trading. “I had a problem of overtrading,” he admitted. “So, tweaking my strategy to where I’m trying to look for one or two trades has definitely allowed me to not overtrade.” By setting a strict limit on the number of trades per day, CoachT was able to focus more intently on quality setups and avoid the pitfalls of impulsive trading.

The strategy is simple yet profound: set a daily trade limit and stick to it. For CoachT, if he hits his daily goal with the first trade, he shuts down his trading platform for the day, irrespective of how many promising setups may appear. This approach is grounded in the realization that it is unrealistic—and ultimately unprofitable—to attempt to capture every market swing.

Identifying Peak Trading Hours

Another cornerstone of CoachT’s strategy is trading during peak market hours. He emphasized the importance of identifying these optimal periods, as they offer the highest probability of success with fewer trades. CoachT typically focuses his trading between 7 AM and 12:30 PM Central Time (8 AM to 1:30 PM Eastern Time), or more specifically, during the first four hours after the market opens (9:30 AM to 1:30 PM Eastern Time). By honing in on these prime hours, he finds that three trades are often sufficient to achieve his daily objectives.

Avoiding the Temptation of Market Chasing

CoachT’s approach to trading NAS100 is methodical and deliberate. He begins by marking zones of interest, identifying key support and resistance levels, and understanding market movements before entering any trade. Different colors and line thicknesses on his charts help distinguish the varying strength of these levels.

One of the critical lessons he shares is to avoid jumping into trades if you miss the initial entry. FOMO (Fear of Missing Out) is a common trap, but CoachT advises waiting for the right moment rather than rushing into a trade. Often, a potential retest—a temporary pullback—provides a safer opportunity to enter the market with lower risk.

The Magic of Three Trades

For CoachT, the number three holds a special significance in trading. He has found that even if he loses two out of his three allotted trades, he can still end the day with a positive return. This disciplined approach prevents the erosion of profits that often accompanies overtrading. He cautions that taking more than three trades in a day significantly increases the risk of wiping out any gains made.

Cutting Losses Early

In trading, minimizing losses is just as important as maximizing gains. CoachT advises cutting losses quickly, especially when they reach a predetermined threshold, such as 15 to 20 points. For smaller accounts, this might translate to a risk tolerance of 15 to 30 percent. By exiting trades before losses accumulate, traders can protect their capital and avoid the downward spiral of a losing streak.

How to Trade NAS100

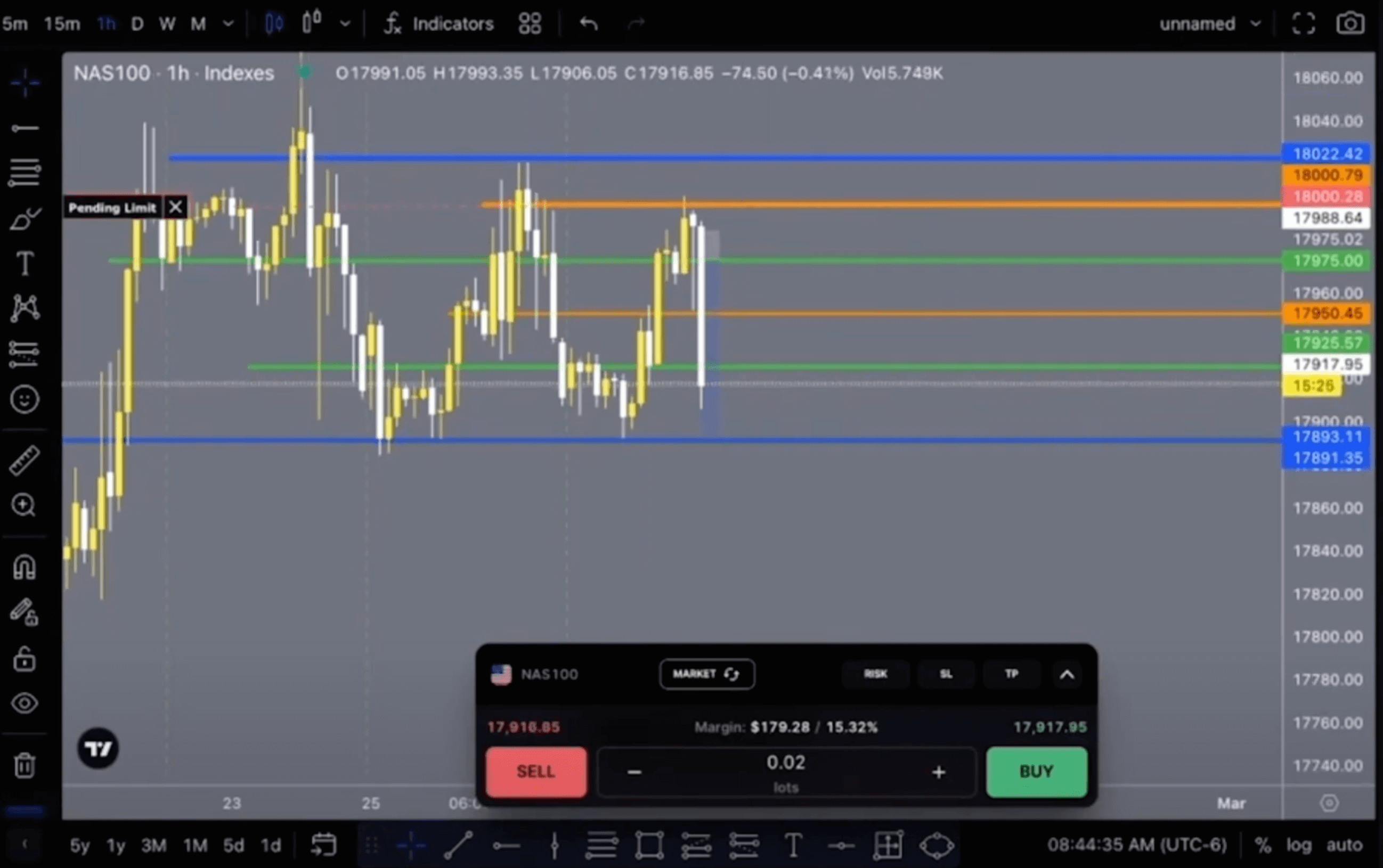

CoachT’s approach to trading NAS100 is methodical and deliberate. He begins by marking zones of interest, identifying key support and resistance levels, and understanding market movements before entering any trade. Different colors and line thicknesses on his charts help distinguish the varying strength of these levels.

One of the critical lessons he shares is to avoid jumping into trades if you miss the initial entry. FOMO (Fear of Missing Out) is a common trap, but CoachT advises waiting for the right moment rather than rushing into a trade. Often, a potential retest—a temporary pullback—provides a safer opportunity to enter the market with lower risk.

Precision in Lot Size Calculation

For NAS100 trading, calculating the appropriate lot size is essential. CoachT recommends starting with an assessment of your risk tolerance and account size. From there, determine the risk per trade, set a stop loss level, and calculate the pip value to find the optimal lot size. Adjusting the lot size according to your account size ensures that you can sustain trading even through inevitable market fluctuations.

Quality Over Quantity in Trade Setups

Finally, CoachT emphasizes the importance of focusing on quality rather than quantity in trade setups. Unlike traders who juggle multiple instruments, CoachT concentrates on one or two setups each day, which he finds more manageable and effective. He also highlights the importance of considering how news events might influence market movements, using this information to inform his trading decisions.

Navigating News-Driven Markets

When it comes to trading around news events, CoachT advises caution. Rather than diving into the market immediately after a news release, he recommends waiting for conditions to stabilize. Pre-planning strategies and avoiding trades during high-impact “red-folder” events can significantly reduce risk. Medium and low-impact news, categorized as “orange” and “green” folders, are less concerning and do not substantially alter his approach.

Mastering the 1-Hour Chart

CoachT’s approach to analyzing the 1-hour chart and candle movement emphasizes a disciplined, adaptive strategy that responds to market conditions in real-time. He highlights the importance of understanding key market signals, such as when the candle fails to make a lower low, which could indicate a potential upward push. Traders are advised to:

- Limit Further Entries: After an initial trade, avoid making additional entries and consider closing the position, depending on stock market conditions.

- Monitor Hourly Candle Closures: Predict upcoming market trends based on how the hourly candle closes. For instance, a hard wick in the next 10-15 minutes might suggest a bounce back up around the 925 area, with potential shifts toward 975 or slightly higher to the 980-990 range.

- Prepare for Retests: If the candle closes below 925, anticipate a possible retest of the previous day’s low.

- Adopt a Conditional Trading Plan: Implement an “if-then” strategy to react to market movements. For example, CoachT targets the one seventy-six area for short trades but recommends waiting for the hour to close to observe the market before making decisions.

- Focus on Key Price Levels: Carefully monitor the key price levels and target zones, and hold off on actions until the hourly candle closes, with an eye on potential pullbacks based on market behavior.

This technical analysis framework allows traders to maintain discipline while remaining responsive to evolving market dynamics.

The Path to Sustainable Trading Success

CoachT’s disciplined approach to trading offers valuable lessons for traders at all levels. By setting clear limits, focusing on quality setups, and adhering to a structured strategy, traders can overcome the temptation to overtrade and achieve consistent, sustainable success in the markets. As CoachT’s experience demonstrates, the key to long-term profitability lies not in the number of trades but in the discipline to make each trade count.