What’s a Bull Market?

A bull market is characterized by a sustained upward trend in the stock market, with widespread expectations of continued price increases. However, this term isn’t exclusive to stocks. It also applies to other financial markets like bonds, real estate, currencies, and commodities. These periods of prosperity can span several months or even years, reflecting a general optimism in the market.

Quick Facts on Bull Markets

- During bull markets, investor confidence tends to be high, fueling further increases in prices.

- Identifying a bull market as it begins can be challenging, as it often becomes evident in hindsight.

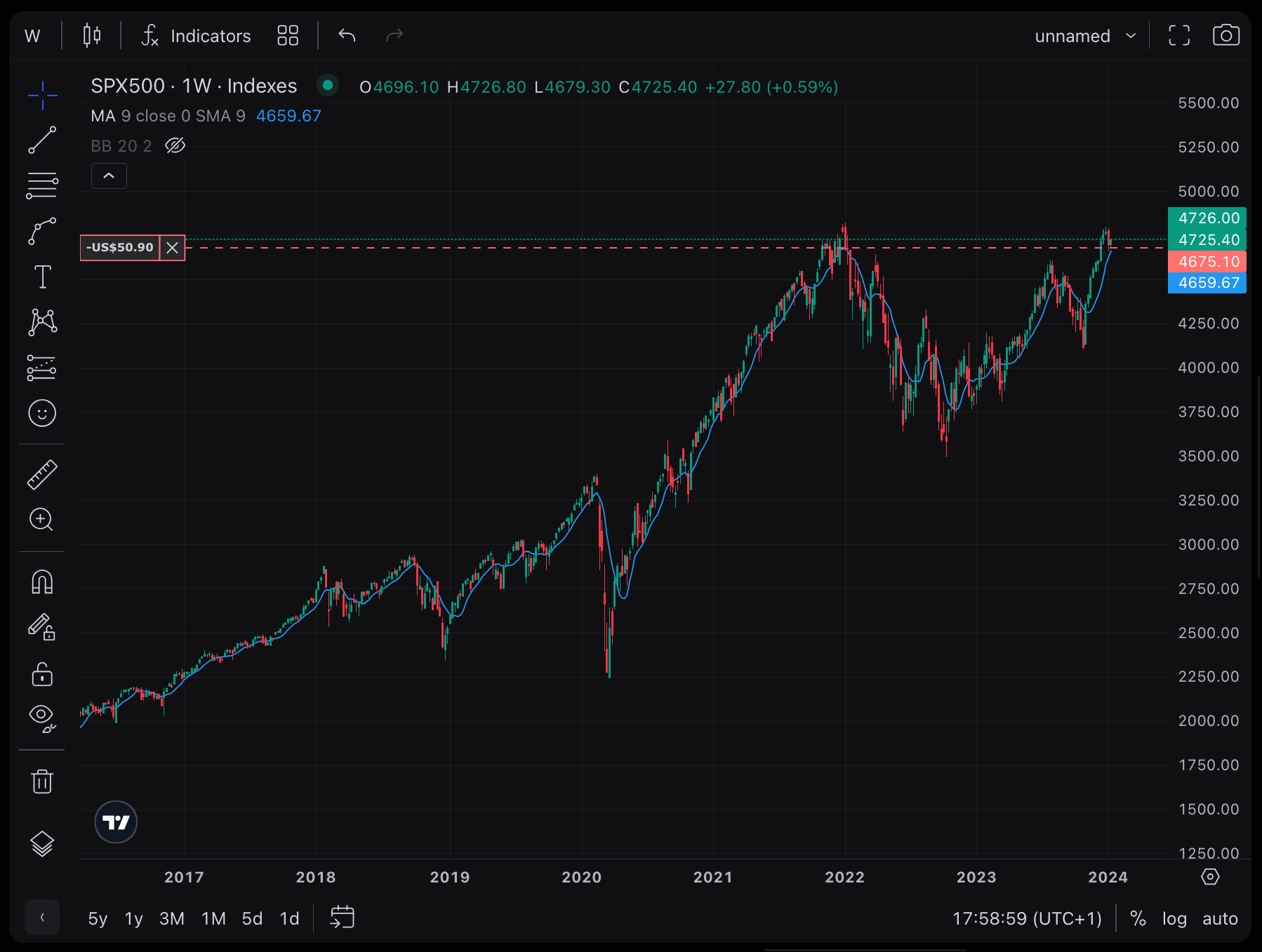

- A common indicator of bull markets is a rise in stock prices by 20% or more from recent lows.

Why Bull Markets Happen

They typically kick off when things are looking good economically—like when businesses are thriving and unemployment’s low. Investors get confident and start buying more in the markets. New companies join in by selling their shares. All this activity drives prices higher.

Traits of Bull Markets

- There’s a high volume of stock trading activity.

- Stock prices increase as investors are ready to pay higher amounts.

- Trading becomes more fluid as the number of participants eager to trade rises.

- Existing companies may distribute larger dividends, and the market sees an influx of new companies issuing shares.

Bull Market vs. Bear Market

In a bear market, it’s the opposite situation: prices are falling and the investment mood is gloomy. The animal metaphors explain it well: while a bull pushes upwards with its horns, symbolizing rising markets, a bear swats down, representing declining market trends.

How to Make the Most of Bull Markets

Here’s what you can do:

- Buy and Hold: This strategy involves purchasing stocks and retaining them long-term, based on the belief that their value will increase over time.

- Increase and Hold: In this approach, investors continue to buy additional stocks as their prices escalate.

- Buy on Dips: This tactic involves purchasing more stocks when there’s a slight decrease in prices, anticipating a subsequent rise.

- Full Swing Trading: Aimed at more experienced traders, this method entails rapidly buying and selling stocks to capitalize on market fluctuations and can include positions that profit from declining prices.

Famous Bull Markets

- The 1920s experienced a significant bull market, characterized by rampant speculation and a booming economy.

- In the 1980s, Japan’s economy witnessed a substantial bull market period.

- The 1980s in the United States also saw a bull market, particularly driven by the success of technology companies.

- The dot-com bubble of the 1990s created a bull market fueled by the frenzy around internet companies.

- The longest recorded bull market spanned from 2009 to 2020, propelled by robust corporate earnings and low-interest rates.

The Bottom Line

Bull markets are a favorable period for investors, marked by rising prices and often accompanied by a robustly growing economy. It presents an excellent opportunity for investment. However, it’s crucial to remain vigilant for signs indicating a potential shift in the market’s direction.