What Is a Drawdown?

A drawdown is a peak-to- trough decline during a specific period for an investment, trading account, or fund. A drawdown measures the historical risk of different investments, compares fund performance, or monitors personal trading performance. It is usually quoted as the percentage between the peak and the subsequent trough. If a trading account has $10,000 in it, and the funds drop to $9,000 before moving back above $10,000, then the trading account witnessed a 10% drawdown.

Understanding Drawdowns

A drawdown is essentially the reduction in the value of an investment or trading account from its highest point until it returns to that level. The Ulcer Index (UI) is a tool used to monitor these changes, and it remains relevant as long as the price is lower than the previous high. For instance, if an account drops by only 10% and then rises above $10,000, the drawdown is considered over when the account’s value exceeds $10,000.

This way of tracking drawdowns is important because it’s impossible to identify the lowest point (trough) until a new high is achieved. Therefore, as long as the value is under the former peak, there’s a possibility of a deeper drop, increasing the drawdown.

Drawdowns are critical in evaluating the financial risk of an investment. The Sterling ratios, for example, use drawdowns to balance the potential rewards of a security against its risks.

In terms of stock prices, a drawdown is often seen as the ‘negative phase’ in the range of a stock’s price fluctuations. This is the change from the highest price point to the lowest. For example, if a stock falls from $100 to $50 and then climbs back to $100.01 or higher, the drawdown would be considered $50 or 50% from its highest price.

Stock Drawdowns

The total volatility of a stock is usually quantified by its standard deviation. However, many investors, particularly retirees who rely on withdrawals from pensions and retirement accounts, pay more attention to drawdowns.

For retirees, volatile markets and significant drawdowns can present challenges. They often evaluate the drawdown of their investments, ranging from stocks to mutual funds, focusing on the maximum drawdown (MDD). This analysis helps them potentially steer clear of investments that have experienced the largest historical drawdowns.

Risk of Drawdowns

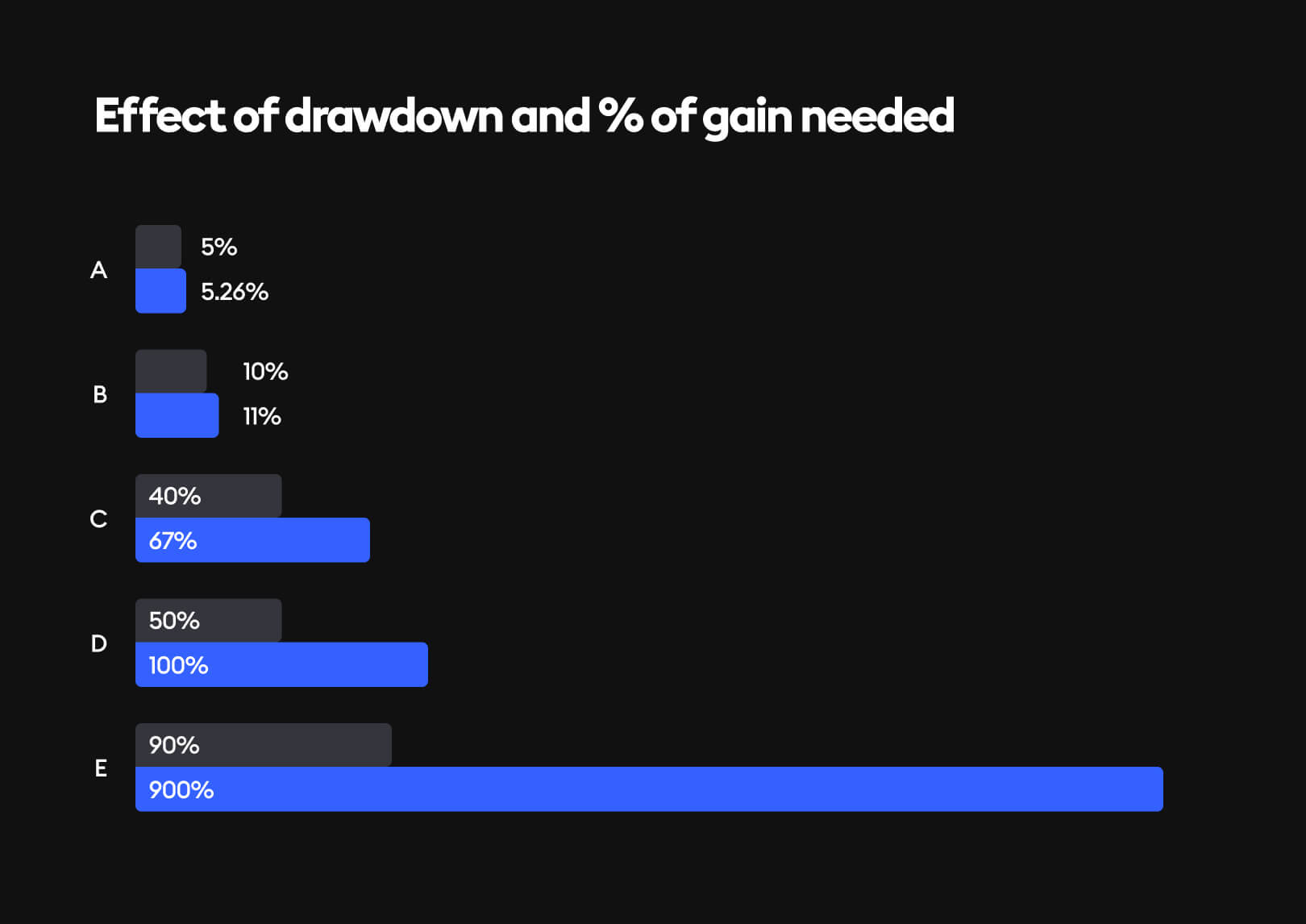

Drawdowns pose a significant risk to investors, especially when considering the magnitude of the share price increase needed to recover from them.

Take, for instance, a stock that loses 1%. It might seem minor as it only requires a 1.01% gain to return to its previous high. However, a 20% drawdown demands a 25% increase to reach the former peak. More dramatically, a 50% drawdown, such as those witnessed during the Great Recession of 2008 to 2009, necessitates a 100% rise to regain the previous high.

In response to this risk, some investors adopt a strategy of avoiding drawdowns greater than 20%. When this threshold is breached, they opt to cut their losses and convert their investment into cash.

Assessment of Drawdowns

Mitigating drawdown risk often involves maintaining a well-diversified portfolio and understanding the timeframe available for recovery. For individuals early in their careers or with more than 10 years until retirement, adhering to the 20% drawdown limit commonly recommended by financial advisors can provide sufficient buffer for their portfolio’s recovery.

However, retirees must exercise extra caution regarding drawdown risks in their portfolios. Given their shorter time horizon before beginning fund withdrawals, they have less time for their portfolio to recuperate from significant losses. Diversifying investments across various asset classes, including stocks, bonds, precious metals, commodities, and cash instruments, can offer some degree of protection against drawdowns. This is because different market conditions have varying impacts on these asset classes.

Time to Recover a Drawdown

Understanding drawdowns involves not only looking at how much an investment drops, but also how long it takes to bounce back. Different investments recover at different speeds. For example, if a hedge fund or a trader’s account experiences a 10% drawdown, it could take years to make up that loss.

In contrast, another hedge fund or trader might recover from losses much faster, returning their account to its peak value in a short period. Therefore, when evaluating drawdowns, it’s important to also consider the typical recovery time for the investment or fund. This helps in understanding the overall risk and time involved in potentially regaining lost value.

Example of a Drawdown

Imagine a trader buys shares of Facebook at $100. The price initially rises to $110 (its peak), but then drops to $80 (its trough), before eventually climbing back above $110. The highest price the stock reached was $110, while the lowest was $80. To calculate the drawdown, which measures the drop from peak to trough, we find it’s 27.3% – this is calculated by dividing the $30 drop ($110 – $80) by the peak price of $110 and then multiplying by 100.

This example illustrates that a drawdown isn’t the same as a loss. While the stock’s drawdown was 27.3%, the trader would have experienced an unrealized loss of 20% when the stock hit $80. This difference is because losses are often viewed in relation to the purchase price (here, $100), not the highest price the stock reached after being bought.

Now, let’s say the stock’s price increases to $120 (a new peak), then dips to $105 (a new trough), before rising again to $125. The latest peak is $120, and the most recent trough is $105, resulting in a drawdown of 12.5%. This drawdown is calculated by taking the $15 difference ($120 – $105) and dividing it by the new peak of $120.

Is a Retirement Drawdown the Same As a Stock Drawdown?

A drawdown in retirement refers to the process of withdrawing funds from retirement savings. Retirees withdraw a specific portion of their savings to support their living standards, often referred to as the drawdown percentage. Withdrawing too much can lead to financial difficulties in later years, whereas withdrawing too little might result in unused funds remaining after the retiree’s passing.

The Bottom Line

There’s a fine line between turning a profit and losing your money when you invest your money. But understanding some of the intricacies of the investment world may help you keep your head in the game. Knowing what drawdowns mean and how they can help assess risk and compare investments may help you become a better trader as you mitigate your losses.