Day traders are skilled investors who earn their income by buying and selling stocks and other assets. They rely on a rigorous discipline and a thorough understanding of market trends, striving to capitalize on the stock market’s fluctuations from minute to minute and hour to hour.

What Is Day Trading?

These days everyone can become a day trader trough a vast rise of low-cost brokerage platform. TradeLocker’s technology was made so it simplifies day trading. Since it involves frequently buying and selling assets troughout the trading day, you have to anticipate and make money from intraday price changes in assets like stocks, bonds, commodities, and exchange-traded funds. As the name suggests, day trading is a short-term investment strategy. The goal is to exit all your trades by the end of the day, holding no securities overnight.

Contrast to long-term investing, where you buy and hold a position for months, even years, day traders attempt to beat the market and generate quick profits.

How to Start Day Trading

The best way to start trading is to open a brokerage account on one of these brokers. When you pass through the registration process, choose TradeLocker as your platform and you are set to day trade. Before you needed a stock broker to make trades for you, but this time-consuming process has been made obsolete with today’s technology. The main benefits of using our platform is the array of advanced risk management features that are beautifully intertwined in our UX and UI.

Once you have your brokerage account set up, it will give you access to buy and sell investments on TradeLocker. This way you can analyse trough TradingView charting tools, follow indicators and screen the market quickly.

As a day trader, you need to identify the markets and investments you want to focus on. You then try to buy and sell throughout the day to time positions that make you money, such as buying a stock right before an announcement pushes the price up and then selling once you think the price hits the peak. Placing orders on our platform is very simple and you can check the tutorial here.

Tools that can help your day trading

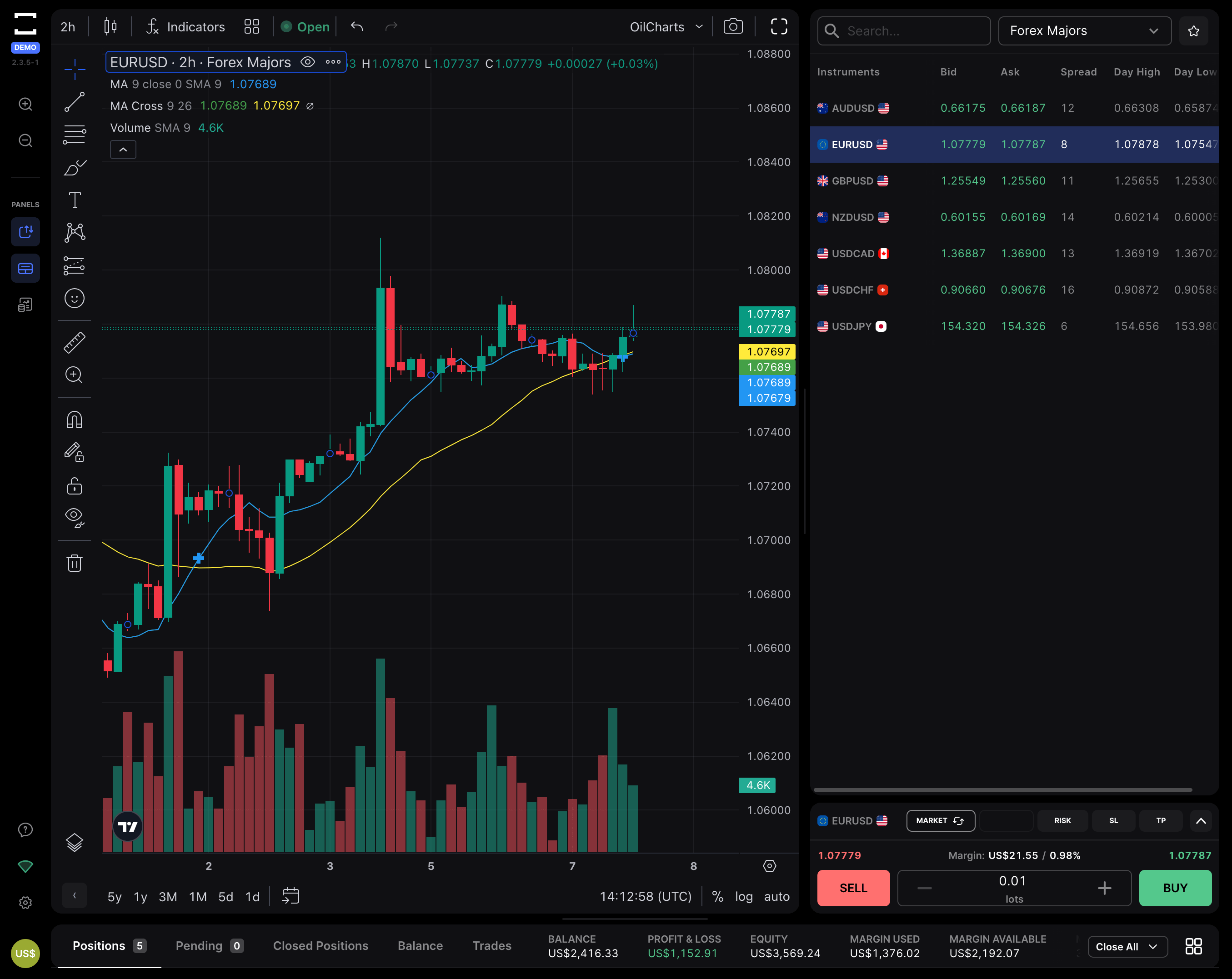

On-chart trading

We have on-chart trading enabled for all TradeLocker users. Main reason to use this was the simplicity of making your orders visually. Instead of typing in numbers, enlarging the screen, zooming out, writing the correct number inside the input field, your only task is to drag and press buy or sell. Alongside of making orders on the chart you are free to set up your Stop Loss and Take Profit on the chart as well. This reduces your risk of losing large amounts of money as your positions are protected with a quite literal safety net.

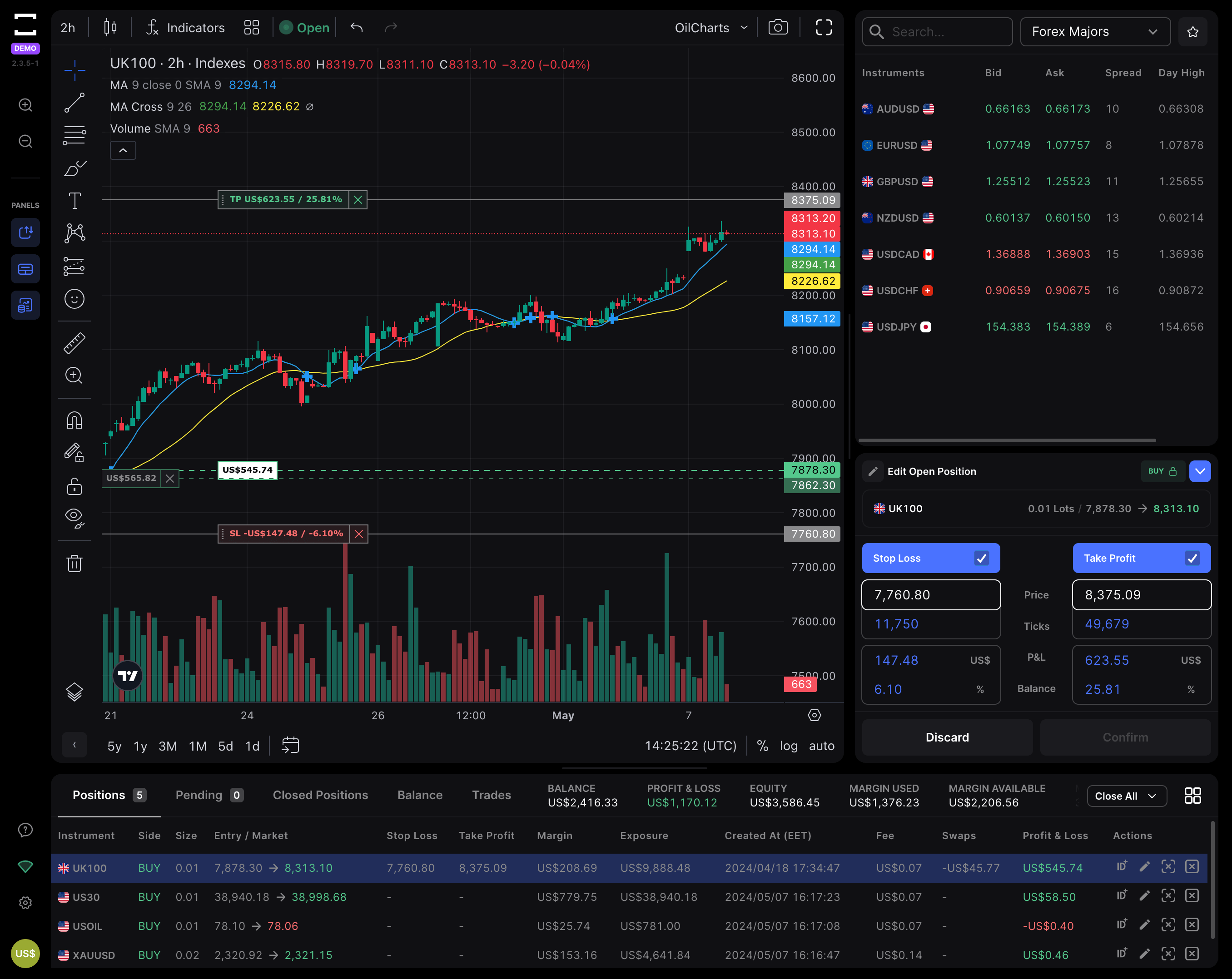

Stop Loss and Take Profit Calculator

The SLTP Calculator offers various parameters to help you strategize. One of the most useful features allows you to determine potential losses and profits, which you can control using two boxes labeled P&L. Additionally, you have the option to enter the number of ticks at which you want your trade to close, clearly marked as “Ticks.” Furthermore, there is a calculator that shows how your portfolio could benefit from the trade, labeled as “Balance.” This feature is particularly valuable during a Prop challenge, where you are not allowed to lose more than 5% of the account balance in a single day. (A special shout-out to the Prop Company that caused me to lose the challenge because of this rule, even though I met 4 out of 5 criteria.) The SLTP calculator also allows you to set your limits using the “Price” field, so if you are aiming for a specific price, you can use this field to place your order.

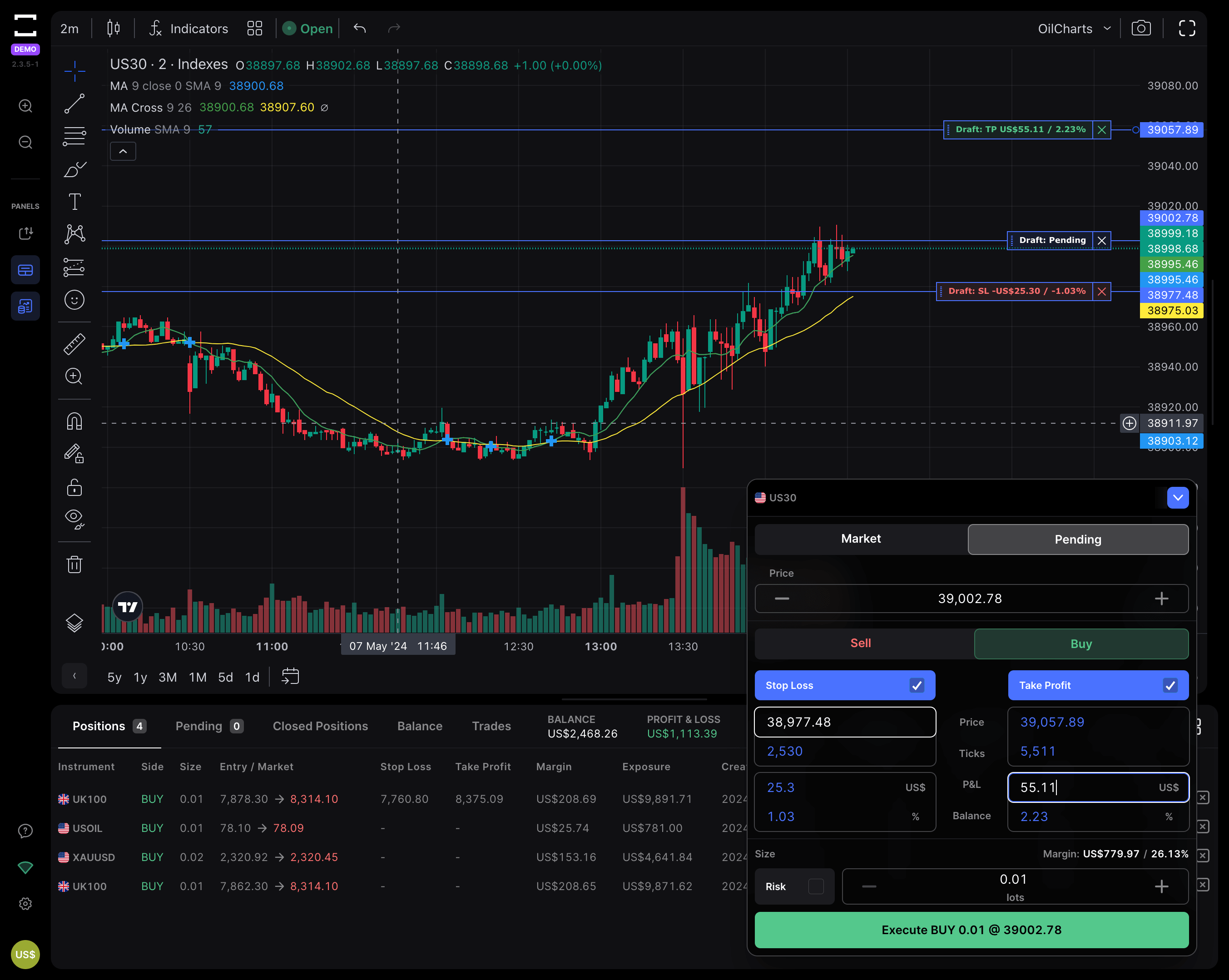

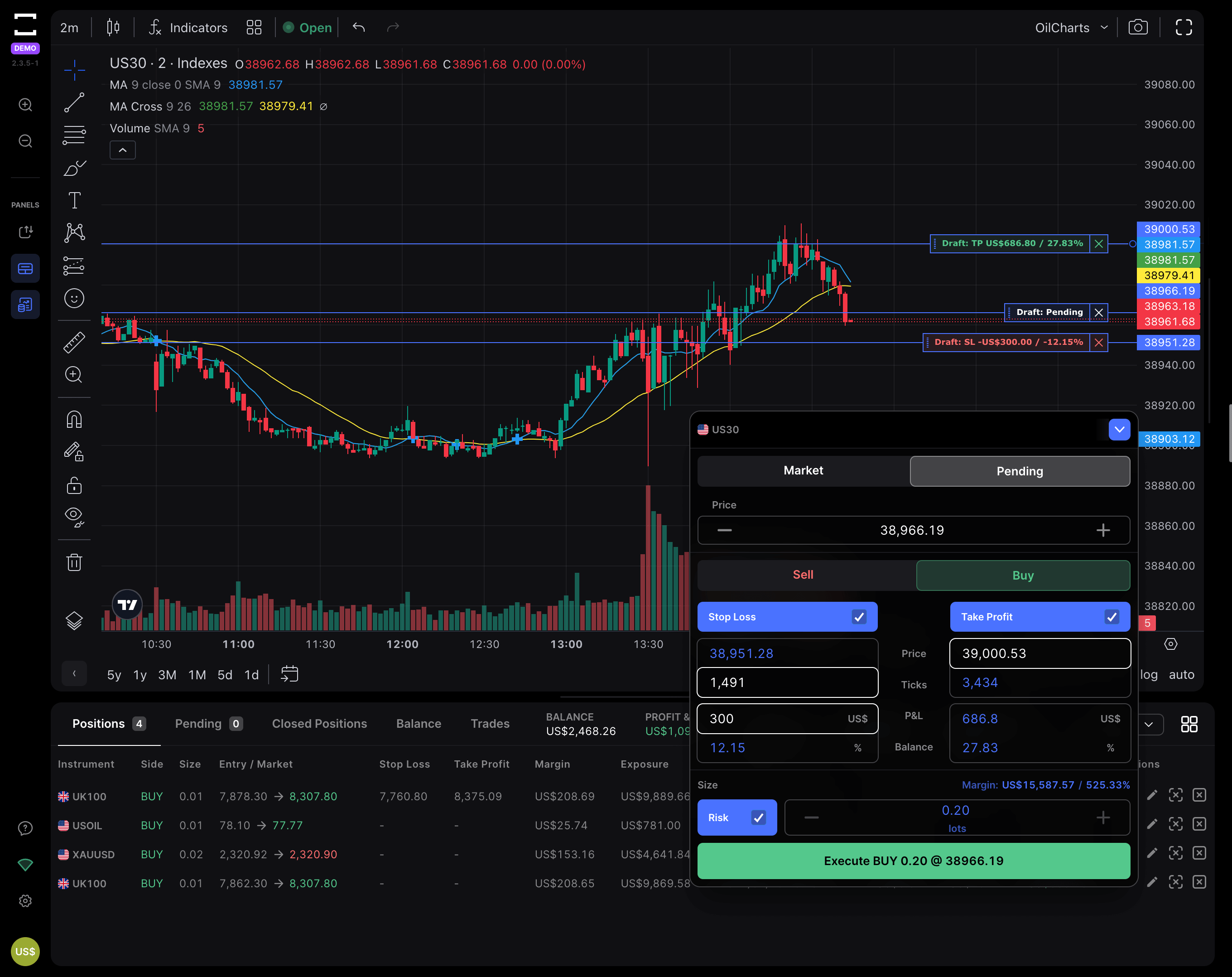

Risk calculator

In the Order panel above the “Execute BUY” button, you will find a small checkbox labeled “Risk.” Day traders often use this feature to risk a fixed amount of money. The Risk Calculator will determine how many lots are needed for this trade in such cases. The chart below displays a scenario where you select the risk checkmark, and as you can observe, the number of lots has changed. The trade is conducted on the same type of chart within the same timeframe to avoid confusion. Note that this trade requires fewer ticks to move, but it will significantly reduce your account balance by 12.15%, however, the potential profit is much higher.

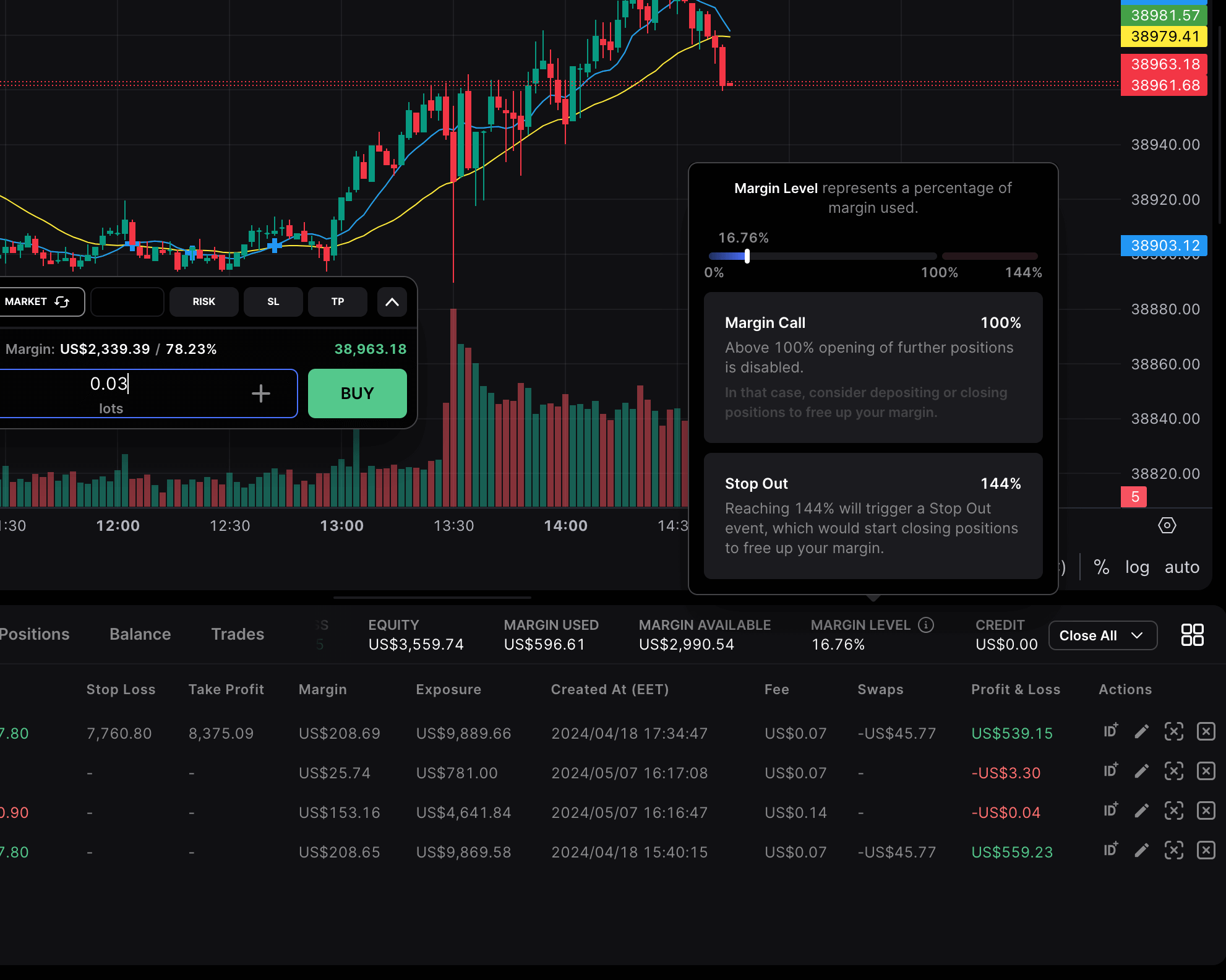

Margin Level

On many trading platforms, even TradeLocker, you have margin level. It’s a tool that shows you how much of your available equity is currently tied up in open positions. Think of it as a snapshot of your financial breathing room – the higher the percentage, the tighter your finances might be.

Keeping an eye on your Margin Level is like having a financial pulse check. It helps you understand how close you are to getting a margin call. Yeah, that dreaded moment when brokers demand you to put up more cash or close positions. We don’t want that, right?

How to Use It:

- Monitor Regularly: Make it a habit to check your Margin Level throughout the trading day. Changes can happen fast, and you need to be on top of it!

- Set Limits: Decide on a Margin Level percentage that you’re comfortable with. Most savvy traders stick to a level that allows them enough room to maneuver without hitting the panic button.

- Balance Your Trades: If you’re pushing the limits, consider closing some positions or adding funds to boost your equity. This isn’t just about cutting losses; it’s about smart asset management.

Most of these features are used to mitigate risk in trading. Mastering them will get you much further than you ever thought it was possible. The actual strategies are something else, you will need a bit of practice to apply them in your day trading.

6 Common Day Trading Strategies

When you day trade, you use some strategy to identify profitable investments. Some of the popular strategies used include the following.

Trade the News

Day traders are always on their toes, keeping an eye on the news to cash in on the market’s swings during big events—think job reports or a shift in interest rates by the Federal Reserve.

They’re all about predicting where asset prices are headed next following major news breaks, or scouting for assets that haven’t adjusted to the latest scoop yet.

This tactic isn’t just about reacting to global headlines; it’s also about zeroing in on specific sectors or individual stocks. A favorite move? Trading a company’s stock around the time they drop their quarterly earnings. Whether it’s just before the news hits or right after, there’s money to be made if you play your cards right.

Range Trading

Range traders are on the lookout for assets that typically stick within a certain price bracket. The game plan? Buy low when the asset’s price dips near the bottom of its usual range, and sell high as it approaches the top.

Nailing the timing is crucial in range trading. Slip-ups in timing your buys and sells can lead to some serious losses. Plus, keep your eyes peeled—unexpected news or market twists can shatter these price ranges, sending prices into unexpected territory.

Scalping

Scalping is like range trading on steroids. Instead of just playing within a set price range, scalpers aim to make quick bucks off tiny price shifts in an investment. A scalper might buy and sell the same asset hundreds of times in a single day, each time targeting a small profit from these minuscule movements.

They’re glued to short-term price charts, hunting for trends that can turn these quick trades into fast profits. It’s all about speed and precision, making sure they’re in and out before the next slight shift.

Fading

In fading, a day trader follows a contrarian mindset. The trader buys into assets that have been heavily sold or sells assets that have gone up in value. A trader using a fading strategy predicts that the herd mentality pushes prices too far in either direction.

The goal is to profit when markets overreact to news or events. Traders assume that prices eventually revert to the mean. But fading can be a high-risk strategy, as it goes against the current trend and may result in losses if the market does not quickly return to equilibrium levels.

Leverage

Day traders often use leverage for their investments. This means trading with borrowed money, using margin. Margin trading has the chance for much higher gains if your trades go well, but you can lose money much more quickly too.

Advantages of Day Trading

- Potential for quick profits. Every decision you make as a day trader is a chance to make a profit. Sure, there’s a big “if” involved—if every trade nails it, you’re looking at faster cash-ins than the average investor. Online courses don’t shy away from hyping up this enticing prospect when they pitch day trading.

- Easy access. Thanks to TradeLocker, day trading has never been easier. You’re all set with just your home computer and iPhone or Android—no need for the old-school complexities.

- It’s not boring. Day trading isn’t your grandpa’s buy-and-hold strategy. It packs an adrenaline rush that long-term investing can’t match. There’s a real buzz in doing your homework, spotting the right moment, and nailing a trade. Trust me, bragging about doubling your money in a day will turn heads at any dinner party, way more than chatting about your 401(k) growth over years.

- No overnight risk. One of the perks of being a day trader is that you don’t carry risks overnight. You wrap up all your positions before the market closes, dodging any potential overnight losses. Meanwhile, the regular investor might be losing sleep over news that could hit their holdings after hours.

- Work for yourself. Some pros carve out a living through day trading alone. If you’ve got a knack for it and it’s working for you, why not make it your day job? You can always check their stories on our Astronaut Auditorium.

Downsides of Day Trading

- High probability of losses. Day trading is a high-risk, high-reward game. If your moves don’t pan out, you could see your funds dwindle much faster than typical investors, particularly if you’re playing with leverage. Consider this: a study tracking 1,600 day traders over two years revealed that 97% of those who traded for more than 300 days ended up losing money. Cracking day trading isn’t just about being diligent and well-educated; sometimes, it’s about getting lucky.

- Fees and taxes. Even though trading expenses have dropped over the years, you’re still on the hook for various fees, especially when you’re trading in high volumes. And let’s talk taxes—you’re hit with higher rates on short-term capital gains if you sell an investment within a year, unlike the more favorable long-term rates.

- High stress. The market is fast, and watching your balance rollercoaster can really test your nerves, especially when trades don’t go your way. Day trading can verge on gambling, with the potential to become addictive and strain your health and relationships.

- Time-consuming and challenging. Get ready to commit. Day trading demands hours of your day, not just for trading but for market research and strategy fine-tuning. Plus, you’re up against everyone else, including pros from big financial institutions—it’s a tough crowd to beat.

- Requires deep pockets. Financial regs say you need at least $25,000 in your brokerage account to take a serious shot at day trading. This isn’t a hobby for the financial faint-hearted.