What Is a Stop-Loss Order?

A stop-loss order is a risk management tool for traders and investors. It involves setting a predetermined price level, and if the investment’s price reaches that level, the order automatically exits the position, limiting potential losses and reducing overall risk in the trade. This helps traders control their losses in case the market moves unfavorably.

As an illustration, consider a trader purchasing shares of a stock at $25 per share. To manage risk, the trader sets a stop-loss order at $20 per share. This means that if the stock’s price drops to $20 per share, the order triggers automatically, closing the trade. It ensures that the trader’s maximum potential loss per share is limited to $5. Stop-loss orders prove valuable, particularly during sudden and significant price swings against the trader’s position.

Understanding Stop Losses

Stop-loss orders can serve another purpose, which is locking in a specific profit in a trade. For instance, if a trader buys a stock at $2 per share and the price later rises to $5 per share, they might set a stop-loss order at $3 per share. This ensures a $1 per share profit if the stock price falls back to $3 per share.

It’s important to differentiate stop-loss orders from limit orders. While limit orders are executed only if the security can be bought or sold at a specified price or better, stop-loss orders become market orders as soon as the price level reaches or surpasses the specified stop-loss price. In fast-moving markets, the order may not be filled at the exact stop price but usually gets executed close to it. However, traders should be aware that in extreme situations, stop-loss orders may not offer much protection.

For example, if a trader buys a stock at $20 per share and sets a stop-loss order at $18 per share, and catastrophic news about the company causes the stock price to gap down to $10 per share on the next trading day, the stop-loss order will be triggered at $18 per share but filled at the prevailing market price of $10 per share.

Unlike limit orders, which guarantee execution at the specified price or better, stop-loss orders ensure immediate execution but at the prevailing market price when triggered.

Advantage Over a Stop-Limit Order

Potential Disadvantages

A drawback of a stop-loss order is the potential for price gaps. If a stock’s price suddenly moves beyond the stop price, the order is triggered, and the stock is bought or sold at the next available price, even if it significantly differs from the desired stop loss level.

Another drawback is the risk of getting stopped out in a volatile market that swiftly reverses direction, missing out on potential gains.

To overcome these drawbacks, investors can combine a stop-loss order with a trailing stop. A trailing stop adjusts the stop price along with the market price, protecting against losses while still allowing for profit-taking as the security’s price rises.

Benefits of Stop-Loss Orders

Stop-loss orders provide a practical and straightforward approach to risk management and profit protection in trading. They are adaptable to any investor’s strategy, instilling discipline in short-term trading activities. These orders enable traders to make rational decisions, free from emotional influences, and relieve the burden of continuous investment monitoring.

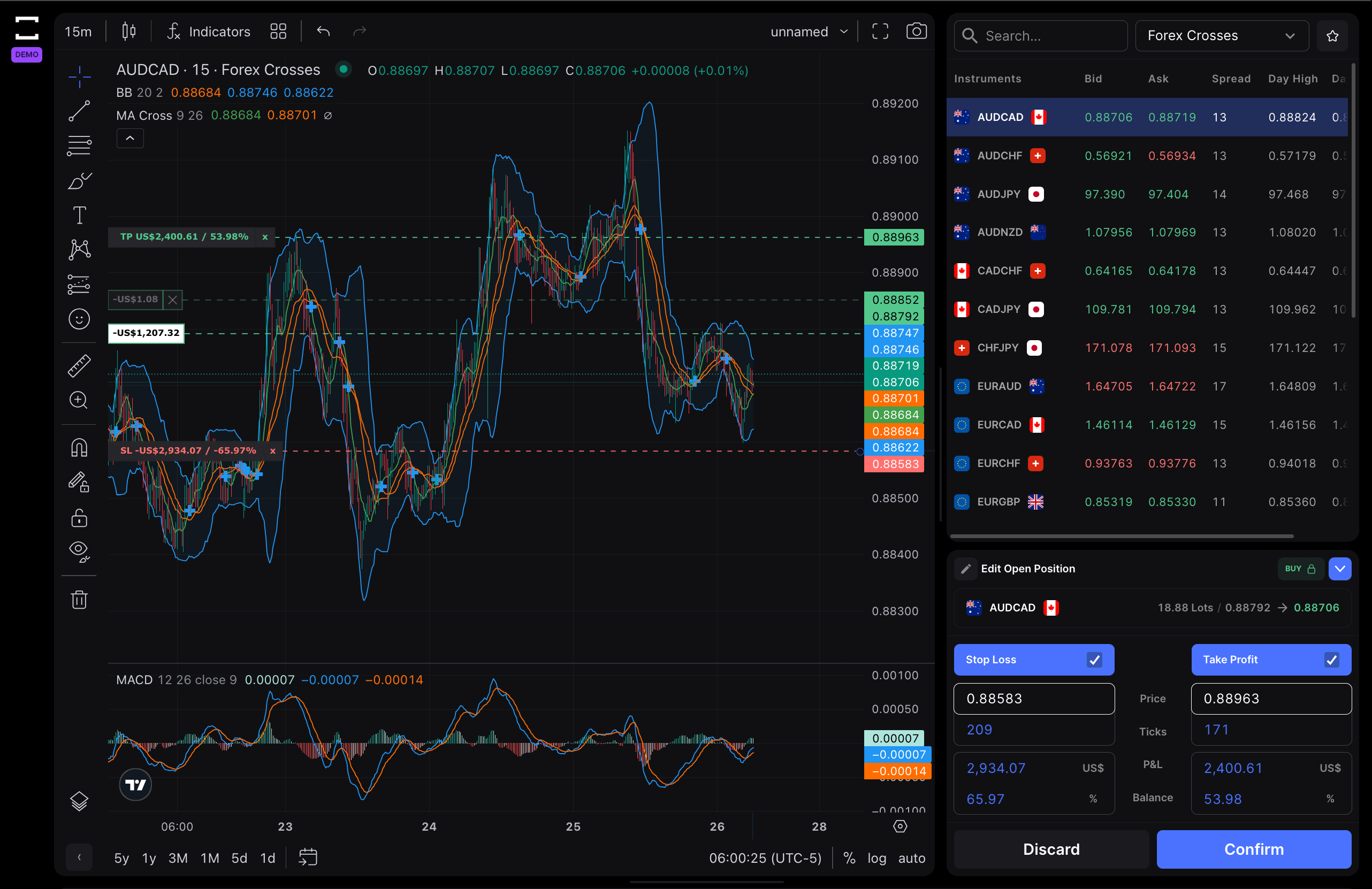

How to create a Stop-Loss Order on TradeLocker?

On TradeLocker there are two easy ways to set up a Stop Loss Order. You can put a desired price, the loss you want to risk in dollars or pips inside of the SL&TP Calculator. The other way is to drag the SL line on your chart.

Examples of Stop-Loss Orders

Here are a couple of examples to illustrate the use of stop-loss orders:

1. A trader buys 100 shares of XYZ Company for $100 and sets a stop-loss order at $90. The stock price declines over the next few weeks and falls below $90. The stop-loss order is triggered, and the trader sells the position at $89.95, incurring a minor loss.

2. A trader buys 500 shares of ABC Corporation for $100 and sets a stop-loss order at $90. After the market closes, the company reports unfavorable earnings results. The next day, when the market opens, ABC’s stock price gaps down. The stop-loss order is triggered, and the order is executed at $70.00, resulting in a substantial loss. However, the market continues to drop and closes at $49.50. Although the stop-loss order couldn’t protect the trader as originally intended, it still limited the loss to a much lower amount than it could have been.

Remember, stop-loss orders can be a valuable tool in managing risk and protecting profits.