In the world of financial markets, few avenues offer the same blend of accessibility, liquidity, and opportunity as Forex trading. For individuals looking to diversify their portfolio, explore new income streams, or simply engage with global economic shifts, the foreign exchange market presents a compelling proposition. But beyond the buzz, what truly makes Forex trading an attractive pursuit for so many?

Nine reasons to trade forex

1. Great for short-term opportunities

The Forex market is renowned for its volatility, with currency pairs constantly reacting to economic news, geopolitical events, and shifts in sentiment. This inherent dynamism creates frequent price fluctuations, offering abundant short-term trading opportunities for those who can identify and capitalize on swift market movements. Whether you’re looking for quick entries and exits or prefer to hold positions for a few hours, the 24/5 nature of the market provides ample action.

2. It’s open 24/5

FX markets are open from 5PM EST Sunday to 5PM EST Friday. This is because the different time zones of the forex trading centers (London, New York, Sydney, and Tokyo) mean that at least one is always open (when New York closes, Sydney opens). This around-the-clock accessibility means you can trade at your convenience, fitting your strategy into your lifestyle regardless of your time zone. No more waiting for market open or rushing to close positions before the bell.

3. Unmatched Liquidity

Imagine a market that operates 24 hours a day, five days a week, from Sunday evening GMT to Friday evening GMT. That’s the Forex market. This continuous operation, spanning major financial centers across the globe, offers unparalleled flexibility for traders worldwide. Whether you’re an early bird or a night owl, you can find a time to engage with the market that suits your schedule.

Furthermore, Forex is the largest financial market in the world, boasting trillions of dollars in daily trading volume. This immense liquidity ensures that you can almost always enter and exit trades with ease, minimizing the risk of price slippage and offering greater control over your positions.

4. Leverage: Maximizing Potential Profits

One of the most appealing aspects of Forex trading is the availability of leverage. Leverage allows you to control a large position with a relatively small amount of capital. For example, with 1:100 leverage, a $1,000 deposit could allow you to control a $100,000 position. This amplification of purchasing power can significantly magnify potential profits.

However, it’s crucial to understand that leverage is a double-edged sword. While it can amplify gains, it can also amplify losses. Responsible risk management is paramount when utilizing leverage, and traders should never risk more than they can afford to lose.

5. Take long or short positions

Unlike some markets where profiting might primarily rely on assets appreciating, Forex allows you to profit from both rising and falling currency values. If you anticipate a currency pair to strengthen, you can “go long” (buy). If you expect it to weaken, you can “go short” (sell). This flexibility means you can seek opportunities in virtually any market condition, making it an incredibly versatile market for strategic traders.

5. Diverse Trading Strategies and Styles

The vastness and flexibility of the Forex market accommodate a wide spectrum of trading strategies and styles. Whether you prefer the fast pace of scalping, aiming for small gains on numerous trades, the short-to-medium term approach of day trading or swing trading, or the long-term focus of position trading, Forex offers the tools and conditions to implement your preferred methodology. This adaptability allows traders to find a style that aligns with their personality, risk tolerance, and time commitment.

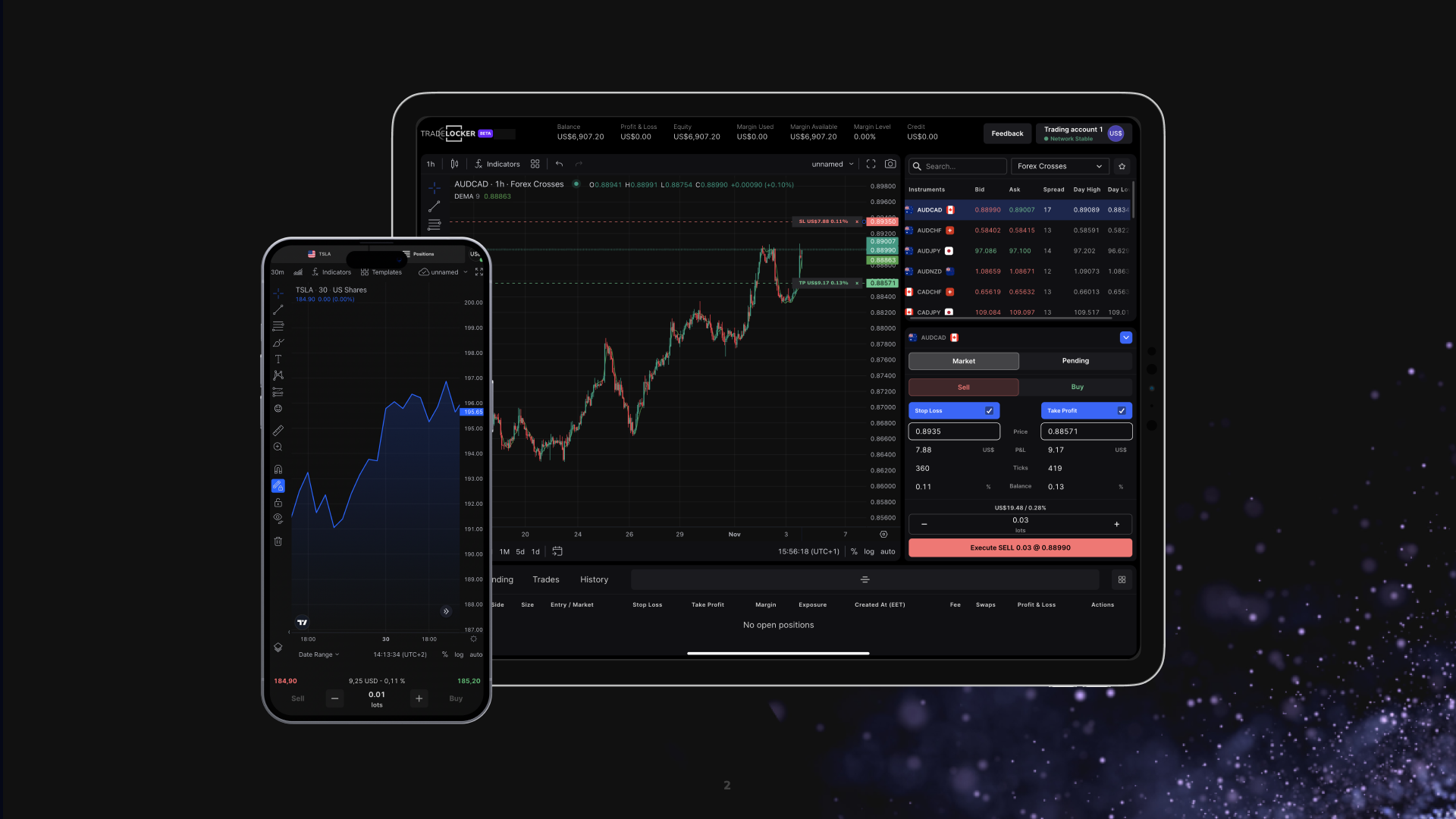

6. Sophisticated Trading Platforms

Navigating the complexities of the Forex market requires robust and intuitive trading tools. From lightning-fast execution to advanced charting capabilities and a seamless user experience, the platform you choose is crucial to your trading success. A reliable platform empowers you to analyze market data, execute trades with precision, and manage your risk effectively. We will suggest TradeLocker because our goal is to give you no reason to switch between screens to do pip, stop loss or take profit calculations, we put everything on one screen and provide you with vast amount of fast data. See our trading features, along with charting and usability to get a clear picture.

7. Global Exposure

Trading Forex inherently provides global exposure. You’re not just trading a company’s stock; you’re trading the economic performance and political stability of entire nations. This broad perspective allows you to stay informed about international events, understand how different economies interact, and potentially capitalize on global economic shifts. It’s an insightful way to connect with the world’s financial pulse.

8. Educational Resources and Community

There is a wealth of educational resources available for Forex traders. From online courses to webinars, forums, and books (you can see our Handbook as well), individuals can access a vast array of materials to learn and improve their trading skills. Additionally, a strong community of traders exists, providing a network for sharing experiences and strategies.

9. Regulatory Improvements

Over the past decade, the Forex market has seen significant advancements in regulatory oversight, particularly in major trading hubs. This increased regulation has led to greater transparency, enhanced investor protection, and a more secure trading environment. Choosing a broker that adheres to strict regulatory standards is crucial for safeguarding your funds and ensuring fair trading practices.

What affects the forex markets?

There’s a reason why forex traders are constantly analyzing the news. Forex is influenced by a plethora of factors, both economic and political, putting the rates constantly in flux.

Economic data

Economic data gives an indication of the health of an economy and therefore the national currency. Unemployment data, government debt, inflation, and interest rates are all figures that forex traders should have on their radar.

Political stability

Major events such as elections, trade deals, conflicts, environmental disasters, and pandemics can all have a profound effect on a currency. Even more minor events such as cabinet reshuffles or small policy changes can also have an impact.

Supply and demand

Supply-and-demand is one of the biggest factors that influences the forex market. If there’s a sudden spike in demand for euros, it reduces supply, and the price will consequently rise.