his section provides a detailed examination of the 24/5 Forex hours, leverage and margin, spreads and swaps, and pip/tick calculations, drawing on extensive research to ensure accuracy and clarity for beginners.

24/5 Forex Hours: The Global Trading Cycle

Unlike equity markets, forex trading hours operate 24 hours a day, five days a week, due to its decentralized nature and the overlapping business hours of major financial centers worldwide. Research indicates that the market opens at 5:00 PM Eastern Standard Time (EST) on Sunday and closes at 5:00 PM EST on Friday, aligning with the current time of 01:03 PM CEST on Thursday, April 24, 2025, which falls within the active trading week (Forex Market Hours).

- Trading Sessions: The market is divided into four main sessions: Sydney, Tokyo, London, and New York. Each session has different levels of volatility and liquidity, with the London and New York overlap (8:00 AM – 12:00 PM EST) being the most active, accounting for the majority of trading volume.

- Why 24/5?: This continuous operation is facilitated by the global time zones, ensuring traders can engage at any time during the week. However, the market is closed from Friday evening to Sunday evening, as most financial institutions do not operate during this period.

- Implications for Traders: The 24/5 nature allows flexibility, but peak activity during overlapping sessions means higher liquidity and potentially better trade execution. Traders should be aware that volatility can spike during news releases, especially during these busy periods.

Forex leverage and margin explained

Leverage and margin are critical concepts in Forex trading, enabling traders to control large positions with relatively small capital, but they also introduce significant risks.

Leverage:

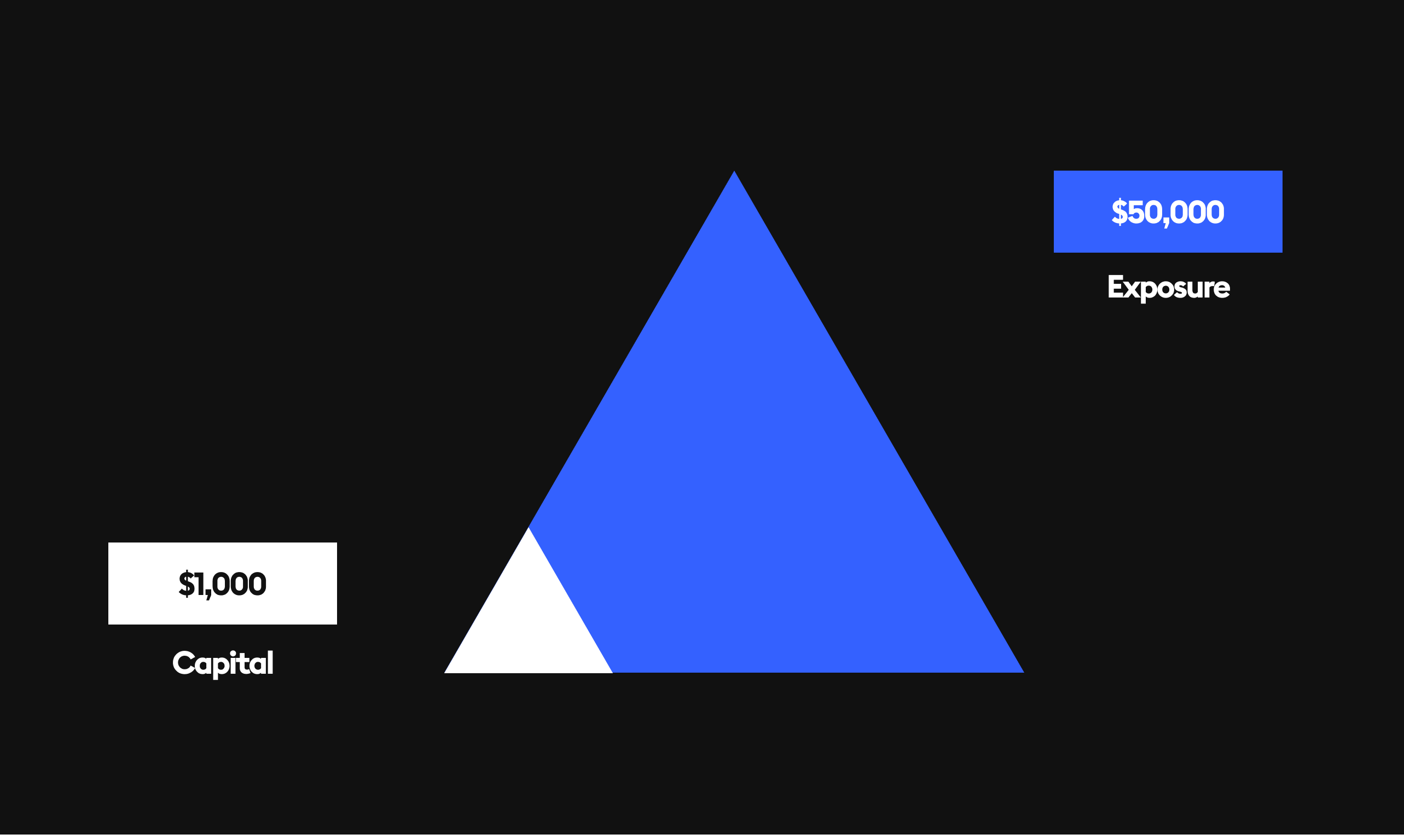

It is essentially a loan provided by the broker, allowing traders to amplify their buying power. For example, with 50:1 leverage, a trader can control a $50,000 position with just $1,000 of their own money (Understanding Forex Margin | Charles Schwab). If a trader wants to trade $100,000 of EUR/USD with 50:1 leverage, they only need $2,000 in their account as margin. This means for every $1 of margin, they control $50 of the position. While leverage can magnify profits, it also amplifies losses. A small adverse price movement can result in significant losses, potentially exceeding the initial margin. For instance, a 2% move against the position could wipe out the $2,000 margin, leading to a margin call.

Margin:

Margin is the amount of money required to open and maintain a leveraged position. It acts as a deposit to cover potential losses and is locked in the account until the trade is closed (Margin and Leverage in Trading – FOREX.com US). Using the same example, to trade $100,000 of EUR/USD with 50:1 leverage, the margin requirement is $2,000. If the account balance falls below this due to losses, the broker may issue a margin call, requiring additional funds or closing the position to prevent further losses. Margin Call – This is a critical risk management tool, ensuring traders do not lose more than their account balance. However, it underscores the importance of understanding leverage and maintaining sufficient funds.

| Aspect | Leverage | Margin |

|---|---|---|

| Definition | Ratio of trade size to margin required | Deposit to open and maintain position |

| Example | 50:1 leverage controls $50,000 with $1,000 | $2,000 needed for $100,000 trade at 50:1 |

| Risk | Amplifies both profits and losses | Can lead to margin calls if losses mount |

Spreads and Swaps

Spread

The spread is the difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy) of a currency pair. It represents the cost of entering and exiting a trade. For example, if the bid price for EUR/USD is 1.1230 and the ask price is 1.1231, the spread is 0.0001 (or 1 pip). This spread is the broker’s profit, as they buy at the bid and sell at the ask. Spreads can be fixed (constant regardless of market conditions) or variable (fluctuating based on volatility and liquidity). Variable spreads are common in Forex, especially during high-impact news. Wider spreads increase trading costs, particularly for scalpers or high-frequency traders, reducing overall profitability.

Swap (or Rollover)

Definition: A swap is the interest rate paid or received for holding a position overnight, also known as overnight financing. It is calculated based on the interest rate differential between the two currencies in the pair. Each currency has an associated interest rate set by its central bank. If you hold a long position in EUR/USD overnight, you might pay the swap if the USD has a higher interest rate than the EUR, or receive it if the opposite is true. If the EUR interest rate is 0% and the USD rate is 5%, holding a long EUR/USD position overnight would typically result in paying a swap, as you are borrowing USD to buy EUR. Some traders use “carry trade” strategies, holding positions to earn positive swap rates, especially in pairs with significant interest rate differentials. We would show you swap fees on TradeLocker Hub, but every broker has their own, and changes them fequently. If you really want this feature, tell us on our Discord.

Tick & Pip Balue Calculation

Pip

A pip (percentage in point) is the smallest price move that a currency pair can make, based on market convention. For most currency pairs (e.g., EUR/USD), a pip is the fourth decimal place (0.0001), but for pairs involving the Japanese Yen (e.g., USD/JPY), it is the second decimal place (0.01) (Comparing Pips, Points, and Ticks: What’s the Difference?).

Example: If EUR/USD moves from 1.1230 to 1.1231, it has moved by 1 pip. For USD/JPY, a move from 120.01 to 120.02 is 1 pip.

Calculating Pip Value: The value of a pip depends on the currency pair, the trade size, and the exchange rate. The formula is:

$$

\text{Pip Value} = \left( \frac{0.0001}{\text{Exchange Rate}} \right) \times \text{Trade Amount}

$$

Trade Size: The number of units traded (e.g., 100,000 for a standard lot).

Exchange Rate: The current rate of the currency pair.

Pip Size: 0.0001 for most pairs, 0.01 for JPY pairs.

Example: For a standard lot (100,000 units) of EUR/USD at an exchange rate of 1.1230, the pip value is:

$$

\text{Pip Value} = \frac{100,000}{1.1230} \times 0.0001 \approx \$8.90

$$

This means each pip movement is worth approximately $8.90 in your account currency.

Tick

Definition: A tick is the smallest possible price change for an asset. In Forex, ticks are often the same as pips or fractions of pips, depending on the broker’s quoting convention. For example, if a broker quotes EUR/USD to five decimal places (e.g., 1.12305), a tick would be 0.00001, which is one-tenth of a pip (How to calculate pip and tick value | Darwinex Docs). A move from 1.12305 to 1.12306 is a tick, representing the smallest possible price change.

These mechanics are integral to understanding how Forex trading works. Leverage and margin enable traders to access larger markets, but they require strict risk management to mitigate potential losses. Spreads and swaps impact trading costs, with spreads affecting short-term trades and swaps influencing long-term positions. Pips and ticks are crucial for calculating profits and losses, ensuring traders can manage risk effectively.

Traders should always use demo accounts to practice these concepts, as highlighted in our previous guide, “Building a foundation,” where we emphasized paper trading to build skills without financial risk. Understanding these mechanics is non-negotiable for success, and continuous learning through resources like economic calendars and charting tools on TradeLocker will enhance trading proficiency.

Conclusion

The core market mechanics of 24/5 Forex hours, leverage and margin, spreads and swaps, and pip/tick calculations form the backbone of Forex trading on TradeLocker. Traders must grasp these concepts to navigate the market effectively, balancing the potential for high returns with the inherent risks. Start with paper trading to test strategies, focus on one ticker to build insight, and always employ risk management to preserve capital. Our next section will explore trading styles and how these mechanics apply in practice.