The Truth About Forex Trading for beginners

Before diving into the guide, here are three essential facts to understand about CFD trading:

- Trading is Challenging

- Success in trading for isn’t just about making intelligent trades; it’s about managing risks, adapting to market changes, and maintaining discipline under pressure.

- Not a Quick Path to Riches

- Forex trading is often misconstrued as a fast way to wealth. It involves a steep learning curve, and many traders do not profit significantly. It’s a skill that takes time to develop.

- Requires Education and Practice

- Effective forex trading is built on thorough market knowledge, ongoing education, and regular practice. Intuition alone is not sufficient; informed decision-making is vital.

About this Handbook

Crafted by the TradeLocker team, this handbook delivers an honest, no-nonsense guide to CFD trading—primarily in forex, with crypto and indices as secondary markets. This forex trading for beginners handbook draws on:

We aim to provide a realistic and practical understanding of forex trading, supported by:

- Insights from seasoned traders.

- Collaborations with financial experts.

- Research into effective trading strategies and trader psychology.

We aim to educate with facts and realistic expectations, debunking myths and providing a clear path for those interested in forex trading.

Contents

Below is the full TradeLocker Trading Handbook. Each chapter dives into what you can do on our platform, from FX majors like EUR/USD to your most-traded assets—XAU/USD, NAS100, BTC/USD, and US30.

We’ve designed it to be as straightforward and realistic as possible.

Here are the core lessons:

- Building a foundation – How do you set realistic goals, prepare for trading, and understand the basic terms?

- Markets you can trade – Overview of markets you can trade in. Forex, Crypto, Indices

- Core Market Mechanics – 24/5 forex hours, leverage & margin, spreads & swaps, pip/tick calculations.

- Trading Styles – Scalping, Day Trading, Swing Trading, Position Trading, News Trading, Algorithmic/Quantitative Trading

- Trading on Forex – Specifics in Forex Trading

- Trading on Crypto – Specifics in Crypto Trading

- Building your Trading plan – Setting goals, choosing instruments, defining entry/exit rules, journaling performance.

- Platform deep dive – TradingView charting, order types (market, limit, stop, OCO), backtesting suite, AI-powered Studio, risk calculators.

- Strategies for each asset and style – Sample tactics for forex, gold, indices, and crypto—tailored to your chosen trading style.

- Risk Management Essentials: Dive into strategies to manage your risks, including the psychological aspects of trading, to help you make level-headed decisions.

- Automating your strategies

- Learning and Adapting: Discover resources for improving your skills and how to adapt your strategies as you gain experience.

Hard facts about forex trading

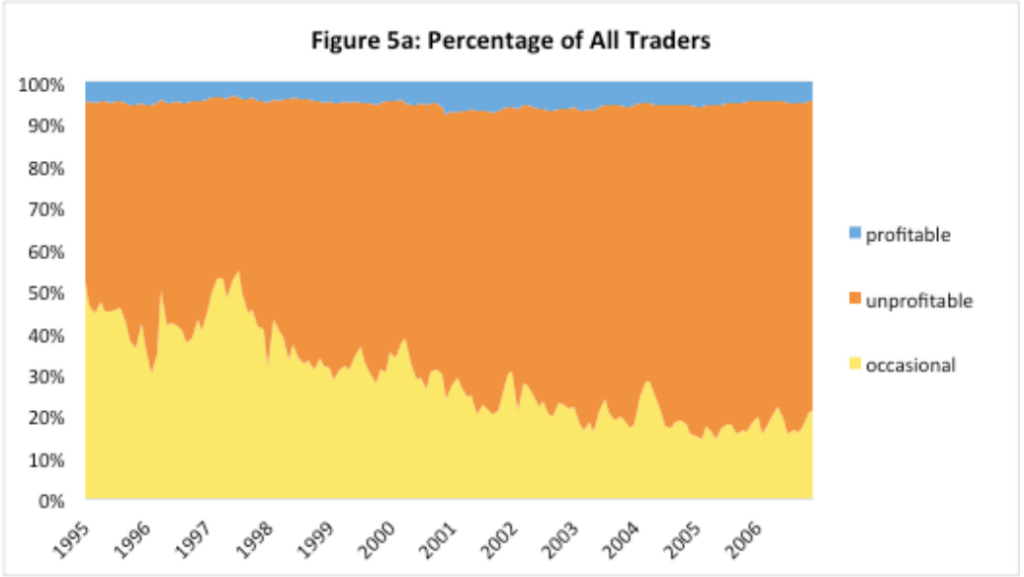

A study conducted by researchers at the University of California reveals several key facts:

- 80% of total forex traders quit within the first two years. After five years, only 7% remain.

- Only 1.6% of traders are profitable in the average year. However, they account for 12% of all trading activity.

- Traders with negative track records continue to trade, continuing to trade even when they have a negative signal regarding their ability.

A Word of Encouragement

Embarking on your forex trading journey is a significant step, and while it’s not without its challenges, it can also be a rewarding learning experience.

This guide is here to support you with the necessary tools and knowledge.

Remember, every expert trader once started as a beginner, and with persistence and the right approach, you can develop the skills needed to navigate the trading world.