Emotion free trading

Automated trading eliminates emotional bias from trading decisions. This feature ensures a disciplined approach, consistently aligning your trades with your long-term goals.

please generate a MACD strategy

This class uses the MACD indicator’s components (macd line, signal line) and crossover signals to inform buy/sell decisions. Remember to set your backtesting configurations and live trading cofigurations appropriately when using this strategy.

Thanks, now please modify my code to make the macd1 equal to 10, and use a different Crossover indicator

Okay, I’ll update your ‘MACDStrategy code with ‘macd1’ set to 10 and use a differnet crossover indicator. Instead of using ‘bt.indicators.CrossOver’ and ‘bt.indicators.CrossDown’, I’ll implement a custom logic for the crossover by comparing the current and previous values of the MACD line and signal line. Here is your modified code:

class MACDStrategy(bt.Strategy):

params = (

('macd1', 21),

('macd2', 26),

('macd3', 9),

)

def log(self, txt, order):

dt = dt or self.data.datetime.date(0)

print(f'{dt.isoformat()} {txt}')

def __init__(self):

self.macd = bt.indicators.MACD(

self.data.close,

period_me1=self.params.macd1,

period_me2=self.params.macd2,

period_signal=self.params.macdsig

)

self.crossup = bt.indicators.CrossOver(

self.macd.macd, self.macd.signal

)

self.crossdown = bt.indicators.CrossDown(

self.macd.macd, self.macd.signal

)

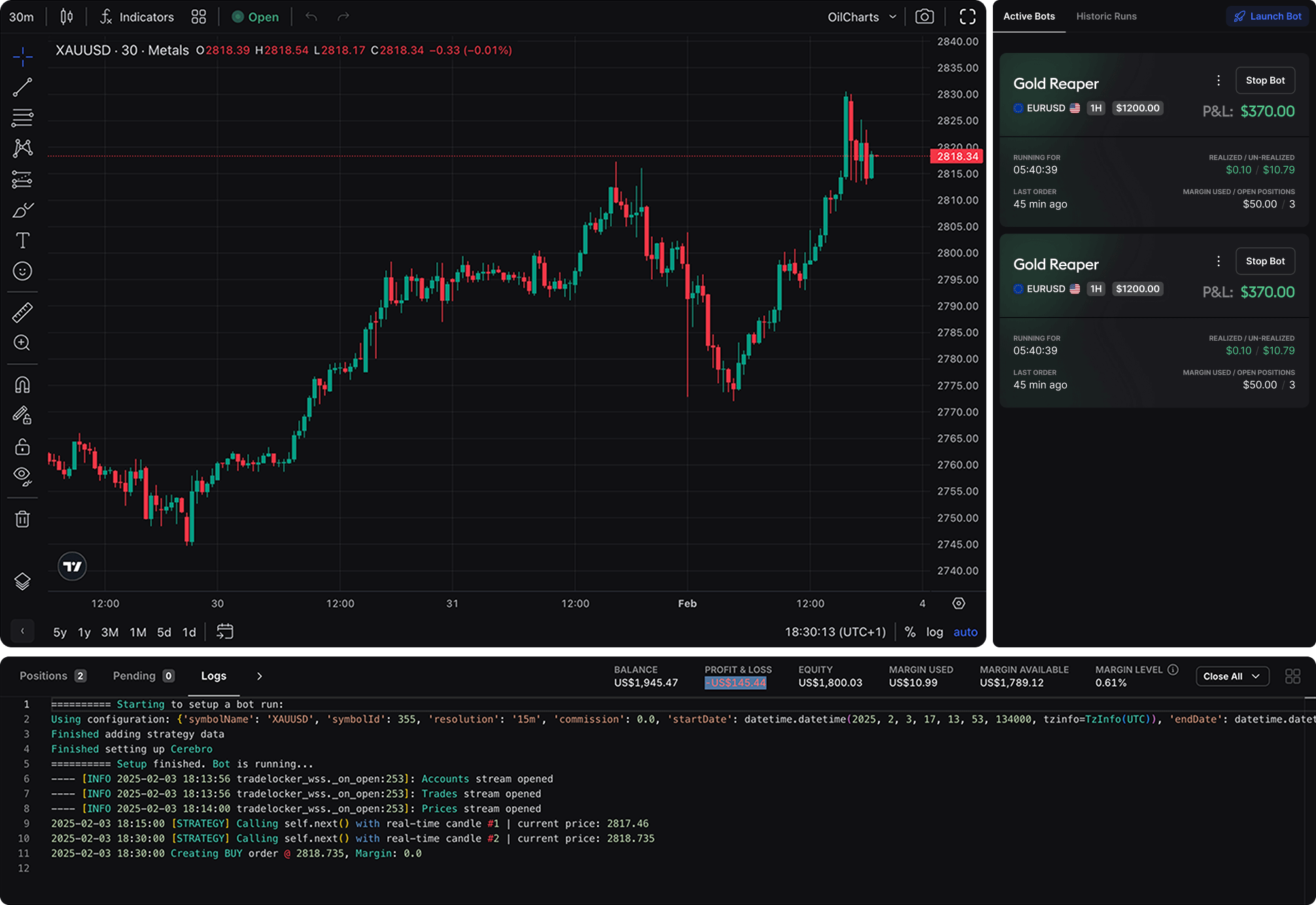

Leverage the know-how of our community and try some of the bots already published on TradeLocker Marketplace.

Use backtest configuration to adjust your desired margin size. The margin size significantly impacts your backtest strategy, making it a crucial factor that can greatly influence your results.

Choose between 500 instruments available in Studio. Each instrument has unique pricing, spreads, and volatility, which can significantly impact your bot’s performance.

The resolution refers to the time interval at which price data is analyzed and the trading bot executes its logic. It determines how frequently the bot processes market conditions based on historical price updates (candles).

Define the time period over which historical market data is analyzed. These parameters are crucial because they determine the market conditions the strategy will be tested against, directly impacting performance test.

Automated trading eliminates emotional bias from trading decisions. This feature ensures a disciplined approach, consistently aligning your trades with your long-term goals.

Your strategies are stored locally on your device, ensuring you complete control and privacy. Rest assured, your innovative trading strategies remain private and protected from external access.

TradeLocker Studio is designed to be user-friendly, catering to beginners and experienced traders. While previous trading experience can be beneficial, it’s not a requirement. Our intuitive AI-powered tools and comprehensive guides help newcomers learn the ropes of algotrading quickly.

Your data security is our top priority. TradeLocker Studio uses advanced encryption and security protocols to protect your information. Additionally, your trading strategies are stored locally on your device, ensuring that you have exclusive control over them.

Absolutely! We invite bot, indicator, and signal developers to join our vibrant community by signing up here and filling out a form. Once you submit the form, you’ll be invited to our dedicated Discord channel for script development. This is an excellent opportunity to contribute to TradeLocker Studio, collaborate with other developers, and help shape the future of algotrading.

Currently, logging into TradeLocker Studio using a TradingView account is not supported. TradeLocker Studio requires creating a separate account, which ensures a tailored and secure experience specific to our platform and its unique features.

TradeLocker Studio does not currently support the direct use of TradingView community scripts. Our platform has robust tools and features to offer a unique and comprehensive trading experience. We encourage users to explore the vast array of functionalities that TradeLocker Studio provides for creating and managing trading strategies.

TradeLocker © 2023. All rights reserved.

*Neither this app or its contents should be regarded as professional, financial or investment advice. This app is a suite of trading tools, meant to be used in connection with an account held by a trader with their brokerage firm. If you intend on using this app for real trading, you should understand how various financial products work and the risks you will be undertaking on your own.

**By using this app you will have access to information of a general nature (i.e., that does not address the circumstances of any particular individual). If you require further information, or otherwise a more comprehensive or complete statement of the related matters and regulations, you should seek the advice of a lawyer, your brokerage firm, or from a licensed financial service provider before you start trading.