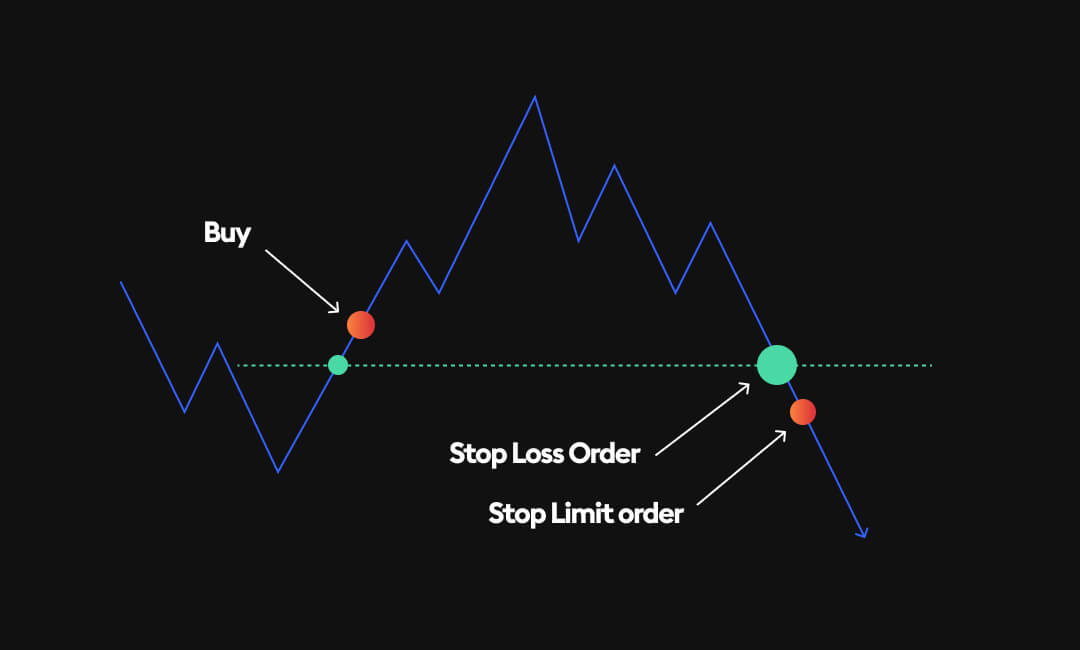

A stop-limit order is a strategic method employed by traders to minimize risks associated with stock trading. This approach involves setting two key prices: a stop price and a limit price. The stop price is essentially a trigger point; it’s the specified price at which the order to buy or sell a stock is activated. Once this stop price is reached, the order becomes a limit order. The limit price, on the other hand, is the specific price point at which the trader is willing to buy or sell a certain number of shares. This combination allows traders to have better control over the prices at which their stocks are bought or sold.

A stop-limit order lets you decide the highest or lowest price for a stock trade. When the stock reaches your chosen price, a special order is activated to buy or sell at that price. This helps prevent big losses by setting a price where you don’t want to lose more.

How Stop-Limit Orders work?

Limit orders are a type of order used in trading to specify the maximum or minimum price at which you are willing to buy or sell a security. This gives traders control over the price at which the trade is executed, unlike market orders, which are executed immediately at the current market price. Here’s how limit orders work:

Limit buy order

This is used when you want to purchase a security at a specific price or lower. You set a limit price, which is the maximum amount you are willing to pay for the stock. The order will only be executed if the security’s price falls to your limit price or lower. This is beneficial when you believe the current price is too high but would be willing to buy if the price drops.

Limit sell order

Conversely, this is used when you want to sell a security at a specific price or higher. You set a limit price, which is the minimum amount you are willing to accept for the stock. The order will only be executed if the security’s price rises to your limit price or higher. This is useful when you aim to sell at a higher price than the current market value.

Why Traders Use Stop-Limit Orders

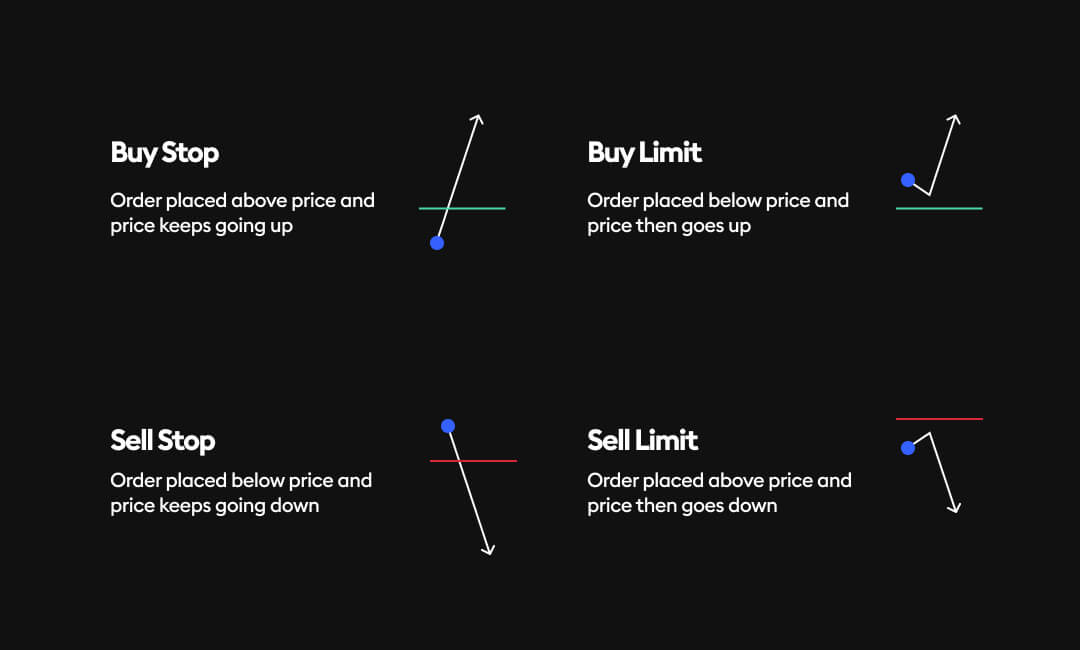

Traders use stop-limit orders when they’re not watching the market closely. These orders automatically buy or sell a stock when it reaches a certain price. There are two main types of stop-limit orders that traders use:

Stop Price vs Limit price

Within a stop limit order, there are two key price components: the stop price and the limit price. This applies to both buy and sell stop limit orders, with each component playing a distinct role:

Stop Price

This is the trigger price that converts the stop limit order into a limit order. It’s the point at which your intention to buy or sell becomes active, but the order itself is not executed immediately at this price. Instead, reaching the stop price triggers the next step of the process.

-

- In a Buy Stop Limit Order, the stop price is set above the current market price. It’s used when you believe that once a stock breaks through a certain price, it will continue to rise.

- In a Sell Stop Limit Order, the stop price is set below the current market price. This is typically used to protect profits or limit losses.

Limit price

After the stop price is reached and the order becomes a limit order, the limit price determines the specific price (or better) at which you are willing to buy or sell the stock. The execution of the order will only occur at this price or at a more favorable price.

-

- In a Buy Stop Limit Order, the limit price is set at or above the stop price. It specifies the maximum price you are willing to pay for the stock.

- In a Sell Stop Limit Order, the limit price is set at or below the stop price. It represents the minimum price at which you are willing to sell the stock.

Risk of a Stop Limit Order

Using a stop-limit order can provide price control and minimize losses, but it’s important to be aware of the potential risks:

- Non-Execution: A stop-limit order doesn’t guarantee execution because the stock price may never reach the limit price. If the limit order is active for a short time and there are other orders in line that use up all available stocks at the current price, the order may not be executed.

- Partial Fills: Sometimes, only a portion of the shares in the order gets executed, leaving the rest of the order open. This can lead to multiple commissions if parts of the order are executed on different trading days, reducing a trader’s overall returns.