Learning risk management in trading is crucial to your success as a trader. In this article you will learn all about the tools and ways on how to handle risk.

Investing More Than You Can Afford to Lose:

Investing more than you can afford to lose is risky for several reasons:

- Financial Stability: Losing money that you need for essential expenses can severely impact your financial stability and quality of life.

- Emotional Stress: Investing money you can’t afford to lose can lead to significant emotional stress, impairing your decision-making abilities.

- Long-term Consequences: Significant losses can have long-term consequences on your financial goals, savings, or retirement plans.

Letting Emotions Drive Trading Decisions:

Trading can be an emotional rollercoaster, and emotions like stress, greed, and fear can significantly impact decision-making:

- Stress can lead to hasty decisions, such as exiting a profitable position too early or holding onto a losing position for too long.

- Greed can result in taking excessive risks or failing to secure profits appropriately.

- Fear can cause hesitation, leading to missed opportunities or panic selling at a loss.

Key Risks in Day Trading

Frequent Trading Increases Exposure

Day traders are known for making numerous trades within a very short time frame. This frequent trading significantly raises their exposure to the market’s ups and downs. While this can lead to quick profits, it also means that the potential for losses is escalated.

Each trade carries its own set of risks, and when these are multiplied by the number of trades made, the overall risk increases. Additionally, this constant trading can incur substantial transaction fees, which can erode profits over time.

Leverage Amplifies Risk

A common practice in day trading is the use of leverage, which involves borrowing funds to increase the potential size of a position. This strategy can indeed amplify gains if the market moves in the trader’s favor.

However, it’s a double-edged sword: if the market moves against the trader, losses can be significantly magnified, potentially leading to severe financial consequences. Leverage can quickly transform a small market movement into a substantial loss, exceeding the initial investment in some cases.

Market Volatility

Day trading inherently involves capitalizing on short-term fluctuations in the market. These movements can be highly unpredictable and influenced by numerous factors like economic news, global events, or changes in market sentiment.

The volatility can be an opportunity for profit, but it also makes day trading one of the riskier trading strategies. The rapid changes in market prices can lead to substantial gains or losses in a very short period, making it a challenging environment, especially for less experienced traders.

How to Reduce Risk

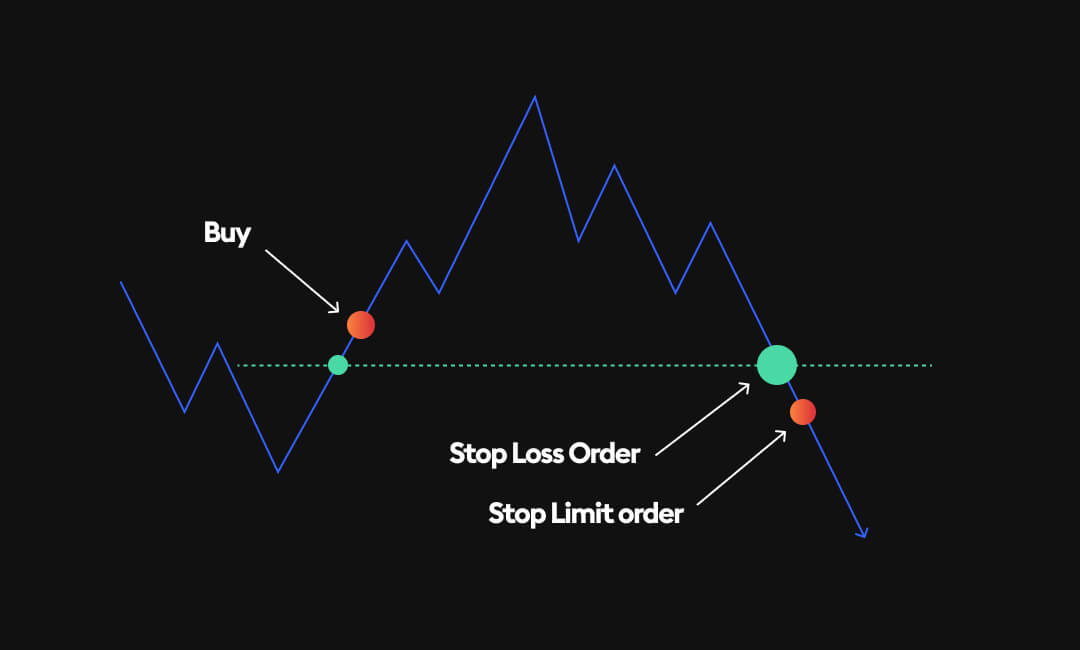

Setting Stop-Loss and Take-Profit Levels

One of the fundamental aspects of risk management in trading is setting stop-loss and take-profit levels. A stop-loss is an order placed with a broker to sell a security when it reaches a certain price. It’s designed to limit an investor’s loss on a security position. Conversely, a take-profit order is set at a price you want to exit a trade profitably. The key to setting these levels effectively lies in a thorough understanding of the market, your risk tolerance, and the specific characteristics of the securities you’re trading.

When setting these levels, consider the volatility of the market and the average price fluctuations. Avoid placing stop-loss orders too close to the market price, leading to premature security sales. On the other hand, setting them too far can result in excessive losses. Similarly, take-profit orders should be placed at realistic levels, reflecting the security’s potential and market trends.

Understanding and Managing Leverage

Leverage in trading refers to using borrowed funds to increase the potential return on an investment. While leverage can magnify profits, it also increases the potential for significant losses, making understanding and managing it crucial.

To manage leverage effectively, it’s essential to:

- Understand the leverage ratio: This is the proportion of borrowed funds to equity. A higher leverage ratio means higher risk.

- Use leverage appropriately: Tailor the amount of leverage to your risk tolerance and the market’s volatility.

- Monitor your positions: Keep a close eye on your leveraged positions, as markets can move quickly and significantly.

Importance of Discipline and Emotional Control

Discipline and emotional control are fundamental to successful trading, requiring a firm commitment to your trading plan by sticking to pre-set rules and strategies while avoiding impulsive decisions. It is equally important to keep emotions in check, recognizing their influence on your choices and stepping back when necessary. Moreover, embracing patience is essential, as not all trades will be immediately successful, but it is a key component for achieving long-term success in the trading world.

Diversification and its Role in Risk Management in Trading

Diversification is spreading your investment across various assets to reduce risk. By not putting all your eggs in one basket, you can mitigate the impact of a poor performance of a single asset on your overall portfolio. Diversification can be achieved by investing in different asset classes, industries, and geographic regions. It’s a crucial part of risk management in trading.

Coping with Losses and Maintaining a Healthy Mindset

Losses are an inevitable part of trading, but how you deal with them is crucial. To maintain a healthy mindset:

- Accept losses as a part of trading: Understand that losses are a normal part of the trading process.

- Analyze your losses: Review your losing trades to identify what went wrong and how you can improve.

- Don’t dwell on losses: Focus on your long-term goals and strategy, rather than individual losses.

- Maintain a balanced lifestyle: Ensure that trading doesn’t consume your life. Balance it with other activities and interests to maintain a healthy mindset.

Summary

In conclusion, risk management in trading is about balancing potential rewards against potential losses, ensuring that emotions don’t override rational decision-making, and maintaining financial security by not overextending one’s financial capabilities. For day traders, where market positions can change rapidly, this becomes even more crucial to ensure sustained trading success and financial well-being.