What is a Pip?

“Pip” stands for “percentage in point” or “price interest point.” It’s the tiniest amount a currency exchange rate can change in the forex (foreign exchange) market. Usually, currency values are shown with four decimal places, and a pip is the value of the fourth decimal place, which is 1/10,000th of a unit.

For instance, the smallest change for the USD/CAD (US dollar to Canadian dollar) currency pair is $0.0001 – that’s one pip.

In forex trading, we talk about pips, but don’t mix them up with bps (basis points) used in interest rates. A basis point is 1/100th of 1%, or 0.01%.

Understanding Pips

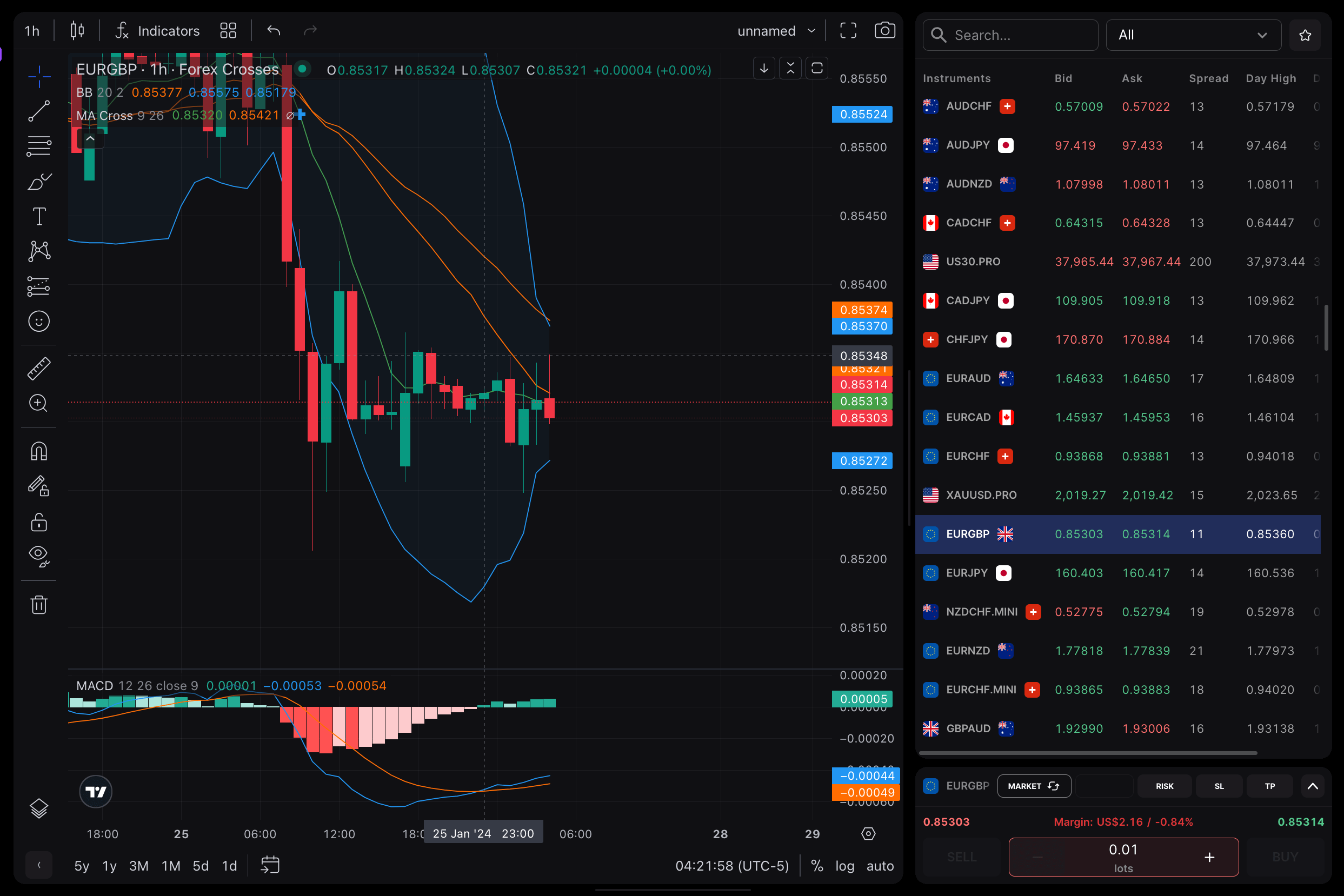

A pip is a key term in foreign exchange (forex) trading. In forex, traders buy and sell currencies, and the value of these currencies is compared to another currency. The prices for these currency pairs are shown with bid and ask spreads, which are precise up to four decimal places.

Changes in the exchange rate are tracked using pips. Because the majority of currency pairs are priced to four decimal places, the tiniest full unit change for these pairs is one pip.

Calculating pips

The worth of a pip changes based on the currency pair, exchange rate, and the amount of the trade. When your forex account uses U.S. dollars and the USD is the second currency in the pair (like in EUR/USD), the pip value is set at .0001.

For example, with the EUR/USD pair, you calculate a pip’s value by multiplying the trade amount by 0.0001. So, if you trade 10,000 euros, multiply it by .0001. This makes the pip value $1. If you buy 10,000 euros at 1.0801 USD and sell at 1.0811 USD, you earn a profit of 10 pips, or $10.

However, when the USD is the first currency in the pair (like USD/CAD), calculating the pip value also requires the exchange rate. Divide the pip size by the exchange rate, then multiply by the trade amount.

For instance, take .0001, divide it by a USD/CAD rate of 1.2829, and then multiply by a trade of 100,000. This gives a pip value of $7.79. If you buy 100,000 USD at 1.2829 Canadian dollars and sell at 1.2830, your profit would be 1 pip, or $7.79.

Pips and Profitability

The profit or loss a trader makes hinges on the exchange rate movement of a currency pair. If a trader buys EUR/USD, they profit if the euro’s value rises against the U.S. dollar. For example, buying euros at 1.1835 and selling at 1.1901 would result in a gain of 66 pips (1.1901 – 1.1835).

Consider a trader who sells USD/JPY at 112.06, aiming to buy Japanese Yen. If they close the trade at 112.09, it’s a loss of 3 pips. But if they close at 112.01, they gain 5 pips.

These differences might seem small, but in the huge foreign exchange market, they can lead to significant profits or losses. For instance, on a $10 million position that’s closed at 112.01, the trader gains ¥500,000. In U.S. dollars, this is $4,463.89 (¥500,000 divided by 112.01).

Real world examples of Pip

When hyperinflation and devaluation hit, exchange rates can skyrocket, making them hard to handle. This not only affects everyday people who have to carry lots of cash, but also makes trading difficult, to the point where the concept of a pip (a small change in exchange rate) becomes almost meaningless.

A famous historical case is Germany’s Weimar Republic. There, the exchange rate plunged from 4.2 marks per dollar before World War I to an unbelievable 4.2 trillion marks per dollar by November 1923.

The Turkish lira is another example. In 2001, it hit 1.6 million per dollar, a level so high that many trading systems couldn’t cope. The government had to drop six zeros from the rate and introduced the new Turkish lira. By January 2021, the exchange rate had stabilized to around 7.3 lira per dollar, a much more manageable figure.

What’s a Pip?

A pip represents the tiniest full unit that measures the gap between the buying (bid) and selling (ask) prices in a foreign exchange quote. One pip is equal to 1/100 of 1%, which is .0001. That’s why forex quotes are detailed to four decimal places. Even smaller changes in price are tracked using “fractional pips,” also known as “pipettes.”

How are they used?

Pips are an essential element in a currency pair’s exchange rate market quote. They show the change in both the quote and the value of a position you might hold in the market. For instance, if you hypothetically bought a currency pair at 1.1356 and sold it at 1.1360, you would have gained 4 pips from your trade. To find out the actual dollar value of your profit, you’d need to calculate the value of a single pip and then multiply that by the size of your trading lot.

What’s a spread in Forex?

The forex spread is the difference between the ask price (the price at which you can buy) and the bid price (the price at which you can sell) of a currency pair. For instance, if the ask price of EUR/USD is 1.1053 and the bid price is 1.1051, the spread is 0.0002, or 2 pips.

To figure out the cost of the forex spread, you multiply the spread by the size of your trade. So, if you’re trading 100,000 units of EUR/USD with a spread of 2 pips, the spread cost would be $20.00, calculated as 0.0002 times 100,000.

Conclusion

Pips are a core concept in the forex (foreign exchange) market and play a crucial role in trading decisions. A pip, standing for ‘Percentage in Point’, is a basic unit used in forex to measure currency movements. It’s usually the smallest price change that an exchange rate can make, following the norms of the market. For forex traders, understanding pips is vital because it helps them quantify their potential profits or losses. This knowledge is essential for effectively managing their leverage and risk.