I this Astronaut Auditorium we had an opportunity to talk to IamTP, also known as Ty, from Elizabeth City, North Carolina. Ty shared his trading journey and everything he know on how to make money trading. His story is a testament to perseverance, strategic thinking, and the importance of mindset in achieving success in the trading world. Whether you’re a new trader or someone struggling to see consistent success, Ty’s experience will be a cornerstone of your trading. Hear his story and get introduced with how to trade GPBJPY in this Astronaut Auditorium.

Starting Point

Ty’s trading journey began in 2021, with no prior experience in trading but a background in music, which helped him identify patterns in the market. Initially, he dabbled in binary options before transitioning to Forex in July 2021. His first trades involved GBPJPY and Ethereum. Like many beginners, Ty experienced significant ups and downs, funding his account with $1000 and turning it into $3000, only to lose it again. He faced numerous blown accounts, losing large sums of money, but each failure was a learning opportunity.

My first pairs were GBPJPY and Ethereum. I started with $1,000, and within two weeks, I had my first $3,000 day during the Bull Run. I was using moving averages, indicators, stochastics, RSI, and Bollinger Bands. Despite some early successes, I lost money quickly and went through about 20 accounts in my first year.

“By the summer of 2022, I had a 72-9 winning streak trading US30 and Ethereum. I had a $9,000 day and a $122,000 day. My biggest flip was turning $48 into $1,200. Now, I’m confident I can consistently make money trading.”

Key Strategies and Mindset

Learning from Losses

Tha emphasizes that losing is part of the trading journey. He experienced a significant loss of $226,000 in one trade, which taught him the importance of managing emotions and not forcing trades.

Education and Self-Study

Ty attributes much of his success to intensive self-study, including watching ICT (Inner Circle Trader) videos and understanding the deeper mechanics of the market. He spent six to eight hours a day studying, often sacrificing sleep to improve his skills.

Risk Management

Effective risk management is crucial. Ty blew over 30 accounts but learned to manage his risk better over time. He advises risking no more than 30 pips per trade and understanding the drawdown to make informed decisions.

Risk management is something I’ve learned the hard way from blowing over 30 accounts, probably more. I’m naturally a risk-taker, but I’ve developed a strategy to manage that risk better. Here’s what I’ve learned:

- Capital Allocation: Only risk a small percentage of your total capital on any single trade. This helps to protect your account from significant losses.

- Stacking Positions: Instead of overleveraging, I stack my positions as the market moves in my favor. This way, I’m not putting all my capital at risk at once.

- Stop Losses: Always use stop losses to limit potential losses on any trade. This ensures that you don’t lose more than you can afford.

- Emotional Control: Treat demo trading as real trading to manage emotions. This practice helps in maintaining discipline and sticking to your strategy.

- Continuous Learning: Study successful strategies and mentors, like ICT, and apply their principles consistently.

Demo Trading

Before risking real money, Ty practiced extensively with demo accounts, treating them as if they were live to understand the emotional aspect of trading. This practice helped him refine his strategies and build confidence.

Within a week, I turned $1,147 into $20,000. I withdrew $10,000 and reinvested the rest. I turned $13,000 into $28,000, then $28,000 into $60,000. My second biggest withdrawal was $26,000. I took the rest and grew it to $72,000, which dropped to $42,000, then rose to $80,000, then $65,000. Finally, when it flashed $100,000, I closed it out.

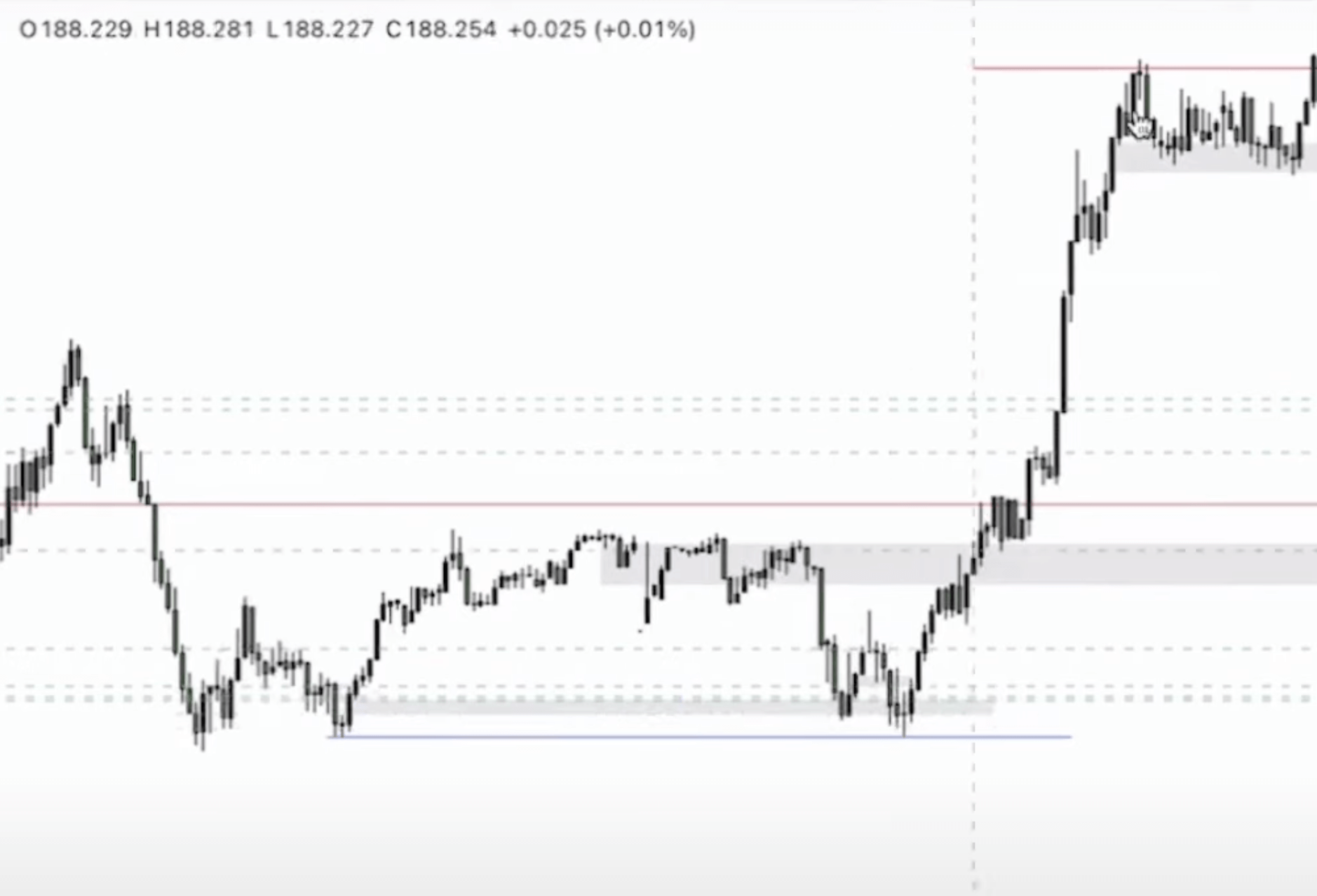

From the GBPJPY support line, I have waited for the price to go trough three different levels of resistance and then it took off. This was on March 11th, still Monday. My whole chat caught this move because I called out this signal. We caught the entire move, and the target price was 189. We captured 100 pips clearly.

How to make money trading

We are going to analyse a GBP/JPY chart.

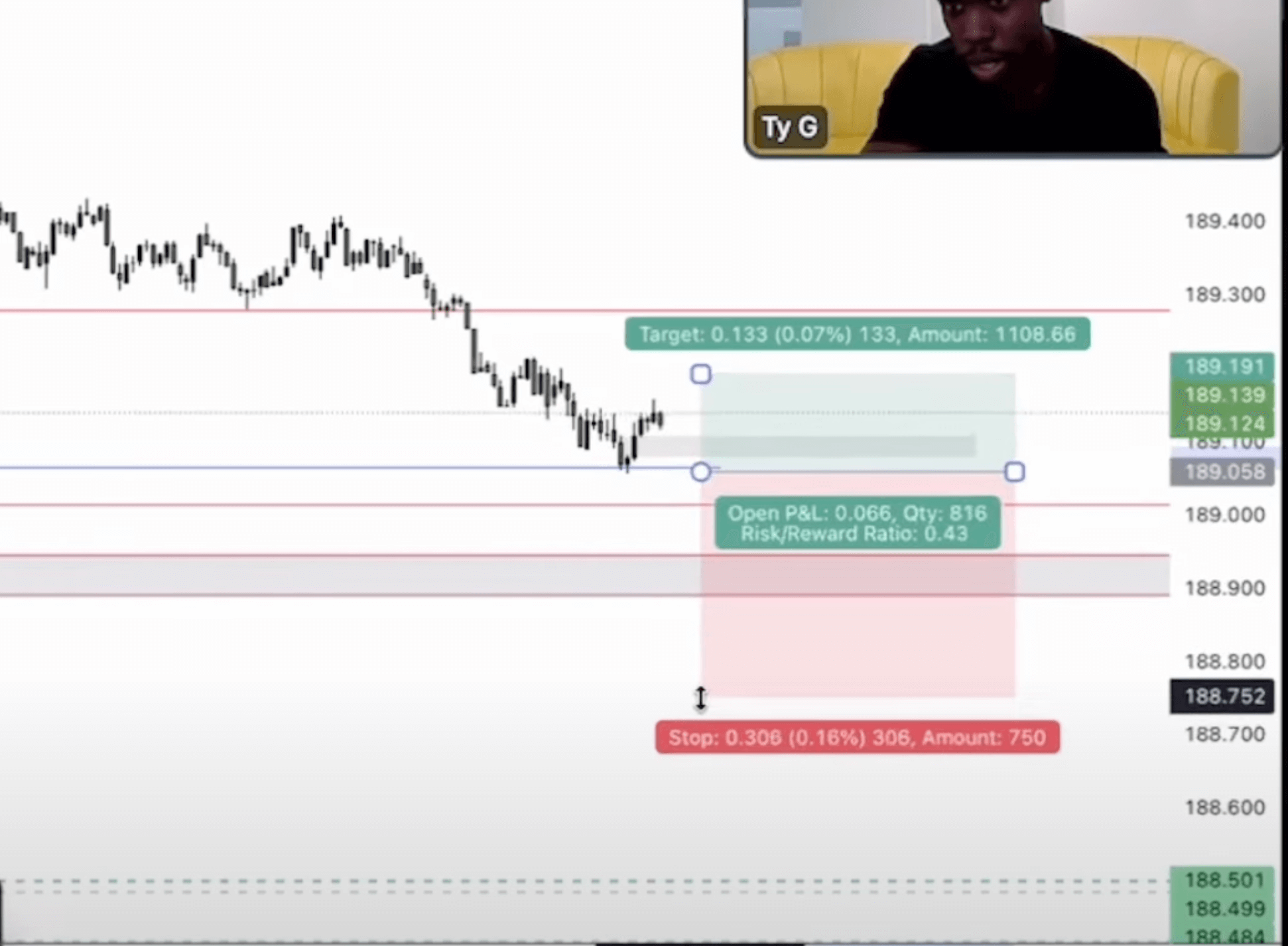

As you can see there is the price came to seek liquidity at 189.093 level. You can buy GBPJPY right now, although this is not financial advice. We just ran sales high on GBPJPY, and the timing is perfect. So, with this move on the one-minute chart, people might impulsively buy, but this candle closed above the previous one. That’s all I needed to see. Even if the price comes down, I’m fine because it would mean the price is seeking this low. That’s a key aspect of my risk management strategy in my signal chat. We keep our risk to no more than 30 pips to manage drawdowns effectively.

One thing I do is buy during drawdowns and sell during drawdowns. You need a certain level of understanding to do this. I could have bought here on my phone, but we’re good; we’re floating. Don’t let the market dig into your P&L too much.

If you were setting a target for GBPJPY, and you bought at 189.050, you should consider levels. The price came to a level at 50. So, your stop loss should be set around 188.750, which is a reasonable distance given the one-minute timeframe on GBPJPY. Overleveraging is on you, but this should be your target.

I’m not shying away from it. It looks like a 1:2 or 1:2.5 ratio to me. My outlook is 189.800 or beyond for GBPJPY.

Morning Trade Analysis

- Initial Position and Adjustment:

- When the price started to trickle up, there was an expectation it would continue higher, but it didn’t.

- We closed two positions, leaving one running, and then entered two more positions as the price came back.

- Bullish Reversal Value Gap:

- We identify a bullish reversal value gap, a critical concept where the price is expected to come back through the gap.

- Ty decided not to overtrade and was cautious about entering more positions.

- Target Points:

- We called specific target points (TP4 and TP5) for 500 pips, and the trade ended successfully with floating equity.

Live Analysis and Time Frame Strategy

- Time Frame Focus:

- Ty primarily uses one-minute to one-hour charts, with a preference for the five-minute chart for detailed analysis.

- Understanding the higher time frames (like daily or weekly charts) is essential as they provide the overall market direction.

- Liquidity and Trade Execution:

- Ty explains that the price seeks liquidity, areas where many traders have set stop-loss orders or pending orders.

- Recognizing these areas helps in predicting potential price movements.

- Risk Management:

- Ty emphasizes the importance of managing risk by keeping stop losses within 30 pips.

- Buying and selling during drawdowns (temporary drops in value) can be strategic, but it requires a solid understanding of market behavior.

Once you recognize the market run, all you do is wait for a failure to break structure, whether you’re buying or selling. Then, you identify if it’s a bearish or bullish value gap. Is it a void? Is it Tetris? I have my own lingo, like “wick to mesh,” that I use as needed. I’m not a one-way trader; I can scalp, trade binary options, intraday, or hold trades. The longest I’ve held a trade was for 21 days.

Questions from the audience

Q: “Do you trade with indicators?”

A: Not at all. I despise them. I will never trade with an indicator again because indicators only show that the move has already taken place. I trade price action and liquidity.

Q: What do you trade? Gold? NAS? Forex?

A: So, I recently inducted myself into the gold academy, but primarily, I trade Ethereum, U30, and GJ. Those are my main trades. I’m adding gold, but I don’t primarily trade it. My trading strategy works with any pair.

Last advice

- Set Clear Goals

- Write down your goals with specific timelines. Clarity in what you want to achieve is crucial.

- Identify the Required Transformation

- On the other side of your goal sheet, jot down the attributes, skills, and mindset you need to develop to achieve these goals. This step is often overlooked but is vital.

- Close the Gap

- The gap between your current self and who you need to become is where the real work happens. Acknowledge that this transformation requires effort, discipline, and sometimes, stepping out of your comfort zone.

- Persist Through Challenges

- There will be moments of doubt and hardship, just like when you found yourself back home with limited resources. During these times, remember that perseverance and strategic actions are key.

- Take Action

- Use every challenge as an opportunity to act. For instance, within a short period, you managed to make significant earnings by leveraging your skills and determination.