In the world of trading, knowing how to execute orders efficiently can make a significant difference in your strategy. A streamlined approach to placing orders is especially valuable for beginner traders in mind.

Let’s explore the types of orders and the difference between pending, stop, and limit orders on TradeLocker.

Pending order

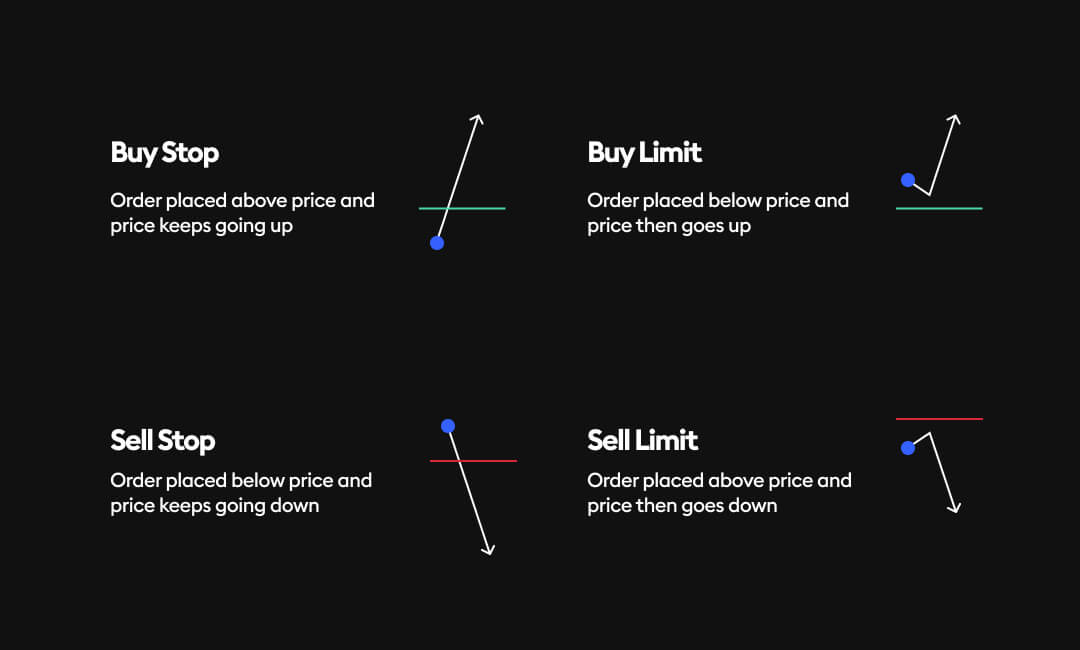

When you set a pending order on TradeLocker, it automatically converts into either a stop order or a limit order. This depends on whether you set it above or below market price and whether it is a buy or sell order with the following logic:

Above the current market price

- For a BUY order, it turns into a Buy Stop.

- For a SELL order, it turns into a Sell Limit.

Below the current market price

- For a BUY order, it turns into a Buy Limit.

- For a SELL order, it turns into a Sell Stop.

Pending orders can simplify the trading process. That way you are less likely to make mistakes by missing your stop or limit price. This approach ensures that you don’t accidentally execute an order at a market price instead of a specific stop or limit price.

Limit order

A limit order is an instruction to execute a trade at a specific price or better. For a Buy Limit order, the price is below the current market price. For a Sell Limit order, it is above the current market price.

This order type is used to specify the maximum or minimum price at which you are willing to buy or sell. This gives you more control over the price at which the trade is executed.

Stop order

A stop order is set to buy or sell an asset once it reaches a predetermined price, known as the stop price.

When the stop price is reached, the stop order becomes a market order. It will be executed at the next available price.

This is particularly useful in managing risks in volatile markets, allowing traders to set a specific point at which they wish to enter or exit the market.

By understanding the types of orders and how pending, stop, and limit orders work, you can navigate the market more confidently and make informed decisions that align with your trading strategy.

Subscribe to the TradeLocker YouTube channel for more tutorials and live trading sessions.