The Truth About Day Trading

Before diving into the guide, here are three essential facts to understand about day trading:

- Day Trading is Challenging

- Success in day trading isn’t just about making intelligent trades; it’s about managing risks, adapting to market changes, and maintaining discipline under pressure.

- Not a Quick Path to Riches

- Day trading is often misconstrued as a fast way to wealth. It involves a steep learning curve, and many traders do not profit significantly. It’s a skill that takes time to develop.

- Requires Education and Practice

- Effective day trading is built on thorough market knowledge, ongoing education, and regular practice. Intuition alone is not sufficient; informed decision-making is vital.

About this Handbook

Crafted by the TradeLocker team, this guide is rooted in honesty and transparency.

We aim to provide a realistic and practical understanding of day trading, supported by:

- Insights from seasoned traders.

- Collaborations with financial experts.

- Research into effective trading strategies and trader psychology.

We aim to educate with facts and realistic expectations, debunking myths and providing a clear path for those interested in day trading.

Contents

If you’re still willing to invest your time and effort into day trading, here’s a no-nonsense guide on how to start.

We’ve designed it to be as straightforward and realistic as possible.

Here are the core lessons:

- Getting Started: What is day trading, and how does it work? This includes an overview of the necessary tools and platforms to start trading.

- Building a Foundation: How do you set realistic goals, prepare for trading, and understand the basic terms?

- Tools, tech and Analysis: Get to know the must-have tools and tech you need for good market analysis and making smart choices.

- Risk Management Essentials: Dive into strategies to manage your risks, including the psychological aspects of trading, to help you make level-headed decisions.

- Developing a Trading Plan: Learn how to create a plan that works for you, incorporating fundamental techniques and an introduction to more advanced strategies.

- Learning and Adapting: Discover resources for improving your skills and how to adapt your strategies as you gain experience.

Hard facts about day trading

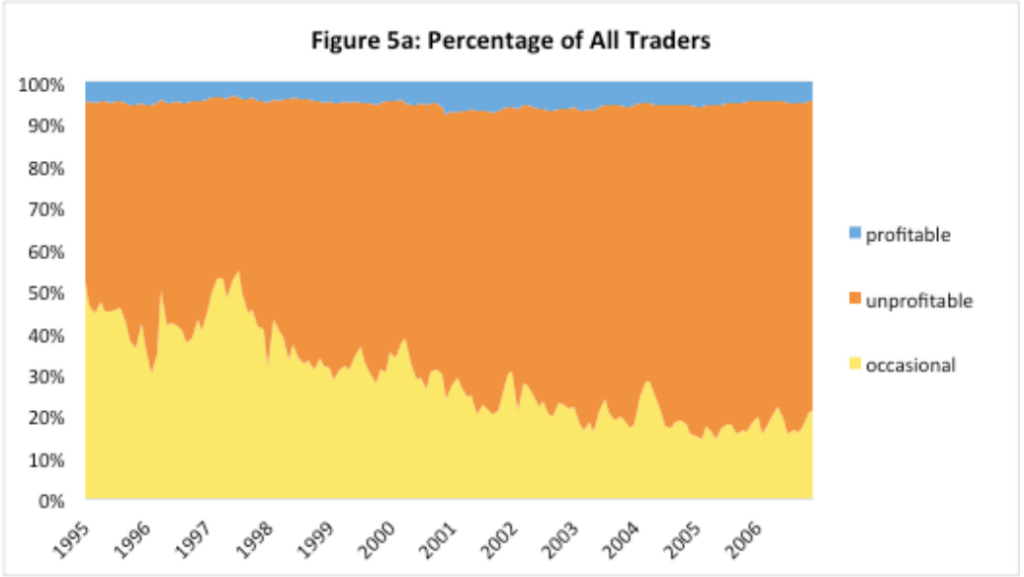

A study conducted by researchers at the University of California reveals several key facts:

- 80% of total day traders quit within the first two years. After five years, only 7% remain.

- Only 1.6% of traders are profitable in the average year. However, they account for 12% of all trading activity.

- Traders with negative track records continue to trade, continuing to trade even when they have a negative signal regarding their ability.

A Word of Encouragement

Embarking on your day trading journey is a significant step, and while it’s not without its challenges, it can also be a rewarding learning experience.

This guide is here to support you with the necessary tools and knowledge.

Remember, every expert trader once started as a beginner, and with persistence and the right approach, you can develop the skills needed to navigate the trading world.